Vietnam’s real estate market is poised for a new growth cycle, supported by a robust legal framework expected to be in place by 2025. Experts predict that 2026 will see stable and sustainable growth, focusing on real demand despite lingering risks that require close monitoring.

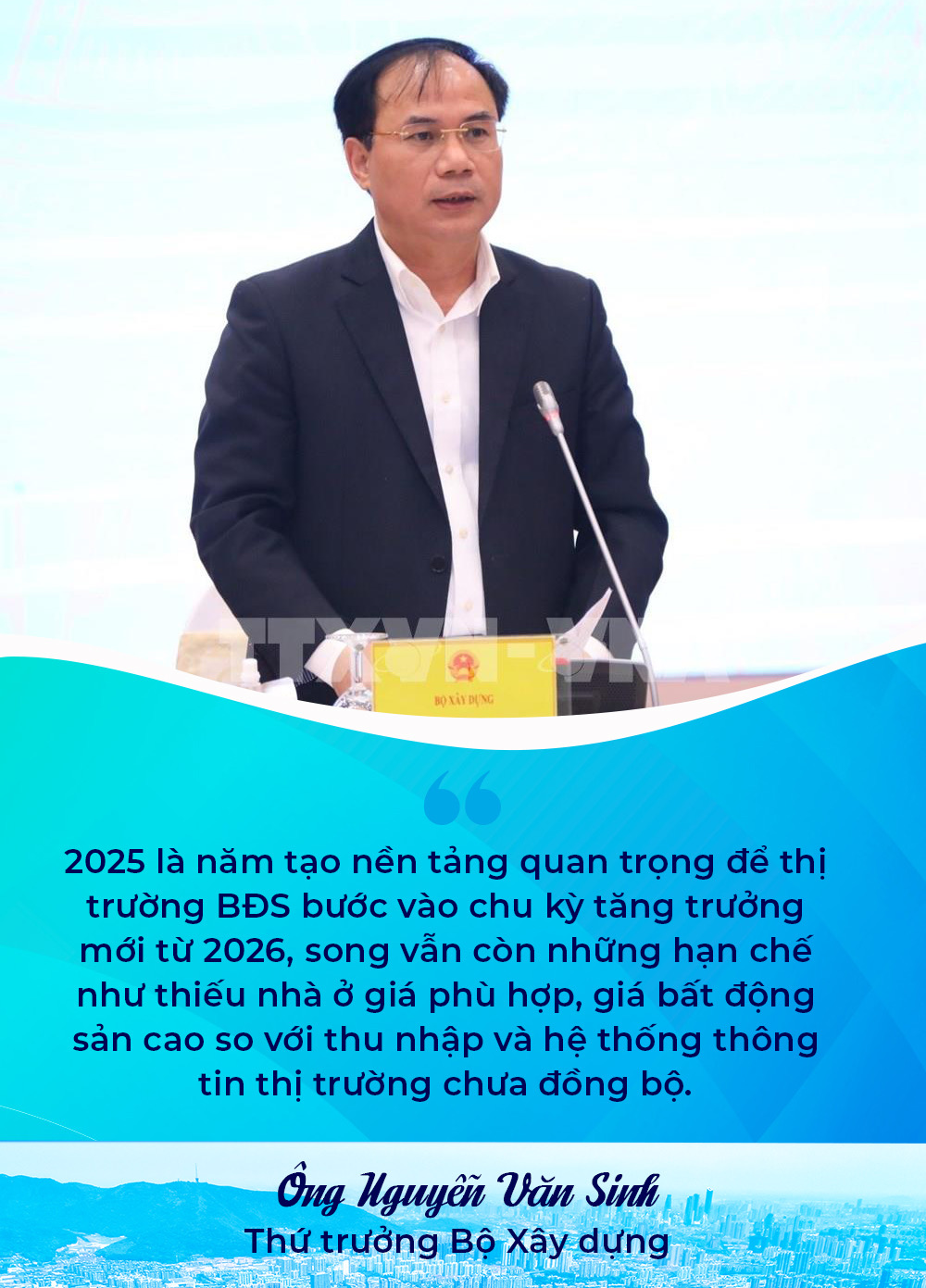

Deputy Minister of Construction Nguyen Van Sinh commented on the 2026 market: “2025 laid the essential groundwork for the real estate market to enter a new growth phase in 2026. However, challenges remain, such as a shortage of affordable housing, high property prices relative to income, and an inconsistent market information system.”

