Domestic Gold Prices Plummet by Nearly $300 per Ounce in One Week

Domestic gold prices have seen a sharp decline over the past week (December 29 to January 4), with adjustments reaching nearly $300 per ounce for both buying and selling rates across major brands.

Specifically, as of January 4, SJC gold bars are listed at 150.8 – 152.8 million VND per tael (buying – selling). Compared to December 29, SJC gold prices have dropped by 6.9 million VND per tael in both trading directions.

Similar trends were observed at other major brands like DOJI, Bao Tin Minh Chau, and Bao Tin Manh Hai. These companies are currently listing gold bars at around 150.8 – 152.8 million VND per tael, approximately 6.9 million VND per tael lower than the previous week. Mi Hong, however, saw a slightly milder decrease. The brand is currently listing at 152.6 – 153.8 million VND per tael, a drop of about 5.9 million VND per tael since December 29.

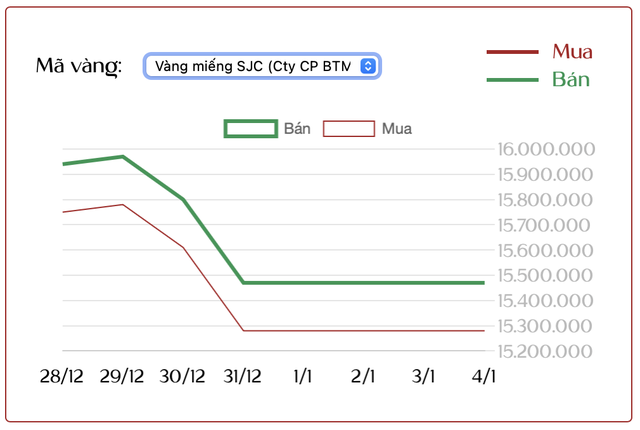

Gold bar price fluctuations at Bao Tin Manh Hai over the past week

Not only gold bars, but domestic gold ring prices also experienced significant adjustments last week, with decreases ranging from nearly $200 to over $300 per ounce, depending on the brand.

Specifically, SJC gold rings, priced at 153.1 – 156.1 million VND per tael on December 29, dropped to 145.9 – 148.9 million VND per tael on January 3. Thus, in just one week, SJC gold ring prices fell by 7.2 million VND per tael in both buying and selling directions—the steepest decline among surveyed brands.

Meanwhile, Bao Tin Minh Chau and Bao Tin Manh Hai recorded milder adjustments. Gold ring prices at these brands, previously at 156.9 – 159.9 million VND per tael, retreated to 152 – 155 million VND per tael, a decrease of approximately 4.9 million VND per tael.

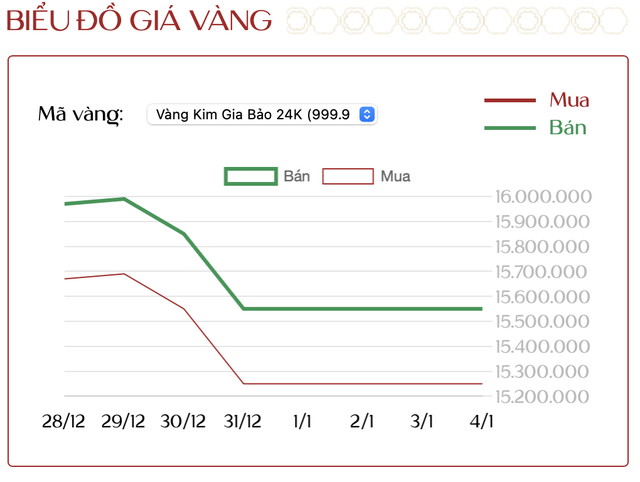

Gold ring price fluctuations at Bao Tin Manh Hai over the past week

For DOJI, gold ring prices fell from 155 – 158 million VND per tael to 149 – 152 million VND per tael, a drop of about 6 million VND per tael over the week.

With the sharp decline over the past week, buyers who purchased gold on December 29 and sold at the end of the week incurred significant losses. Specifically, buying SJC gold bars at 159.7 million VND per tael and selling at 150.8 million VND per tael resulted in a loss of approximately $250–$300 per ounce. For gold rings, the losses were even higher, ranging from $250 to over $350 per ounce, depending on the brand. This highlights the substantial risks of buying gold at high prices in a volatile market.

Global Gold Prices Fluctuate Wildly: What Do Experts Say?

Last week, the global gold and silver markets closed 2025 with their strongest gains since 1979 and are entering the new year on a positive note, despite signs of short-term peaking.

During the shortened trading week due to holidays, gold prices surged to a new record high, nearing $4,550 per ounce. However, the precious metal failed to sustain its rally after the Chicago Mercantile Exchange (CME) increased margin requirements earlier in the week, forcing investors to deposit more funds to maintain futures positions in gold, silver, platinum, and palladium.

Meanwhile, low liquidity during the holiday season caused gold prices to fluctuate wildly. By week’s end, gold prices had fallen by over 4%, marking the sharpest sell-off since November 2024. Nonetheless, the precious metal found new support around $4,330 per ounce before the weekend. At the time of reporting, prices were hovering around $4,330.3 per ounce.

Despite the volatility and profit-taking in gold and silver, analysts remain optimistic about the long-term upward trend of these precious metals.

“It won’t rise in a straight line. Over time, there will be very strong corrections. Currently, precious metals are overbought, so a correction of over 10% could happen at any moment, simply because the upward momentum temporarily collapses under its own weight,” said Philippe Gijsels, Chief Strategist at BNP Paribas Fortis, in an interview with Kitco News.

Despite short-term challenges, gold and silver prices are expected to remain well-supported as the U.S. dollar continues to weaken. The USD Index is forecast to end the week around 98 points.

“The primary driver of gold prices remains the relationship between real interest rates and the U.S. dollar,” noted Rania Gule, Senior Market Analyst at XS.com. “The USD Index is currently around 98.3 points, down about 9.5% for the year, easing pressure on USD-denominated commodities. Meanwhile, the real yield benchmark—measured by instruments like 10-year TIPS—is around 1.92%, which continues to define the opportunity cost of holding a non-yielding asset like gold.”

In a report released on Friday, Christopher Lewis, Senior Market Analyst at FXEmpire, suggested that despite gold being overbought in the short term, investors will likely seize opportunities to buy during downturns.

As the holiday season officially ends, the market is expected to return to normal trading conditions but may face heightened volatility due to upcoming critical labor market data. Some economists believe this will be the first “clean” jobs report since the 43-day U.S. government shutdown that ended in October.

Linh San

Gold Prices Plunge Further Tonight

Gold prices have plummeted by 2 million VND per tael, pushing the historic peak of 160 million VND further out of reach!