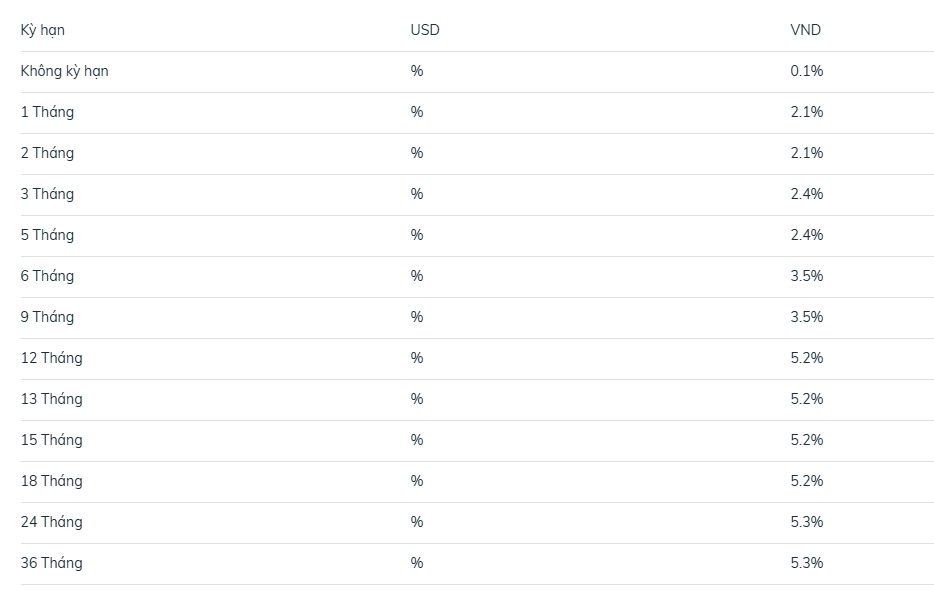

BIDV Bank Deposit Interest Rates for January 2026

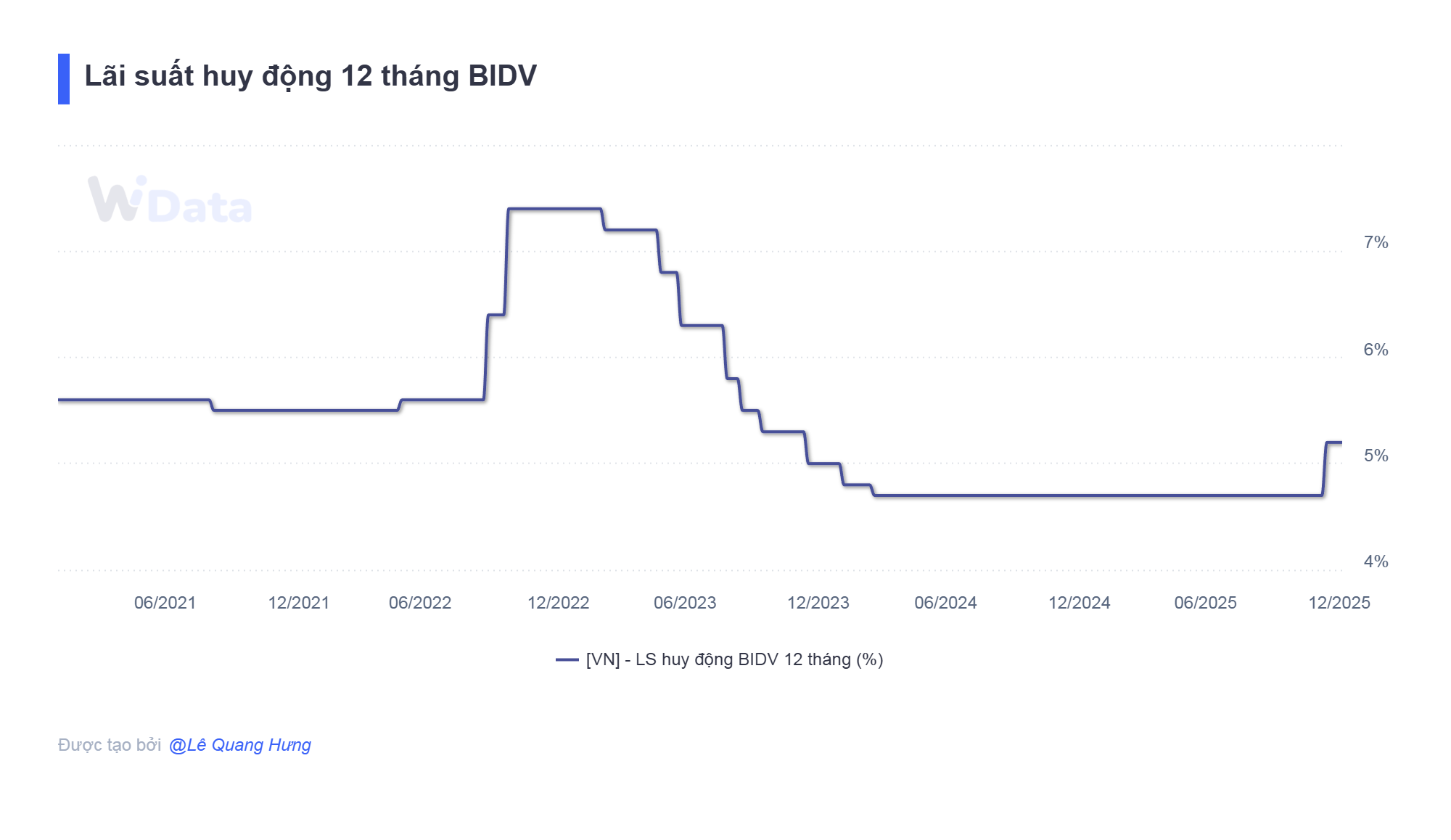

As we step into January 2026, BIDV continues to maintain its new deposit interest rate framework following a significant adjustment in December 2025. This marks the first time BIDV has raised deposit rates in over three years, ending a prolonged period of rate reductions and stable low-interest rates. The last rate increase occurred in late October 2022.

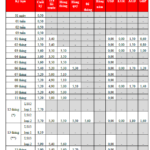

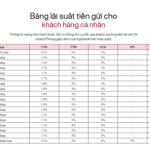

According to the current deposit interest rate schedule for individual customers, BIDV has set higher rates across most terms. For short-term deposits, the 1–2 month term is listed at 2.1%/year, while the 3-month and 5-month terms are both at 2.4%/year.

BIDV offers a 3.5%/year rate for 6-month and 9-month terms. The 12, 13, 15, and 18-month terms share a 5.2%/year rate. Meanwhile, the 24-month and 36-month terms are listed at 5.3%/year, higher than the other terms.

Thus, the 24-month and 36-month terms currently offer the highest interest rates at BIDV in January 2026, making them the most lucrative options for long-term financial planning.

BIDV Deposit Interest Rate Schedule for Individual Customers as of January 8, 2026

How Much Interest Will You Earn on a 100 Million VND Deposit at BIDV?

To illustrate, the interest earned on a 100 million VND deposit at BIDV can be calculated using the formula:

