Over 30,000 New Real Estate Properties Launched in Hanoi and Ho Chi Minh City in Q4/2025

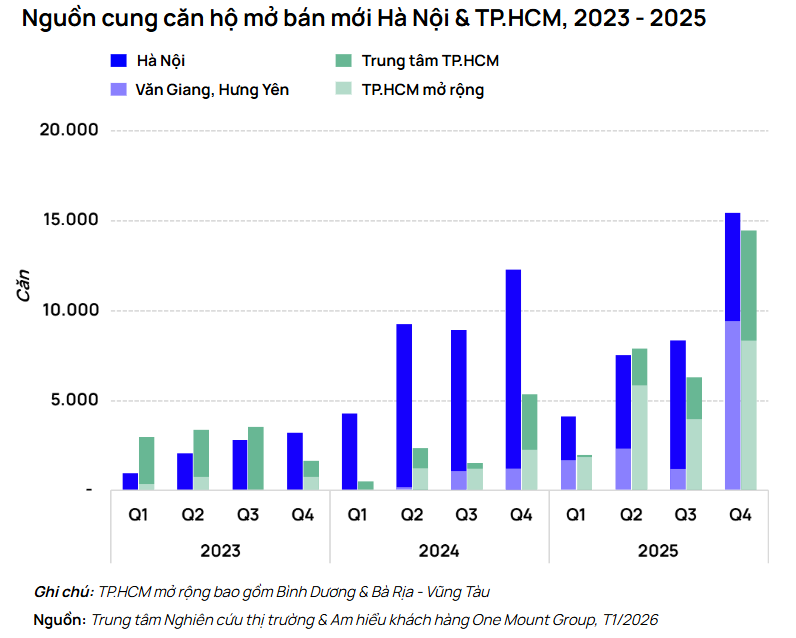

According to data from the Market Research & Customer Insight Center of One Mount Group, in Q4/2025, the total new apartment supply in Hanoi and Ho Chi Minh City reached over 30,000 units—the highest level in the past three years. The large supply concentrated in the last three months of the year reflects significantly strengthened confidence among developers in market prospects.

In Hanoi, the new supply in Q4 reached approximately 15,500 units, up 85% compared to Q3/2025 and 26% year-over-year. Notably, the market saw the launch of 14 new projects—the highest number ever recorded in a single quarter. The supply continues to shift outward from the city center, with Van Giang (Hung Yen) leading by providing around 9,400 units, accounting for 61% of the total market supply, an 8.6-fold increase from the previous quarter.

Meanwhile, Ho Chi Minh City showed a clear recovery after a prolonged slowdown. The new supply in Q4/2025 reached approximately 14,500 units, up 130% quarter-on-quarter and 2.7 times higher than the same period in 2024. Binh Duong continued to be the main driver, contributing around 8,200 units, or 57% of the new supply, with impressive quarterly and annual growth.

A notable highlight of Q4/2025 was the return of many major developers. In Hanoi, numerous new and large-scale projects were launched by well-known companies, while in Ho Chi Minh City, many developers restarted or launched projects in the city center and core urban areas. This trend reflects ongoing legal unblocking and indicates businesses’ expectations for a more sustainable growth cycle in the medium to long term.

Liquidity Remains Positive, High-End and Luxury Segments Continue to Lead

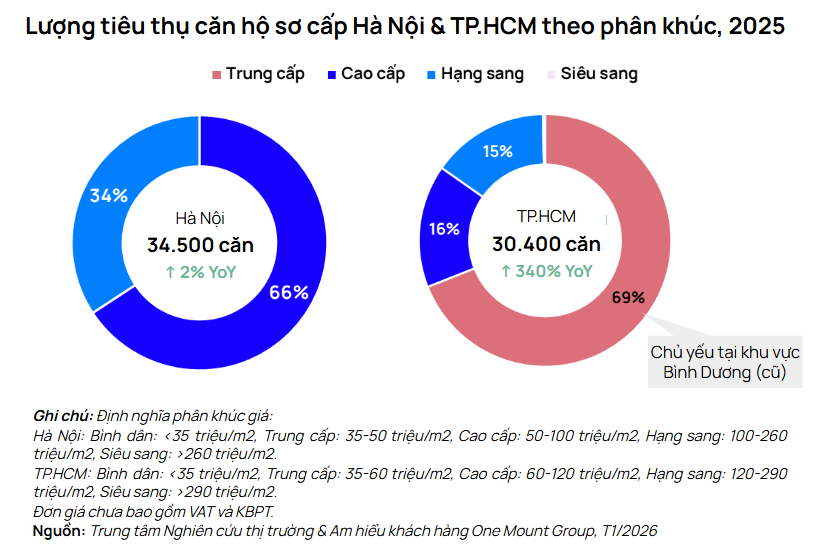

Alongside the increased supply, market absorption remained positive. In 2025, Hanoi absorbed approximately 34,500 apartments, up 2% from 2024, while Ho Chi Minh City reached around 30,400 units, 2.4 times higher than the previous year.

