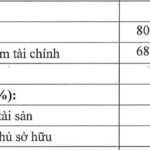

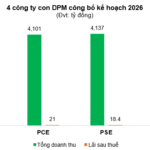

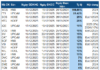

According to the 2026 plan, pre-tax profit is projected to reach VND 850 billion, with post-tax profit at VND 680 billion. In terms of financial structure, the company maintains a safe debt-to-equity ratio of 0.55. A 12% dividend payout is anticipated for 2026.

Production volumes are forecasted as follows: Phú Mỹ Urea (converted) at 902,700 tons, Phú Mỹ NPK at 180,000 tons, and UFC 85 at 10,000 tons.

Sales volumes include Phú Mỹ Urea and Urea-based products at 833,000 tons, Phú Mỹ NPK at 180,000 tons, commercial fertilizers at 310,000 tons, production chemicals at 99,500 tons, and commercial chemicals at 29,600 tons.

For 2026, DPM plans a total investment capital requirement of over VND 1,160 billion, allocated to basic construction (VND 580 billion), equipment procurement (VND 370 billion), and financial investments (VND 210 billion). The entire investment plan will utilize equity capital without borrowing.

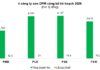

2025 Exceeds Plan

Reflecting on 2025, the Phú Mỹ Urea Plant operated safely and stably, enhancing product quality and ensuring a continuous supply to the market. Total production volume in 2025 is estimated at nearly 1,180,000 tons of fertilizers and chemicals, with most products surpassing their targets.

Notably, Phú Mỹ NPK production saw an impressive 155% growth compared to 2024. The plant also introduced new products such as Phú Mỹ NPK SOP, Phú Mỹ DAP, and DEF Phú Mỹ Xanh, contributing to a comprehensive Phú Mỹ product ecosystem.

Chemicals Emerge as a New Growth Driver

In business operations, the chemical segment stood out as DPM continued to strengthen its presence, becoming a significant revenue growth driver alongside fertilizers. The product portfolio includes key items like NH₃, CO₂, UFC 85, and new chemical lines.

DEF Phú Mỹ Xanh, in particular, has been successfully commercialized, expanding business activities beyond agriculture to meet emission control and green transition trends. This has significantly increased the chemical segment’s contribution to the corporation’s revenue structure.

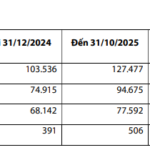

By mid-December 2025, DPM is estimated to achieve VND 16,000 billion in revenue, meeting the challenging target set by its largest shareholder, Petrovietnam, in the 2025 growth plan.

– 10:30 08/01/2026

BVBank Seeks to Boost Capital by 9.912 Trillion VND

Ban Viet Joint Stock Commercial Bank (BVBank, UPCoM: BVB) has announced the materials for its 2025 Extraordinary Shareholders’ Meeting, scheduled for December 26. The agenda includes proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members of the Board of Directors and Supervisory Board for the 2025-2030 term.

Vinatex Projects 2025 Profits to Surpass VND 1.3 Trillion, Approaching Historic Highs

Groundbreaking profit information from Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) was announced by the Group’s leadership at Hanosimex’s 2025 year-end conference, amidst a context where many member units are beginning to turn a profit again.