In the latest adjustment, VIB increased the interest rate for 6-9 month term deposits by 0.5 percentage points to 5.1% per annum. Other terms remain unchanged: 3.5% per annum for 1 month, 4.75% per annum for 3 months, and 6.5% per annum for 12 months.

From December 17, 2025, BVBank significantly raised deposit interest rates by 0.25-0.9 percentage points across all terms. Specifically, 1-3 month deposits increased to 4.75% per annum; 6-9 months to 6.15% per annum; 12 months to 6.45% per annum; 24 months to 6.15% per annum; and 36 months to 6.4% per annum.

VPBank also increased deposit interest rates by 0.2 percentage points for terms of 6 months and above from January 1, 2026. For deposits under 1 billion VND, the bank maintains a 4.75% per annum rate for 1-3 month terms, while rates for 6 months and above increased to 6% per annum.

LPBank raised interest rates by 1-1.1 percentage points across all terms from December 11, 2025. The bank increased 1-month deposits to 4% per annum, 3 months to 4.2% per annum, 6-9 months to 5.2% per annum, 12 months to 5.5% per annum, and over 12 months to 5.8% per annum.

From mid-December, state-owned banks (Agribank, Vietcombank, VietinBank, and BIDV) also increased savings deposit rates after a long period of stagnation.

For over-the-counter deposits, Vietcombank, BIDV, and VietinBank apply the same interest rates. The 1-month rate increased to 2.1% per annum, 3 months to 2.4% per annum, 9 months to 3.5% per annum, 12 months to 5.2% per annum (up 0.5 percentage points), and over 12 months to 5.3% per annum.

Agribank offers 2.4% per annum for 1-month deposits, 2.7% per annum for 3 months, 3.8% per annum for 9 months, and 5.2% per annum for 12 months.

As of January 5, 2026, deposit interest rates for 1-3 months range from 1.6% to 4.75% per annum, 6-9 months from 2.9% to 6.5% per annum, and 12 months from 3.7% to 6.55% per annum.

For 12-month terms, Bac A Bank offers the highest rate at 6.55% per annum, followed by VIB at 6.5% per annum, BVBank at 6.45% per annum, and OCB at 6.3% per annum.

For 6-month terms, Bac A Bank leads with 6.5% per annum, followed by OCB at 6.2% per annum, and BVBank at 6.15% per annum.

For 3-month terms, the highest rate is 4.75% per annum, offered by OCB, BVBank, VPBank, PVcomBank, VIB, Sacombank, and TPBank.

|

Personal savings deposit rates at banks as of January 5, 2026

|

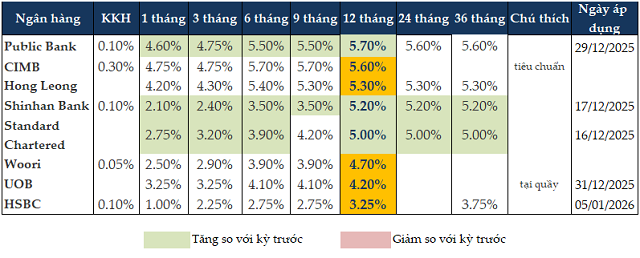

Foreign banks such as Public Bank, Shinhan Bank, and Standard Chartered Bank also increased deposit rates. For 12-month terms, Public Bank offers the highest rate at 5.7% per annum; for 6-month terms, CIMB leads with 5.7% per annum; and for 3-month terms, the rate is 4.75% per annum.

|

Personal savings deposit rates at foreign banks as of January 5, 2026

|

In the Vietnam Outlook 2026 report published on December 26, 2025, MBS forecasts that 12-month deposit rates may increase by another 50 basis points in 2026 due to three main reasons.

First, widening the lending-deposit spread at commercial banks. The economy’s capital demand is expected to continue rising strongly over the next five years, aiming to increase the total investment capital to GDP ratio from 32% to 40%. MBS forecasts credit growth to remain at 20% in 2026. Meanwhile, deposits are shifting to less liquid investment channels like gold, USD, and real estate, slowing the economy’s capital turnover.

Second, the term structure mismatch between deposits and loans. Currently, short-term deposits (under 6 months) account for 80% of total system deposits, while the demand for medium and long-term capital for infrastructure investment is significant, leading to a long-term capital shortage in the system.

Third, asset quality has not improved. The bad debt ratio and group 2 debt ratio at the end of Q3/2025 reached 2%, slightly up from 2024. The bad debt coverage ratio was 84.3% at the end of Q3/2025, lower than 91.4% at the end of 2024.

Bad debts remain high, while coverage is declining, indicating increased provisioning pressure for commercial banks in the future. This is another factor making interest rate reductions unlikely in the near term.

Additionally, MBS notes the potential impact if the Bank of Japan continues to raise interest rates in 2026, which could trigger a return of cheap capital from Asia, including Vietnam, to Japan, indirectly pressuring domestic capital sources.

In the investment strategy report published on December 31, 2025, Rồng Việt Securities (VDSC) forecasts that the State Bank of Vietnam (SBV) will not raise policy rates until at least mid-2026, prioritizing open market operations.

Instead, the SBV will flexibly manage liquidity through open market operations to address exchange rate pressures and short-term liquidity needs. The economy’s investment capital demand is still met by short and medium-term capital from the banking system. This may cause localized liquidity tensions at certain times in the year, leading to spikes in actual interest rate volatility. Deposit rates are expected to rise by 50-100 basis points in 2026. Lending rates will follow suit. VDSC expects the corporate bond market to maintain its recovery with a more diversified industry structure to share the burden of long-term investment capital with banks. However, this transformation will proceed slowly due to issuer and investor caution. Credit growth in 2026 is expected to remain at 18%, supporting high economic growth targets.

– 12:00 07/01/2026

Agribank Interest Rates January 2026: First Increase in Over 3 Years – Which Term Offers the Highest Rate?

In early January 2026, Agribank announced its highest interest rates for individual deposits, specifically for the 24-month term.

Bank Boosts 6-Month Savings Interest Rate to Over 7% Annually

The savings interest rate race is heating up as a leading bank has just pushed its 6-month term deposit rate past the 7% per annum mark.