Interest = Principal × Annual Interest Rate × Number of Months / 12.

Based on BIDV’s January 2026 rates, a 100 million VND deposit yields the following interest amounts: 1-month term (2.1%/year) earns approximately 175,000 VND; 3-month term (2.4%/year) earns 600,000 VND; 6-month term (3.5%/year) earns 1,750,000 VND; 12-month term (5.2%/year) earns 5,200,000 VND; and 24-month term (5.3%/year) earns 10,600,000 VND after 2 years.

For those prioritizing liquidity and short-term needs, the 1–3 month terms are ideal. With rates of 2.1–2.4%/year, a 100 million VND deposit earns 175,000–600,000 VND in interest while ensuring flexibility for withdrawals.

If you don’t need access to your funds for 6–12 months, the 6-month or 12-month terms offer a balance between returns and deposit duration. The 12-month term, with 5.2 million VND in interest, stands out compared to shorter terms, making it suitable for medium-term financial plans.

For long-term savers, the 24-month or 36-month terms are optimal, offering BIDV’s highest rates. After 2 years, a 100 million VND deposit can generate 10.6 million VND in interest, the highest among all available terms.

Latest HDBank Interest Rates January 2026: Which Term Offers the Highest Returns?

At the beginning of January 2026, HDBank offered its highest deposit interest rate for an 18-month term.

Which Bank Offers the Highest Interest Rates on Deposits Right Now?

Interest rates on deposits remain at a high level, with some banks offering rates of up to 8.3% per annum for 12-month terms.