From another perspective, Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association, stated: “In 2026, the real estate market faces numerous opportunities with a double-digit economic growth target, sustained capital inflows, and flexible monetary policies. New urban models like compact cities and transit-oriented development (TOD) are prioritized. However, the market will no longer tolerate speculative investments. Moving forward, market participants must be more professional, transparent, and compliant with market discipline within a data- and technology-driven ecosystem.”

Businesses and experts share a cautiously optimistic outlook for 2026. Nguyen Hoai An, Senior Director at CBRE Hanoi, believes that 2026 will mark the beginning of a more stable and selective cycle for Vietnam’s real estate market, with active participation from long-term investors and genuine buyers.

According to An, the supply remains diverse across segments and locations. However, increased competition among developers to attract buyers and tenants will force companies to restructure products, enhance quality, improve sales policies, and optimize operations. Additionally, rising project development costs will further pressure profit margins and investment efficiency.

The Senior Director at CBRE Hanoi noted that strong supply in Hanoi and surrounding provinces could lead to oversupply if demand does not increase accordingly, resulting in inventory risks and price reductions in certain segments. Moreover, new supply tends to concentrate in the high-end segment, making it harder for young people and low- to middle-income groups to access housing.

Given the abundant supply and macroeconomic uncertainties, buyers and investors are adopting a cautious yet confident approach, prioritizing properties with price appreciation potential, clear legal status, and stable cash flow.

For businesses, oversupply and interest rate fluctuations are the primary concerns. According to Nguyen Quoc Hiep, Chairman of GP.Invest, the 2026 real estate market will be highly competitive. Numerous projects prepared in 2025 will launch in 2026, flooding the market with products.

The market faces two key risks in 2026: opaque land prices, which could drive property prices higher, and soaring bank interest rates. Both buyers and sellers rely on credit. Rising rates will increase selling prices, reduce liquidity, and dampen market activity. Most buyers need bank loans, and only a few can afford to purchase without financing.

Hiep emphasized that without appropriate credit policies from the government, the real estate market faces significant risks. While supply is expected to surge, purchasing power may decline due to limited cash flow. Most buyers depend on bank loans, but high interest rates restrict access to capital, posing the biggest risk to the 2026 market.

He stressed: “The 2026 real estate market’s performance will depend on the government’s macroeconomic policies, particularly credit policies. Regarding land policies, if provincial People’s Councils establish a more reasonable coefficient K, it will help curb rising land prices. Balanced credit policies will also foster market development.”