In Hanoi, the high-end and luxury segments continued to lead the market, with an average absorption rate of around 89%, reflecting stable demand for high-quality products. The high-end segment absorbed approximately 22,700 units, accounting for 66% of total transactions, mainly in the East area. The luxury segment, concentrated in the North and West areas, saw around 11,800 units absorbed during the year.

In contrast, Ho Chi Minh City’s market showed more diverse absorption patterns. The city center continued to lead with high-end and luxury products, accounting for around 80% of transactions. Meanwhile, the mid-range segment shifted strongly to satellite markets, particularly Binh Duong, which contributed over 60% of total transactions in 2025.

Divergent Price Trends Between the Two Markets

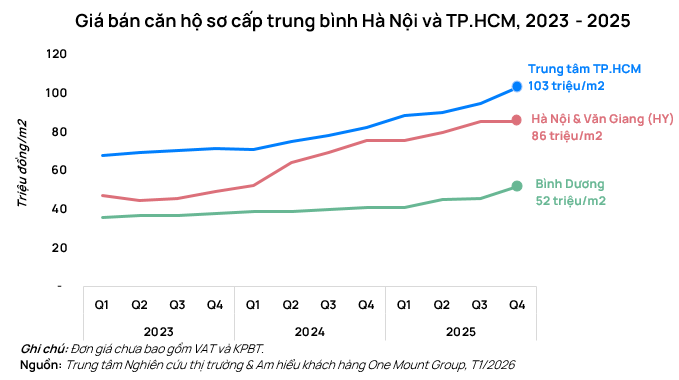

Average prices in the two markets witnessed contrasting trends in 2025, reflecting diverse supply and investment expectations.

In Hanoi, the average primary price in Q4/2025 was 86 million VND/m², flat compared to the previous quarter but up 13% year-over-year. The price increase slowed mainly due to new supply concentrated in outlying areas like Van Giang (Hung Yen), Dan Phuong, Hoai Duc, and Hoa Lac. Meanwhile, prices for new projects in the city center remained high, averaging 124 million VND/m².

In central Ho Chi Minh City, the average price reached 103.2 million VND/m², up 8.6% quarter-on-quarter and a significant 25% year-over-year. In 2025, the main driver of the primary price index was the emergence of luxury projects with record prices. For example, Eaton Park’s final tower exceeded 200 million VND/m², and new subdivisions in Phu My Hung urban area set prices above 180 million VND/m². The focus on high-end and luxury segments directly repositioned the entire price landscape in the southern economic hub.

Additionally, the former Binh Duong market showed growth comparable to central Ho Chi Minh City. The average price there reached 51.8 million VND/m², up 13% quarter-on-quarter and 26% year-over-year. Investor expectations for synchronized infrastructure development and planning after the merger, creating strong connectivity with central Ho Chi Minh City, provided a significant boost. In border areas like Di An and Thuan An, new projects quickly established price thresholds of 50–60 million VND/m², significantly higher than pre-merger levels.

