According to VIS Rating, GELEX is the first entity to have its credit rating outlook upgraded from Stable to Positive in the 2025 assessment cycle, a rare feat achieved in less than a year. This underscores GELEX’s exceptional financial health and operational efficiency improvements, particularly in a tightening credit standards environment. It also highlights the Group’s robust governance, adaptability, and potential for further credit rating upgrades in the medium term.

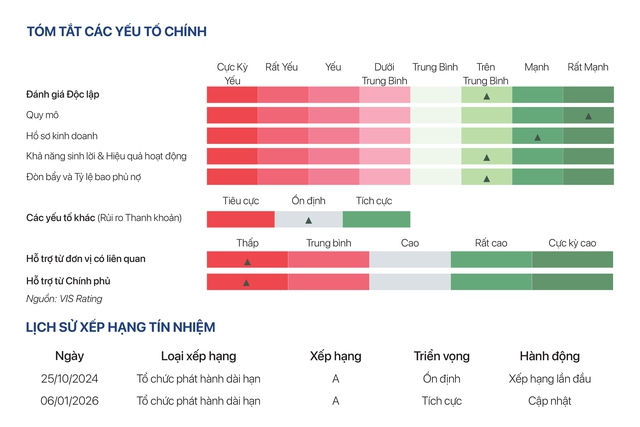

VIS Rating has upgraded GELEX’s long-term credit rating outlook from “Stable” to “Positive” while maintaining its A rating.

GELEX’s A credit rating, coupled with its Positive outlook, reflects expectations of sustained revenue and cash flow growth over the next 12–18 months. This optimism is grounded in the Group’s strong core business performance in electrical equipment and construction materials.

From 2024 through the first nine months of 2025, GELEX recorded nearly 15% revenue growth, significantly outpacing the 2021–2023 average. Notably, its EBITDA margin improved to approximately 23%, demonstrating enhanced operational efficiency and cost management at the consolidated level.

The electrical equipment segment remains GELEX’s primary growth driver. Through market expansion, new product development, and supply chain optimization, the Group has significantly increased its market share in the industry.

CADIVI, a key subsidiary specializing in electrical cables, has notably expanded its presence in Northern Vietnam since early 2024, boosting its nationwide market share. Supported by scale expansion and improved production efficiency, the electrical equipment segment’s EBITDA margin surged from around 13% to over 20% in the first nine months of 2025.

The electrical equipment segment drives GELEX’s revenue and profit growth.

VIS Rating anticipates stable growth in this segment, fueled by strong demand for electrical equipment amid robust public and private investment in national power infrastructure.

For GELEX Infrastructure, the construction materials segment is expected to see margin improvements due to the real estate market recovery, reduced competition in the glass segment following Vietnam’s anti-dumping investigation in July 2025, and sales channel restructuring.

The utilities segment, with an EBITDA margin exceeding 70%, is projected to bolster the Group’s overall growth upon completing its water treatment capacity doubling plan in Q1/2026.

Strong demand for industrial infrastructure will support leasing activities and cash flow in the industrial real estate segment. GELEX Infrastructure plans to launch ANmaison, a residential project in Hai Phong co-developed with Frasers Property (Singapore), in Q1/2026. The Group also aims to expand its residential land bank and develop new projects. From 2026–2027, GELEX’s revenue is expected to grow at a 14% CAGR, with EBITDA margins stabilizing around 20%.

Rendering of the ANmaison project in Hai Phong.

VIS Rating highlights GELEX’s strong profitability and operating cash flow (CFO), which underpin its stable financial health. Specifically, the EBIT/Interest Coverage ratio stands at 4.5–5.0x, while the CFO/Debt ratio remains at 15–20%.

These metrics indicate GELEX’s financial flexibility to pursue medium- and long-term investments while effectively managing leverage and liquidity risks in a volatile financial environment.

According to VIS Rating, GELEX’s credit rating could be upgraded in the medium term if it sustains an EBITDA margin above 20%, a CFO/Debt ratio above 20%, and pursues a prudent investment strategy with limited reliance on debt financing.

Conversely, overly rapid expansion or delays in key projects could strain cash flow and liquidity, potentially impacting future rating outlooks.

The maintenance of an A credit rating and the upgrade to a Positive outlook by VIS Rating underscore GELEX’s creditworthiness, financial management prowess, and sustainable business foundation. This achievement not only strengthens investor and creditor confidence but also positions the Group to access long-term capital at competitive rates, supporting its sustainable growth strategy.

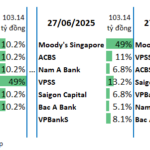

VIS Rating is Vietnam’s independent credit rating agency, licensed by the Ministry of Finance in September 2023. Established through a partnership with Moody’s and other stakeholders under the Vietnam Bond Market Association (VBMA) initiative, it provides credit risk and financial capability assessments for domestic enterprises.

GELEX’s Long-Term Credit Rating Outlook Upgraded to “Positive” by VIS Rating

On January 6, 2026, GELEX Group Joint Stock Company (HoSE: GEX) had its long-term issuer credit rating affirmed at A by Vietnam Investment Credit Rating Joint Stock Company (VIS Rating), while its outlook was upgraded from “Stable” to “Positive.”

Nanoco 2026: Vietnam’s Leading Lighting Company Achieves ETL Certification, Launches Products in Walmart USA

With a solid foundation built on years of expertise in the lighting industry, Nanoco is poised to make a significant leap in 2025–2026. Our LED lighting products have achieved the prestigious ETL certification, a critical milestone that unlocks access to the U.S. market. This achievement is further amplified by our official entry into Walmart’s retail network, marking a new era of growth and accessibility for Nanoco.

GELEX and FPT Forge Strategic Partnership to Advance Blockchain Technology for Global Markets

On December 25th in Hanoi, FPT Corporation and GELEX Group signed a strategic alliance agreement in the field of blockchain technology. The two conglomerates will collaborate on research, product development, and business models related to digital assets, initially focusing on Vietnam, with plans to expand into international markets.