Agribank Deposit Interest Rates for January 2026

As we step into January 2026, Agribank continues to maintain its new deposit interest rate structure following a significant adjustment in December 2025. This marks the first time Agribank has raised deposit rates in over three years, ending a prolonged period of rate reductions and stable low rates. The last rate increase occurred in late October 2022.

The December 2025 adjustment applied uniformly across all terms. For short-term deposits, rates for 1 to 11 months increased by 0.3 percentage points compared to late November. Longer terms, such as 12 to 24 months, saw a 0.5 percentage point increase, significantly boosting rates ahead of the new year.

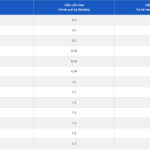

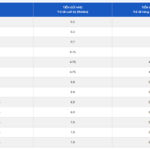

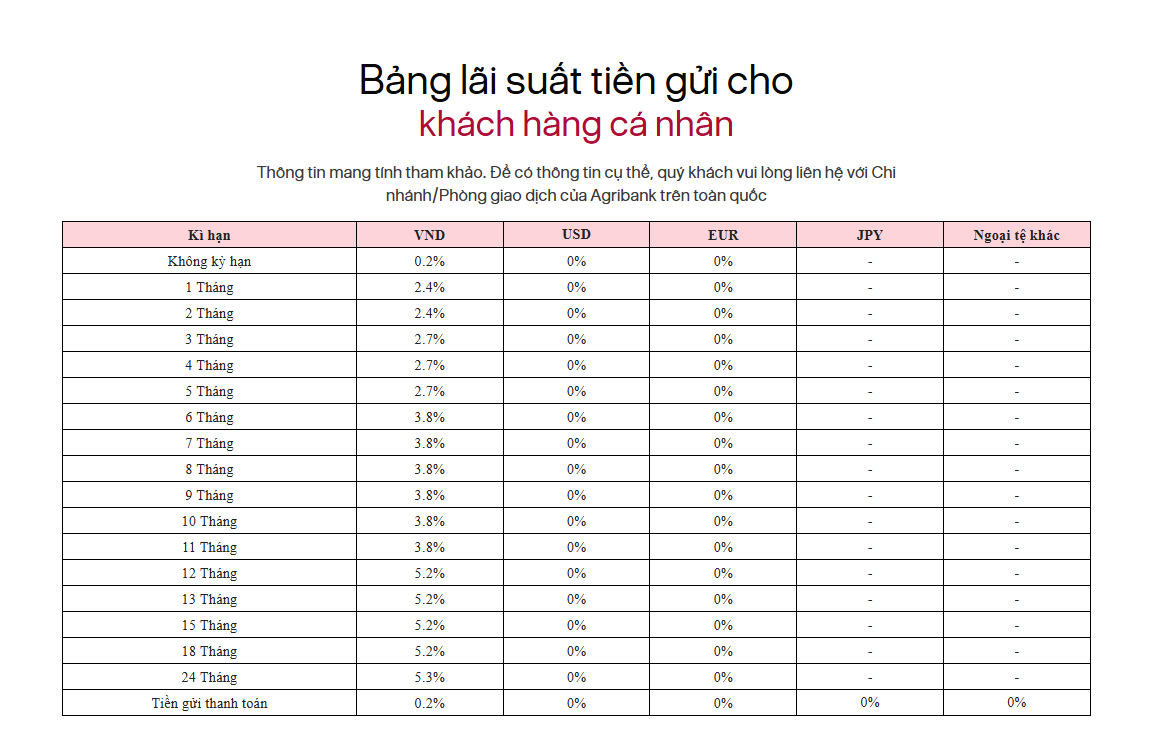

Following this increase, Agribank’s deposit rates for individual customers in January 2026 remain stable. Specifically, the non-term deposit rate is 0.2%/year. Terms of 1–2 months are listed at 2.4%/year, while 3–5 months are at 2.7%/year. These rates are significantly higher than the previous extended period.

Agribank applies a uniform rate of 3.8%/year for all terms from 6 to 11 months.

For long-term deposits, rates remain at the highest levels in the listed chart. Agribank offers 5.2%/year for terms of 12, 13, 15, and 18 months, while the 24-month term is listed at 5.3%/year. Thus, the 24-month term currently offers the highest interest rate at Agribank in January 2026.

Agribank Deposit Interest Rate Chart for Individual Customers as of January 5, 2026

To enhance benefits for depositors, Agribank has launched the “Save Today – Win Prizes Instantly” Savings Lottery program, offering over 3,300 attractive prizes with a total value of 9.7 billion VND. Customers can participate at all Agribank transaction points nationwide.

From November 10, 2025, to March 31, 2026 (or until the program ends early if Agribank runs out of lottery codes), individual customers depositing as little as 8 million VND for a 6-month term, 10 million VND for a 9-month term, or 15 million VND for a 12-month term at any Agribank transaction point nationwide will receive a lottery code. This gives them a chance to win one of 3,370 grand prizes, totaling 9.7 billion VND.

How Much Interest Will 100 Million VND Earn at Agribank?

To illustrate, the interest earned on a 100 million VND deposit at Agribank is calculated using the formula:

Interest = Principal × Interest Rate (%/year) × Number of Months / 12.

According to Agribank’s January 2026 rates, depositing 100 million VND yields the following interest amounts: a 1-month term (2.4%/year) earns 200,000 VND; a 3-month term (2.7%/year) earns 675,000 VND; a 6-month term (3.8%/year) earns 1,900,000 VND; a 12-month term (5.2%/year) earns 5,200,000 VND; and a 24-month term (5.3%/year) earns 10,600,000 VND after 2 years.

For those prioritizing liquidity and short-term needs like spending or capital rotation, 1–3 month terms are ideal. With rates of 2.4–2.7%/year, 100 million VND earns 200,000–675,000 VND in interest while maintaining flexibility for withdrawals. This suits individuals without long-term financial plans or those needing funds for unexpected expenses.

If the 100 million VND won’t be needed for 6–12 months, 6-month (3.8%/year) or 12-month (5.2%/year) terms offer a balance between profit and deposit duration. A 12-month term yields 5,200,000 VND, significantly higher than shorter terms. This is suitable for medium-term goals like asset purchases, travel, or one-year savings. However, early withdrawals result in interest calculated at the non-term rate.

For long-term financial goals, the 24-month term (5.3%/year) maximizes returns at Agribank. After 2 years, 100 million VND generates 10,600,000 VND in interest, outperforming shorter and medium-term options. This is ideal for those not needing funds long-term and seeking maximum interest.

To enhance flexibility, depositors can split the 100 million VND into smaller amounts. For example, 50 million VND for a 6-month term (earning approximately 950,000 VND) and 50 million VND for a 12-month term (earning approximately 2,600,000 VND). This approach leverages higher long-term rates while allowing early access to some funds.

In summary, depositing 100 million VND at Agribank offers various options based on financial goals. 1–3 month terms suit flexible needs, 6–12 month terms are ideal for medium-term plans, and 24 months maximize returns. Before depositing, consider capital needs and review the latest rates for the best term choice.

Bank Boosts 6-Month Savings Interest Rate to Over 7% Annually

The savings interest rate race is heating up as a leading bank has just pushed its 6-month term deposit rate past the 7% per annum mark.

Interest Rates on Deposits Rise Within Permitted Range

Banking system liquidity is under strain as the year-end approaches, driven by rapid credit growth and rising interbank interest rates. This has compelled banks to raise deposit interest rates after a prolonged period of stability. However, the increase remains within the permissible range.