When the Index Peaks, Individual Stocks Surge

2025 closed with a historic milestone as the VN-Index reached a new all-time high closing price of 1,784.49 points, marking a 517.71-point increase from the beginning of the year, equivalent to a 40.87% rise. However, alongside the positive index performance, there were extreme fluctuations at the individual stock level, with prolonged consecutive ceiling and floor price sessions creating both opportunities for significant gains and risks of substantial losses for investors.

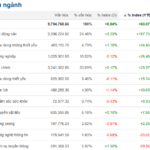

Consecutive ceiling price sessions are always seen as the clearest indication of overwhelming demand and heightened expectations. In 2025, the market recorded 6 stocks with ceiling price streaks exceeding 10 consecutive sessions, reflecting unprecedented excitement in certain individual stocks.

Among regularly traded stocks, the longest ceiling price streak of the year belonged to Bac Kan Minerals JSC (HNX: BKC). This stock recorded 15 consecutive ceiling price sessions from February 4th to 24th, driving its price from 12,450 VND/share to a closing price of 46,650 VND/share (after adjustments), a 275% increase in less than a month. BKC’s surge occurred amidst escalating US-China trade tensions, particularly China’s tightening of strategic mineral exports.

| BKC Stock Price Movement in 2025 |

The company later attributed the price movement to positive business results, with 2024 revenue reaching 567 billion VND and net profit of 52 billion VND, the highest since its listing. However, after the surge, the stock entered a prolonged correction phase, ending 2025 at 20,400 VND/share. Despite a significant drop from its peak, BKC still recorded a near doubling in value for the year, with average liquidity of over 49,000 shares per session.

Most Notable Ceiling Price Streaks in 2025

|

Another standout case was Thuong Dinh Shoe JSC (UPCoM: GTD), where price movements were closely tied to state capital divestment. The auction of 68.77% of GTD shares by Hanoi People’s Committee was successful, with an average winning price of 215,999 VND/share, 10.5 times the starting price. Subsequently, the stock recorded 12 consecutive ceiling price sessions from November 19th to December 4th, resulting in a 340% price increase.

| GTD Stock Price Movement in 2025 |

The rally continued, pushing GTD to a historic high of 95,200 VND/share on December 18th. By year-end, the stock closed at 86,000 VND/share, a 10% drop from its peak but still a 778% increase from the beginning of the year, accompanied by a sevenfold improvement in liquidity during the peak period.

Overall, the longest ceiling price streaks in 2025 were concentrated among stocks on the HNX and UPCoM, clearly reflecting the high-risk appetite of speculative capital, which favors stocks with large price fluctuations to maximize short-term profits.

The Flip Side of Euphoria: Brutal Floor Price Streaks

In contrast to ceiling price streaks are prolonged floor price sessions, where selling pressure completely dominates and buying liquidity virtually disappears. This is the clearest manifestation of extreme market risk.

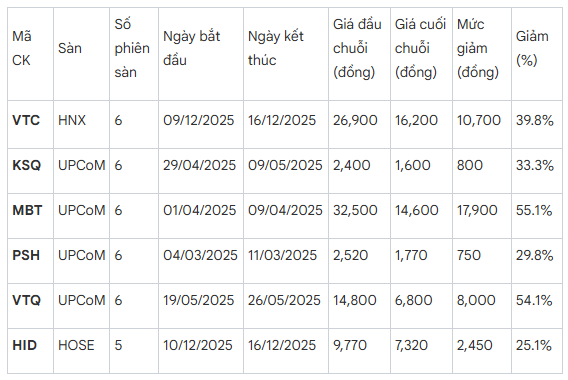

Most Notable Floor Price Streaks of the Year

|

Among regularly traded stocks, VTC Telecom JSC (HNX: VTC) recorded the longest floor price streak of the year with 6 consecutive sessions from December 9th to 16th, causing its price to lose nearly 40% in just over a week of trading.

The situation became even more pronounced among restricted trading stocks, which are only matched on Fridays. With this characteristic, a 5-7 session floor price streak can actually last over a month, amplifying psychological impact and risk for investors.

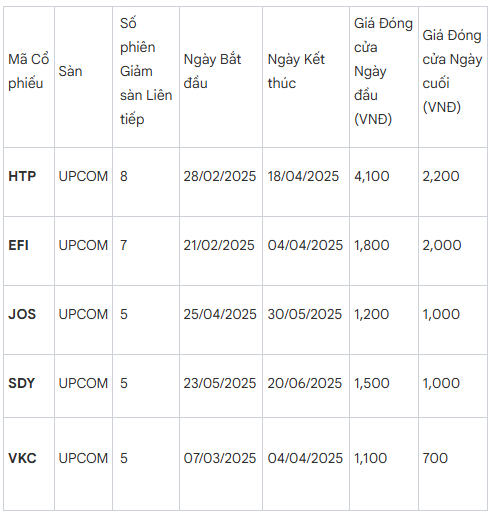

The saddest record of 2025 belonged to Hoa Phat Educational Book Printing JSC (UPCoM: HTP), with an 8-session floor price streak from February 28th to April 18th, lasting two months and causing its price to “evaporate” by over 46%, from 4,100 VND/share to 2,200 VND/share. This company is currently under restricted trading status after being delisted from the HNX for violating information disclosure obligations.

