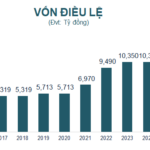

According to the Certificate of Registration for Public Offering of Additional Shares No. 563/GCN-UBCK dated December 31, 2026, issued by the State Securities Commission (SSC), ABBANK will increase its charter capital by VND 3,105,110,280,000 (equivalent to a 30% increase in the current charter capital) through a public offering of shares to existing shareholders via rights issuance.

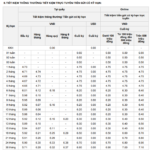

Key details of the offering are as follows: Rights ratio: 100:30 (for every 100 shares held on the record date, shareholders can purchase 30 new shares); Number of shares offered: 310,511,028 shares; Offering price: VND 10,000 per share.

Record date for allocating additional purchase rights (i.e., the final registration date for existing shareholders to exercise their rights to purchase additional shares): January 15, 2026.

– Rights transfer period: From January 22, 2026, to February 6, 2026.

– Subscription and payment period: From January 22, 2026, to February 10, 2026.

Upon completion, ABBANK’s charter capital is expected to reach VND 13,455,477,900,000. This additional capital will strengthen the bank’s financial foundation, improve capital safety ratios, and enhance investment in technology. It will also provide room for business expansion amid anticipated high credit demand from 2026 onward. This move is a critical step in ABBANK’s strategy to enhance financial capacity and competitiveness during its accelerated growth phase from 2026 to 2027.

Commenting on the capital increase plan, Mr. Vu Van Tien, Chairman of ABBANK’s Board of Directors, stated: “The approval to increase our charter capital not only strengthens ABBANK’s financial foundation but also demonstrates the confidence of regulatory authorities and the market in our development strategy. This is a crucial step as we prepare for a new growth cycle, focusing not only on business expansion but also on enhancing governance, transparency, and aligning with higher market standards.”

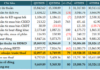

ABBANK’s capital increase plan comes amid robust and sustainable business performance in 2025. As of November 2025, the bank’s cumulative pre-tax profit reached VND 3,400 billion, achieving nearly 200% of the annual target. Return on Equity (ROE) remained high at 16%–18%, while the cost-to-income ratio (CIR) decreased to approximately 33%, reflecting significant operational efficiency improvements.

Alongside strong financial results, ABBANK has recently implemented strategic initiatives, including strengthening its senior leadership team, accelerating digital transformation, and optimizing its retail and SME business models. These segments are recognized for their strong profit margins and long-term growth potential, aligning with the bank’s sustainable development goals.

Additionally, the positive performance of ABB shares reflects market confidence in ABBANK’s restructuring and growth efforts. The bank’s ongoing efforts to standardize its financial foundation, governance, and transparency are paving the way for a potential market upgrade and official listing in 2026–2027, provided conditions are favorable. This strategic move will enable ABBANK to attract a broader investor base, enhance governance standards, and increase long-term enterprise value.

ABBank Finalizes Public Share Offering, Boosting Capital to 13.455 Trillion VND

On December 31, 2025, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) received the certificate of registration for its additional public offering of shares, thereby increasing its charter capital by over 3.105 trillion VND.

Convergence of Internal and External Forces Makes 2026 a Prime Year for Stock Market Investment

During the “2026 Investment Outlook – Balancing Opportunities” livestream hosted by DNSE Securities on December 29th, experts delved into the prospects of the stock market as it approaches the threshold of 2026. Despite lingering macroeconomic challenges, there was a consensus among the specialists that this year is undoubtedly “a must-invest year.”