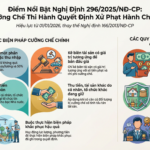

According to Decree 296/2025/NĐ-CP (effective from January 1, 2026), individuals who fail to voluntarily pay administrative fines may face enforcement measures, including the deduction of funds from their bank accounts or salaries/income.

The maximum deduction rate is 30% of monthly salary or pension (after deductions for insurance and taxes) and 50% for other income sources per instance. The decree expands the scope of enforcement to include seasonal workers and pensioners, replacing Decree 166/2013 and clarifying the enforcement process.

When Does This Take Effect?

The provision for deducting salaries for administrative violations, including road traffic violations, has been in place since the Law on Handling Administrative Violations 2012, effective from July 1, 2013, as guided by Decree 166/2013/NĐ-CP on the enforcement of administrative penalty decisions.

Citizens may face salary or income deductions for administrative violations. Photo: Minh Phong

Specifically, Article 86(2)(a) of the Law on Handling Administrative Violations 2012 states that deducting a portion of salary or income, or funds from an individual’s bank account, is one of the measures to enforce administrative penalty decisions.

The Government has issued Decree 296/2025/NĐ-CP, effective from January 1, 2026, replacing Decree 166/2013/NĐ-CP, to regulate the enforcement of administrative penalty decisions, including salary deductions for traffic violations.

Scope of Application

Under Decree 296/2025/NĐ-CP, salary or income deduction is an enforcement measure for administrative penalty decisions when the violator:

– Fails to voluntarily comply with the administrative penalty decision; or

– Fails to reimburse expenses as required under the Law on Handling Administrative Violations (Article 86 of the 2012 Law, amended by Article 1(43) of the 2020 amended Law).

This measure applies to all administrative violations, including traffic violations, if the offender does not voluntarily pay the fine as per the effective decision.

According to Article 10 of Decree 296/2025/NĐ-CP, the following individuals are subject to salary or income deduction:

– Government officials, civil servants, public employees, military personnel, police officers, and individuals working in secure organizations;

– Individuals employed and receiving salaries or income from an agency, unit, organization, or those with seasonal income from households, businesses, or employers;

– Individuals receiving pensions under social insurance regulations.

Deduction Rates

Decree 296/2025/NĐ-CP specifies the maximum deduction rates for salary and income as follows:

For salaries and pensions: up to 30% of the monthly net salary or pension (after deductions for social insurance, health insurance, unemployment insurance, and personal income tax), ensuring the individual’s minimum living conditions and those of their dependents as per the law.

For other income sources: up to 50% of the monthly income, ensuring the individual’s minimum living conditions and those of their dependents as per the law.

Procedure and Decision for Deductions

The process for salary or income deduction is detailed in Chapter II, Section 1 of the Decree, including:

– Verification of the offender’s current salary or income level for deduction purposes;

– Within the specified timeframe, the competent authority issues an enforcement decision for salary or income deduction, detailing the reason, deduction amount, duration, and recipient account. This decision is sent to the individual and the salary/income managing entity;

The salary/income manager (e.g., agency, unit, enterprise) must deduct and transfer the specified amount to the State Treasury’s account as per the enforcement decision.

Application to Traffic Violations

From January 1, 2026, individuals penalized for traffic violations (under relevant decrees) who fail to pay fines within the legal timeframe will face enforcement measures, including salary or income deduction, as per Decree 296/2025/NĐ-CP.

However, this Decree does not specify traffic violation fines but focuses on enforcement for non-compliance. Specific traffic violation fines are outlined in other decrees, such as Decree 168/2024/NĐ-CP.

Decree 296/2025/NĐ-CP is a significant step toward enhancing the legal framework for administrative penalty enforcement, promoting stricter, unified, and effective state management.

It addresses long-standing challenges in penalty enforcement, particularly non-compliance, thereby strengthening the law’s authority.

The Decree enhances deterrence and public awareness, especially among road users, by establishing a clear, transparent, and feasible legal framework for enforcement procedures, authority, and measures.

This ensures consistent and lawful enforcement by competent authorities, fairness among offenders, and the practical implementation of all lawful penalty decisions, regardless of the offender’s intent.

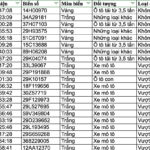

159 Vehicle Owners Swiftly Settle Traffic Violation Fines Under Decree 168

The Traffic Police Department under the Ministry of Public Security has recently released a list of traffic violations detected by its advanced AI camera system, marking a significant step in enforcing road safety measures.

314 Motorcyclists and Car Owners Identified via AI Cameras Urged to Settle Traffic Violation Fines Under Decree 168

According to the published list, the two most common violations are motorcyclists failing to wear helmets and disregarding traffic signal commands.