Floor Price Streaks of Restricted Trading Stocks in 2025

|

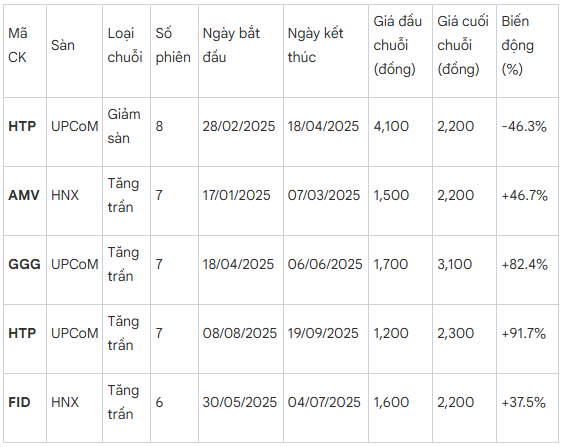

Two-Way Volatility and the “Christmas Tree” Pattern

Notably, restricted trading stocks not only recorded floor price streaks but also significant ceiling price streaks. Stocks like Vietnam-America Pharmaceutical and Medical Equipment JSC (HNX: AMV), Giai Phong Automobile JSC (UPCoM: GGG), and even HTP – during another period from August 8th to September 19th – had 7 consecutive ceiling price sessions, pushing HTP‘s price up by nearly 92%. The recurrence of long volatility streaks in this group highlights low liquidity and price manipulation by a small group of investors.

Typical Volatility Streaks of Restricted Trading Stocks

|

When a stock exhibits not just one but multiple ceiling and floor price streaks, even consecutively, the price movement pattern often resembles a “Christmas tree.” The most typical case in 2025 was VTC Telecom (VTC). Before entering the longest floor price streak of the year among regularly traded stocks, this stock had a 14-session ceiling price streak from November 19th to December 8th, pushing its price from 9,000 VND/share to a historic high of 29,800 VND/share, a 263% increase.

|

VTC Stock Price Movement in 2025 |

The wave was built on expectations of VNPT‘s state capital divestment, but when the deal fell through due to a lack of investor registration, all expectations collapsed, and the stock plummeted uncontrollably. By the end of 2025, VTC was trading around 12,900 VND/share, a 57% drop from its peak but still significantly higher than the 8,000-9,000 VND/share range maintained for the previous two years.

|

The phenomenon of consecutive ceiling and floor price streaks was not limited to VTC Telecom. Halcom Vietnam JSC (HOSE: HID), after a 200% increase in two months due to two 5-session ceiling price streaks, immediately faced a 5-session floor price streak, erasing nearly half its value from the peak. Similarly, Petro Central Investment and Production JSC (HOSE: PMG) recorded an 8-session ceiling price streak before reversing with 5 consecutive floor price sessions, dragging its price down by 30% and continuing to weaken, ending the year at 6,890 VND/share, a nearly 47% drop from its peak and 16% lower than the beginning of the year.

The clearest risk signal was demonstrated by Ha Noi Thong Nhat JSC (UPCoM: TNV). This stock once surged 292% due to a 9-session ceiling price streak from February 6th to 18th, but built on very thin liquidity, averaging only 600 shares per session. When entering a 5-session floor price streak from February 27th to March 5th, liquidity skyrocketed to 4,500 shares per session, clearly reflecting distribution after the price pump. By year-end, TNV closed at 19,500 VND/share, a 60% drop from its peak but still a 119% increase for the year.

| TNV Stock Price Movement in 2025 |

Additionally, the market recorded stocks with “volatile personalities” like Tourism and Seafood Development Investment JSC (HOSE: DAT), with two consecutive ceiling price streaks of 11 and 5 sessions in September-October 2025, or An Giang Import-Export JSC (Angimex, UPCoM: AGM), with two 5-session floor price streaks in April, indicating systemic selling pressure rather than isolated events.

Looking back at 2025, behind the index’s growth were numerous extreme price fluctuations in individual stocks. Quickly erased ceiling price records, liquidity traps in restricted trading stocks, and “rapid rise – sharp fall” patterns associated with speculative expectations or divestment, exposed significant risks for investors participating in the late stages of a wave.

Ceiling or floor price streaks, ultimately, are not just about the number of sessions but a harsh test of risk management capabilities. When facing a surging stock, the line between a breakthrough opportunity and a risky rollercoaster ride can sometimes be just a few trading sessions apart.

– 12:00 08/01/2026

The Foundation for VN-Index to Reach 2,032 Points

The year 2026 marks the beginning of a new growth cycle, where strategically positioning your investments from the outset will be pivotal to success.