Industry Giants Kick Off the Year with Bold Moves

Vietnam’s automotive market in 2026 is poised for an unprecedented level of competition among brands. From the first days of January, aggressive incentives from leading companies have signaled their determination to capture market share.

The clearest indicator of this trend is the simultaneous announcement of record-breaking incentives by the two largest market holders, VinFast and Toyota.

Toyota Vietnam focuses on reducing ownership costs and reinforcing long-term quality commitments. Specifically, the Japanese automaker offers up to 100% registration fee support for the Veloz Cross and Avanza Premio family vehicles. For popular sedans and urban SUVs like the Vios and Yaris Cross, customers receive 50% registration fee support.

Toyota Veloz offers 100% registration fee support.

Additionally, Toyota has extended its official warranty to 10 years for new models, paired with a preferential loan interest rate starting at 3.49% annually through Toyota Financial Services.

Meanwhile, VinFast has launched the “Fierce for a Green Future” campaign with groundbreaking financial terms. The Vietnamese electric vehicle manufacturer offers a 0% down payment policy, allowing consumers to finance 100% of the vehicle’s value through partner banks without any upfront payment.

Beyond financial support, VinFast has reduced prices by 6% to 10% across models from VF 3 to VF 9. Another significant benefit is free charging at V-Green public stations until June 2027 for cars and May 2027 for electric motorbikes.

VinFast leads with a “0 down payment” incentive to encourage the shift from gasoline to electric vehicles.

These initiatives demonstrate both companies’ efforts to reduce initial financial barriers and provide maximum peace of mind for buyers in a fiercely competitive market.

Following VinFast and Toyota, Hyundai, the third-largest brand, has also joined the fray. Its flagship models, the Santa Fe and Palisade, have been discounted by 220 million and 200 million VND, respectively. Other models like the Stargazer, Accent, Tucson, and Creta have received discounts of 96 million, 64 million, 58 million, and 50 million VND, respectively. Hyundai has also extended its warranty to 8 years or 120,000 km across its entire product lineup.

The fact that established companies are deploying strategic financial and pricing measures from the year’s start underscores a service arms race.

What’s Driving This, and Who Benefits?

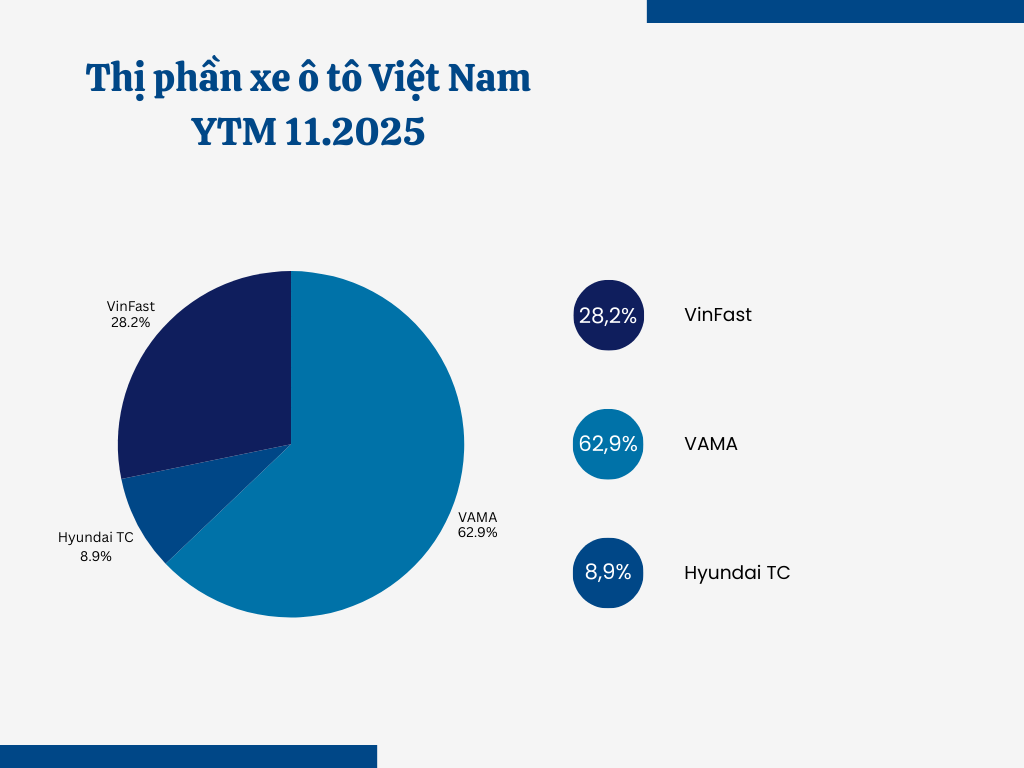

The first reason for this intense competition is Vietnam’s emergence as one of the region’s most promising automotive markets. As of November last year, total vehicle sales reached 522,644 units, surpassing the 2022 record of 509,141 units.

The market’s expansion not only creates opportunities but also makes Vietnam an attractive “pie” for all automakers to compete for market share. As consumer demand rises, companies must maximize efforts to become the preferred choice.

VinFast is accelerating to expand its market share.

The second reason lies in the shifting dynamics among domestic automakers. Currently, VinFast has risen to become Vietnam’s top-selling automaker.

Specifically, the Vietnamese electric vehicle company sold 147,450 units from January to November 2025, capturing 28.2% of the market. This figure not only surpasses other brands but also significantly outpaces Toyota, which sold over 63,625 units by November 2025.

To maintain its leading position, VinFast continues to introduce groundbreaking sales policies. Meanwhile, Toyota and other traditional gasoline vehicle manufacturers face pressure to reclaim lost market share from electric vehicles.

VinFast’s VF3 and Limo Green models lead their segments in sales.

The clash between the rising new champion and the experienced former leaders creates a fiercely competitive landscape.

The third reason for heightened competition is the influx of Chinese automakers into Vietnam. Brands like Geely, BYD, Omoda & Jaecoo, and Lynk&Co are aggressively targeting various segments with competitive technology and pricing.

Omoda & Jaecoo is accelerating its factory construction in Vietnam. In 2026, the company will launch 16 new models, primarily green vehicles (EVs, HEVs, PHEVs). Geely has focused on expanding its dealership network, with 47 3S dealerships nationwide by the end of 2025.

Chinese automaker Geely expanded to 47 3S dealerships in 2025, affirming its long-term commitment to Vietnam’s automotive market.

While these brands’ sales remain low, their serious presence and investment are forcing Korean and Japanese automakers to adjust their strategies quickly. Without strong incentives, established brands risk losing market share to emerging competitors.

In summary, the combination of a large market potential, traditional brands’ fight to regain dominance, and pressure from new entrants has intensified competition in Vietnam’s automotive market. The January 2026 incentives are just the beginning of a turbulent year. Consumers stand to benefit most from this race, with more choices and optimized ownership costs.

However, for manufacturers, 2026 will be a true test of financial strength and adaptability in a rapidly changing market.

Omoda & Jaecoo Aim for 10,000 Sales in Vietnam by 2026: From Factory Construction to New Model Launches, What Are the Challenges Ahead?

Omoda & Jaecoo are poised to enter Vietnam’s automotive market with targeted strategies. However, as newcomers under the Chery Group umbrella, they face intense competition from established brands that currently dominate market share.

Tucson Emerges as Hyundai Thanh Cong’s New Ace in the Hole

Hyundai Thanh Cong has unveiled its November 2025 sales results, with the Hyundai Creta and Hyundai Tucson SUVs continuing to dominate the top spots.