“Rebranding and New Models”

In November 2024, the State Bank of Vietnam announced the transfer of CBBank to Vietcombank and Oceanbank to MB. This followed similar transfers announced in January 2025, where GPBank was transferred to VPBank and DongABank to HDBank.

Immediately after the transfers, the parent banks swiftly implemented comprehensive restructuring measures. The four struggling banks underwent rebranding, repositioning themselves as next-generation digital banks. DongABank was renamed Vikki Digital Bank (Vikki), CBBank became VCBNeo (Digital Foreign Trade Commercial Bank), Ocean Bank was rebranded as MBV (Modern Vietnam Bank), and GPBank was renamed Prosperity Era Bank, retaining its original acronym.

The State Bank of Vietnam reported that after one year, the transferred banks achieved positive results: streamlined organizational structures, strengthened senior leadership, new branding, and enhanced customer trust through the backing of their parent brands.

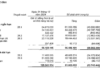

VCBNeo recorded a profit of over 1.8 trillion VND in 2025.

The transferred banks showed significant operational improvements. Total assets, deposits, and loan portfolios grew substantially. Non-performing loans were gradually addressed, with some banks turning profitable or reducing losses compared to 2024. Essentially, the four banks met their first-year targets in Phase 1.

“Trillion-Dong Profits”

At the recent 2026 Banking Task Deployment Conference, Mr. Nguyen Thanh Tung, Chairman of Vietcombank’s Board of Directors, stated that during the restructuring process, Vietcombank implemented synchronized solutions in credit, liquidity, technology, and risk management. They also deployed high-quality personnel to oversee and develop business operations.

By the end of 2025, VCBNeo reported a profit of over 1.8 trillion VND, marking a significant turnaround from previous years.

Mr. Pham Nhu Anh, CEO of MB, noted that immediately after the takeover, MB assigned 200 staff members to MBV’s Board of Members, Supervisory Board, and Executive Board. They also streamlined the entire organization for efficiency.

MB supported MBV in upgrading 20 critical IT systems to ensure security and uninterrupted operations. MBAMC’s involvement in managing bad debts reduced MBV’s non-performing loan ratio from 30% to 3%, stabilizing business operations.

HDBank’s 9-month business report revealed that Vikki Bank became profitable after just 7 months of transition. The digital bank now serves over 1.3 million new customers and is expanding its digital banking model.

Earlier, VPBank announced that GPBank became the first transferred bank to turn a profit, just 5 months after the takeover.

VPBank’s leadership expects GPBank to achieve a profit of 500 billion VND this year, emphasizing that the goal of the restructuring project is not short-term profit but long-term growth, with a 35% credit growth target over 5 years.