USD Edges Higher on Expectations of Fed Holding Rates Steady in January

Payroll processor ADP reported yesterday that private sector employment rose by 41,000 jobs in December, following a decline of 29,000 jobs in November (as per revised data). Although this figure fell short of economists’ forecasts of a 47,000 increase, it indicates that the U.S. labor market is not deteriorating.

This optimism is further bolstered by economists’ estimates that the December Jobs Report may show the world’s largest economy adding 60,000 new jobs in December, following a 64,000 increase in November. Consequently, the U.S. unemployment rate is projected to drop to 4.5% in December, after surging to a four-year high of 4.6% in November.

Expectations that the Fed will maintain interest rates in January have thus continued to rise. According to CME’s FedWatch tool, investors are now pricing in nearly a 90% chance that the Fed will hold rates steady at its January 27-28 meeting, up slightly from approximately 82% before the ADP employment report was released.

These expectations supported a modest rise in the U.S. dollar yesterday, with the upward momentum continuing into this morning (Thursday, January 8). The U.S. Dollar Index—which measures the greenback’s strength against six major currencies—climbed to around 98.75, nearing the one-month high set earlier this week.

However, according to Olivier Bellemare, Senior Options Trader at Monex Canada, the current movement in the U.S. dollar is more tactical than anything else, “because without definitive policy updates, there will be a weakening compared to the usual trend.”

“The focus will be on the employment data at the end of the week, and the reason is that the market is still seeking inflation signals as a more stable indicator to guide the value of the U.S. dollar relative to other currencies,” he added.

Outlook Remains Negative

Notably, a Reuters poll reveals that currency strategists remain pessimistic about the U.S. dollar’s prospects at the start of 2026. Most strategists predict the world’s primary reserve currency will weaken slightly by year-end due to persistent concerns about the Fed’s independence and the likelihood of further rate cuts.

Specifically, the Reuters survey conducted from January 5 to January 7 indicates that the U.S. dollar’s downward trend will persist. Meanwhile, the euro is forecast to rise approximately 1% each quarter, reaching 1.19 USD/EUR by mid-year and 1.20 USD/EUR by year-end. Only 17%, or 12 out of 71 currency strategists surveyed, predict the euro will weaken from its current level by the end of 2026.

“The White House wants to take control of monetary policy and steer interest rates—and that points toward further easing,” said Vincent Reinhart, Chief Economist at BNY Investments and a former Fed staffer. He added that the U.S. dollar will trade sideways in the short term due to limited changes in monetary policy until a new Fed Chair is appointed.

However, “in the medium to long term, there are numerous reasons for the U.S. dollar to depreciate. The Fed is easing more than other central banks, the U.S. is seen as a less attractive safe haven, and the growth differential between the U.S. and its major trading partners is narrowing.”

The Fed cut rates three times in 2025, lowering the benchmark rate to the current range of 3.50%-3.75%, largely due to growing concerns about a weakening labor market. The average forecast of Fed policymakers suggests an additional 25 basis point cut this year.

However, policymakers have signaled a pause to assess upcoming data before further easing, highlighting divisions between officials cautious about pushing inflation above the 2% target and those concerned about additional job losses without rate cuts.

Paul Mackel, Global Head of FX Research at HSBC, noted that the impact of the Trump administration’s fiscal expansion “has begun to take effect,” and the effects of last year’s tariffs “are still lingering.”

“I don’t think we can confidently say the inflation story is over and it will only ease from here,” Mackel said. “But the Fed remains fundamentally biased toward monetary easing… so we are in a weak dollar environment, which is likely to persist in the coming months.”

Currency traders, who maintained a net short position on the U.S. dollar for most of 2025, appear set to continue their stance in the near term. Specifically, nearly 90% of surveyed currency strategists—35 out of 40—indicated that net short positions on the U.S. dollar would remain unchanged or increase by the end of January.

Markets are currently betting on the Fed cutting rates at least twice more this year, with potential for further easing if policy decisions become more politically influenced. According to some analysts, this risk is closely tied to developments surrounding Fed personnel, particularly the successor to Jerome Powell as Fed Chair.

“We could also see the risk of multiple members being removed and increased implicit pressure on the Fed,” said Erik Nelson, G10 FX Strategist at Wells Fargo, noting that this could accelerate the dollar’s decline and make it more severe.

Wells Fargo was the most accurate institution in forecasting major currencies in last year’s Reuters surveys.

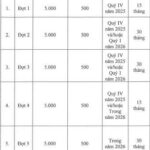

TCBS Launches 15-Month Bond Issuance

On December 25, 2025, TCBS issued a VND 500 billion bond under the code TCX12504, with a 15-month maturity.

Macroeconomic Stability Goals for 2026 and Monetary Policy

Stabilizing the macroeconomy is a cornerstone of Vietnam’s development strategy, as outlined in Resolution 244/2025/QH15 by the National Assembly for the 2026 socio-economic development plan. This goal is not limited to 2026 alone; it has been a consistent priority for the government over many years, underscoring its indispensable role in the nation’s overall growth trajectory.