In 2025, Vietnam’s import-export turnover reached a record-breaking $930 billion for the first time, amidst a backdrop of tax exemptions and reductions aimed at supporting businesses, plummeting oil and coal prices, and frequent natural disasters. Budget revenues from import-export activities significantly exceeded projections.

As of December 31, 2025, budget revenues from import-export activities surpassed VND 469.5 trillion, achieving 114.2% of the target and marking a 9.8% increase compared to the same period in 2024.

Mr. Nguyễn Sỹ Hoàng, Head of Tax Operations at the Customs Department, attributed the revenue growth primarily to raw materials, machinery, equipment, and production components. This category accounted for approximately 50% of total taxable import turnover, rising by 11.3% year-on-year and contributing an additional VND 23 trillion to the budget. This trend highlights businesses’ resilience and expansion in investment, despite global economic uncertainties.

Additionally, whole car imports emerged as a significant revenue driver, with import volumes increasing by 19% and value surging by 30%, adding approximately VND 12.3 trillion to the budget. New tax policies also proved effective, such as the application of value-added tax (VAT) on fertilizers, generating around VND 1.5 trillion, and taxes on low-value goods, contributing an additional VND 1.4 trillion.

A 19% increase in car imports in 2025 boosted budget revenues by VND 12.3 trillion.

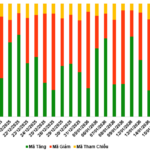

Conversely, several key commodities dampened revenue growth. Fuel imports decreased by nearly 6% in volume and 16% in value, resulting in a budget shortfall of approximately VND 5.6 trillion. Coal imports, while slightly up in volume, saw a sharp price decline, reducing revenue by around VND 3.4 trillion. The 2% VAT reduction led to a VND 37.5 trillion drop in VAT collections from import-export goods. Furthermore, amendments to preferential export-import tax schedules during 2024-2025 decreased import-export tax revenues by roughly VND 2.4 trillion.

Looking ahead to 2026, budget collection pressures are intensifying. The National Assembly has set a revenue target of VND 451 trillion for the Customs sector, a 9.7% increase from the previous year’s target, amidst persistent risks such as stricter U.S. origin control, volatile input prices, and potential expansions of free trade agreements leading to further import tax reductions.

Facing these challenges, the Customs Tax Operations Department plans to focus on procedural reforms, modernizing management, and risk control. Key strategies include closely monitoring revenue sources by region and commodity group, tightening controls on valuation, HS codes, and origin verification, enhancing post-clearance inspections, and collaborating to combat smuggling and trade fraud.

Revitalizing Ho Chi Minh City’s Struggling Textile and Traditional Retail Sectors

According to the Ho Chi Minh City Business Association, the textile and garment industry continues to grapple with the adverse effects of declining demand and rising production costs. As a result, numerous companies have been forced to scale back operations, with some even facing bankruptcy as the Lunar New Year approaches.

Eliminating Lump-Sum Tax: Concerns Over Penalties and Lingering Questions

During a dialogue session with taxpayers, several concerns were raised regarding electronic invoicing, with suggestions to streamline processes and reconsider administrative penalties to make them more lenient. This is particularly relevant given the upcoming transition of business households from lump-sum tax to self-assessment by January 1, 2026.