On January 6th, the Office of the President held a press conference to announce the President’s Decree promulgating 12 laws passed by the 15th National Assembly during its 10th session.

Deputy Director Luu Duc Huy addresses the media at the press conference.

During the conference, a reporter from Nguoi Lao Dong newspaper inquired about the timeline for implementing regulations on the taxable value threshold for gold bars and the application of personal income tax on gold bar transfers.

In response, Mr. Luu Duc Huy, Deputy Director of the Department of Tax Policy Management and Supervision (Ministry of Finance), stated that the 2025 Personal Income Tax Law has included income from gold bar transfers as taxable, with a tax rate of 0.1%.

According to Mr. Huy, the Ministry of Finance has been tasked by the Government to draft a Decree guiding the implementation of the Personal Income Tax Law, including provisions on tax management for gold bar transfers.

“The Ministry is currently collaborating with relevant ministries and agencies, including the State Bank of Vietnam, to research and propose an appropriate taxable value threshold for gold bars. This threshold will be specified in the Government’s Decree,” Mr. Luu Duc Huy explained.

Regarding the submission timeline, Mr. Huy mentioned that the Government has instructed the Ministry of Finance to submit the draft Decree by April 2026, but the Ministry aims to complete and submit it earlier.

The 2025 Personal Income Tax Law, effective from July 1, 2026, has included income from gold bar transfers as taxable, with a rate of 0.1% per transfer. The Law authorizes the Government to determine the taxable value threshold for gold bars, the implementation timeline, and adjustments to the personal income tax rate for gold bar transfers in line with the gold market management roadmap.

Similarly, income from the transfer of digital assets is subject to the same 0.1% tax rate, consistent with the tax rate for securities transfers.

Ho Chi Minh City to Establish Urban Railway Corporation

Speaking at the Ho Chi Minh City teleconference, Vice Chairman of the City People’s Committee Nguyen Cong Vinh announced the establishment of the Urban Railway Corporation by Ho Chi Minh City.

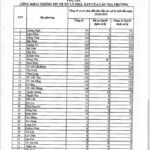

Revealing Local Land and Property Handling Status Across Regions

In compliance with the directives of the Prime Minister and the Party Committee of the Ministry of Finance, the Ministry of Finance has released comprehensive data on the status of land and property arrangement, allocation, and handling across localities as of December 26, 2025. This disclosure highlights both the achievements and challenges observed in the process.

Exciting News for Vehicle Registration Plate Applicants in Hanoi and Ho Chi Minh City

The Ministry of Finance has proposed a 30% reduction in vehicle registration and license plate fees. Specifically, for passenger cars with nine seats or fewer in Hanoi and Ho Chi Minh City, the fee will be lowered to 14 million VND per vehicle per registration.