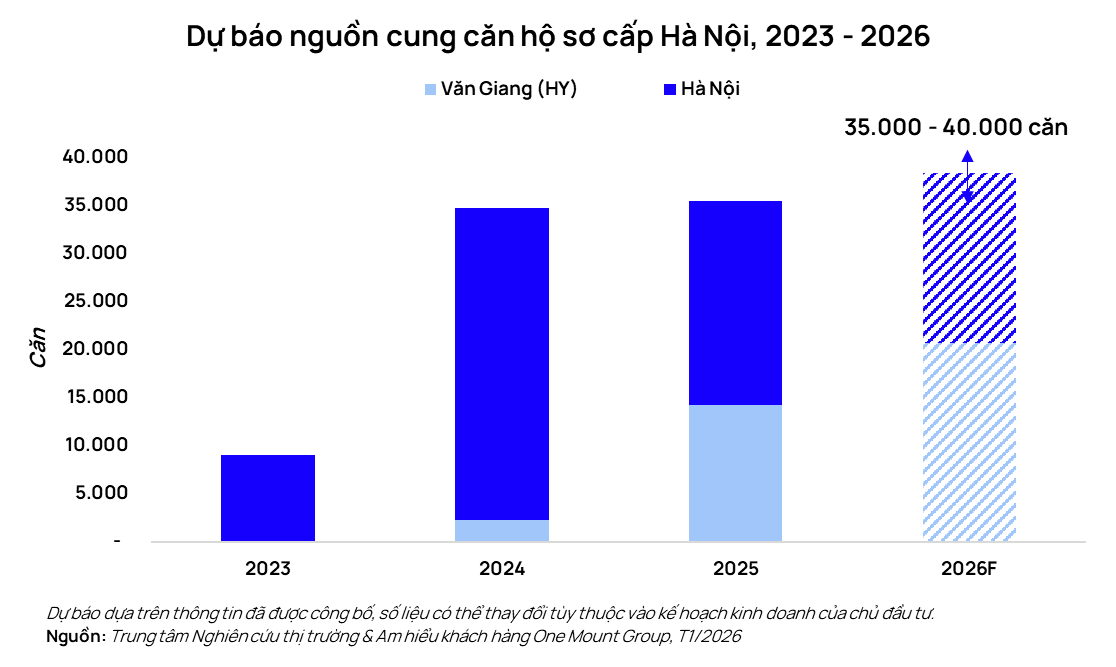

New Supply Expected to Continue Rising in 2026 in Both Cities

In 2026, the Hanoi primary apartment market is expected to maintain positive growth, with new launches projected at 35,000–40,000 units, equivalent to or higher than 2025, and surpassing post-Covid-19 averages. Van Giang (Hung Yen) is expected to supply 20,000–25,000 new units, leading the market for the first time due to large-scale megacities like Vinhomes Ocean Park 2-3, Ecopark, Alluvia City, and Sunshine Legend City.

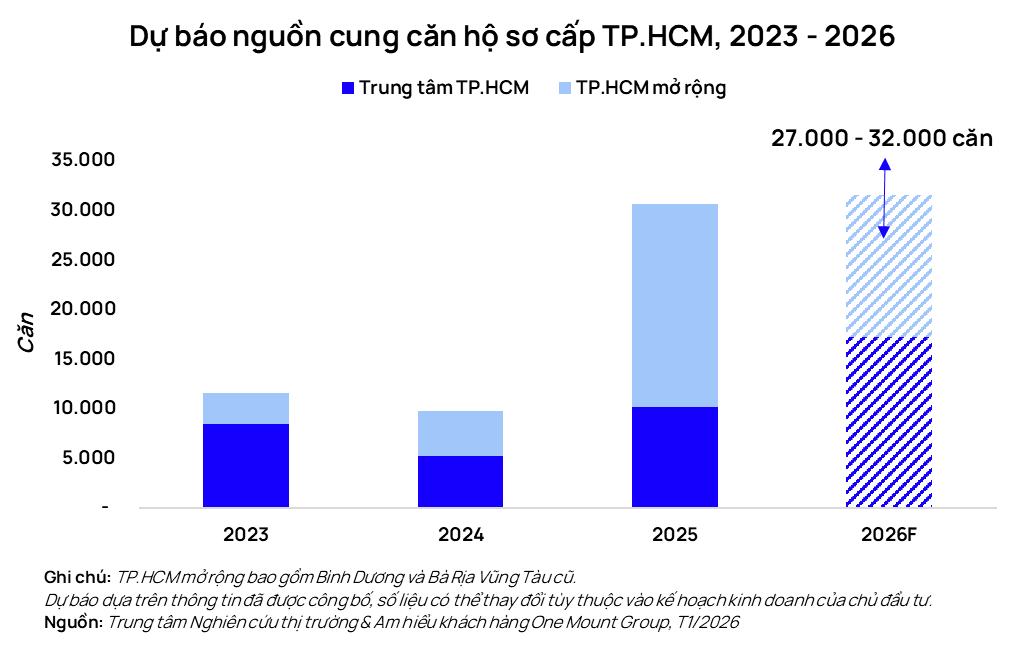

In Ho Chi Minh City, the market is expected to continue its recovery trend in 2026. The main driver will be the government’s efforts to remove legal bottlenecks and implement new laws (Land Law, Housing Law, Real Estate Business Law). These fundamental legal changes will create a “green corridor” for new projects and restart many previously stalled projects, restoring market confidence and investment flow.

Total new supply in Ho Chi Minh City is projected to reach 27,000–32,000 units annually. The city center is expected to contribute 16,000–17,000 units per year in 2026–2027. The significant increase in both quantity and quality of primary supply reflects developers’ readiness to capitalize on the new growth wave.

Mr. Tran Minh Tien, Director of the Market Research & Customer Insight Center at One Mount Group, commented: “The apartment markets in Hanoi and Ho Chi Minh City are entering a transformative phase with distinct growth drivers. After a strong breakout in 2024–2025, Hanoi’s market is expected to maintain steady growth with more accessible price levels. Meanwhile, Ho Chi Minh City is poised for a new growth wave as legal bottlenecks are cleared. Notably, the implementation of key projects in Thu Thiem in 2026 will act as a ‘locomotive,’ setting new price benchmarks and redefining the central area’s value landscape.”

Hanoi Constructs Six-Lane Underpass at Me Tri – Duong Dinh Nghe – Ring Road 3 Intersection

The Mễ Trì – Dương Đình Nghệ underpass project, designed with a 6-lane capacity, aims to resolve traffic conflicts and significantly reduce congestion at this critical intersection.

Developer of the $430 Million Flood Control Project to Receive at Least Three Land Parcels from Ho Chi Minh City

In January, Trung Nam Group is set to acquire at least three land plots from Ho Chi Minh City through a BT project swap for the tidal and flood prevention initiative. These projects are slated for development within the next 6 to 9 months.