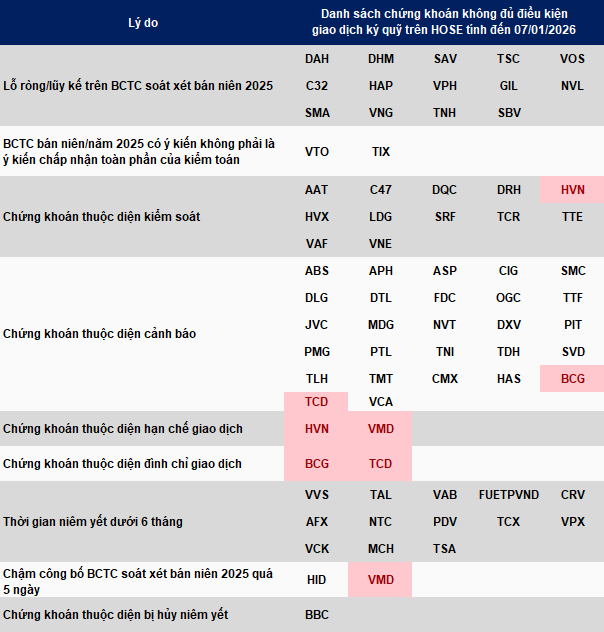

Recently, the Ho Chi Minh City Stock Exchange (HOSE) announced a list of 71 securities ineligible for margin trading in Q1/2026, an increase of 8 compared to Q4/2025.

Most securities were included due to warnings (27 codes), net/accumulated losses on the semi-annual 2025 audited financial statements (14 codes), being under control (12 codes), and listing for less than 6 months (13 codes).

The remaining securities were listed due to restrictions (2 codes), suspensions (2 codes), semi-annual/annual 2025 audited financial statements with non-clean audit opinions (2 codes), delays in announcing semi-annual 2025 audited financial statements exceeding 5 days (2 codes), and delisting (1 code).

In this list, HOSE noted 4 securities facing two issues simultaneously, including Bamboo Capital’s duo BCG and TCD (warned and suspended), HVN (controlled and restricted), and VMD (restricted and delayed in announcing semi-annual 2025 audited financial statements).

Notably, the number of securities ineligible for margin trading due to listing for less than 6 months increased significantly, from 5 in Q4/2025 to 13 in Q1/2026, amid a resurgence in IPO and listing activities. In the final months, newly listed stocks on HOSE attracting significant attention included the securities group with 3 cases of TCX, VPX, and VCK, as well as the appearance of consumer industry giant MCH from UPCoM.

* Codes with red backgrounds face two penalties simultaneously – Source: HOSE, compiled by the author

|

– 11:26 08/01/2026

Foreign Block Net Selling as VN-Index Surges 28 Points, Two Blue-Chip Stocks Dumped for Over 700 Billion VND

Foreign investors’ transactions were a notable drawback, as they net sold approximately VND 520 billion across the entire market.