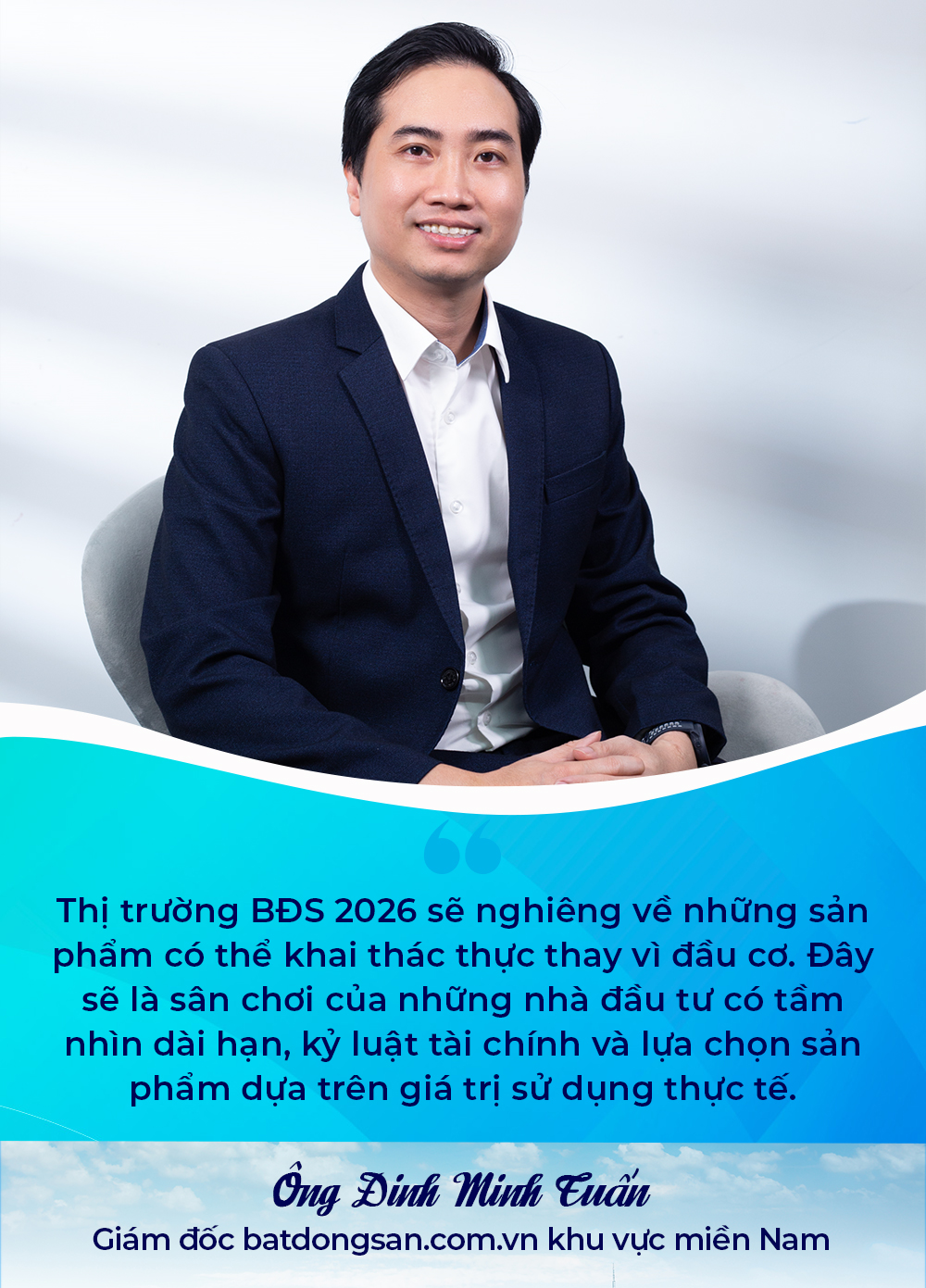

Dinh Minh Tuan agreed that the 2026 market will experience stable and selective growth. This cycle will not be marked by rapid price increases but by cautious capital flows prioritizing safety, operational efficiency, and long-term sustainability.

Promising segments in 2026 include products catering to real demand and generating cash flow. Condominiums in major cities and well-connected satellite areas will continue to drive liquidity. Low-rise housing in well-planned urban areas with complete legal frameworks will appeal to long-term asset accumulators.

For investment-oriented segments, the market will favor products with actual exploitation potential over speculative price increases. This indicates that 2026 will be a playground for long-term investors with financial discipline and a focus on real utility.

Experts predict that 2026 will not see a market “boom” like previous cycles but rather stable, selective, and sustainable growth. With strong policy support and ample supply, the market offers opportunities for genuine buyers, but investors must beware of high-end oversupply and interest rate risks to avoid short-term pitfalls.

On January 13, 2026, CafeF (under VCCORP) will host the FChoice 2025 Awards and the “Double-Digit Economic Growth Drivers and 2026 Investment Opportunities” Seminar.

The event will honor the most outstanding events, entrepreneurs, and businesses in Vietnam’s 2025 economy while serving as a platform for in-depth discussions among leading experts and businesses on achieving over 10% growth during 2026–2030.

Key issues such as removing bottlenecks in traditional growth drivers, effectively activating new development spaces, and the private sector’s role will be thoroughly analyzed.

Event details:

Date: Morning of January 13, 2026

Venue: Sheraton Hanoi Westlake Hotel

Register for the event HERE.

Unveiling FChoice 2025 Results: Celebrating Vietnam’s Pioneering Achievements in the Era of Ascent

After a rigorous selection process by the esteemed Judging Council and an unprecedented surge of millions of reader votes, FChoice 2025 proudly unveils its prestigious Hall of Fame. These are the shining milestones on Vietnam’s economic achievement map during the pivotal year of 2025.

Is Vietnam’s Real Estate Market Following in China’s Footsteps?

Amid the relentless surge in housing prices over recent years, investors are increasingly apprehensive as the government begins to implement more stringent tightening policies. This raises the question: Could Vietnam’s real estate market face a “black swan” event akin to China’s aftermath of the Evergrande Group crisis?