Amidst a buoyant stock market, CAN shares of Ha Long Canned Food JSC bucked the trend, plummeting to the floor price of VND 27,900 per share at the opening of the January 8th session. This sharp decline, pushing the stock to its lowest point in over three years, coincided with the revelation of a scandal involving 120 tons of contaminated pork.

On January 7th, the Hai Phong Police Department’s Investigation Agency for Corruption, Economic, and Smuggling Crimes uncovered a scheme where 120 tons of African swine fever-infected pork were being processed into canned meat for market distribution.

The agency discovered that a network had procured over 120 tons of infected pork, delivering it to the warehouse of Ha Long Canned Food JSC (stock code: CAN). Approximately 2 tons had already been processed into canned meat, all of which was found to be spoiled, leaking, and emitting a foul odor.

Some Ha Long Canfoco products currently available on the market

Authorities confirmed that Ha Long Canned Food JSC had stockpiled over 120 tons of African swine fever-infected pork, including numerous finished canned products.

After gathering evidence, authorities collaborated with relevant units to implement legal measures. The entire seized inventory, comprising over 120 tons of contaminated raw meat and processed cans, was safely destroyed to prevent disease spread.

Consistent Annual Revenue in the Hundreds of Billions

Established in 1957 in Hai Phong as the Ha Long Fish Cannery, Ha Long Canned Food JSC (Ha Long Canfoco) is a longstanding player in Vietnam’s processed food industry.

Ha Long Canfoco is renowned for its convenient canned products, including Hai Phong lamppost pâté, liver pâté, salmon pâté, oil-packed tuna, canned meat, and fruit preserves.

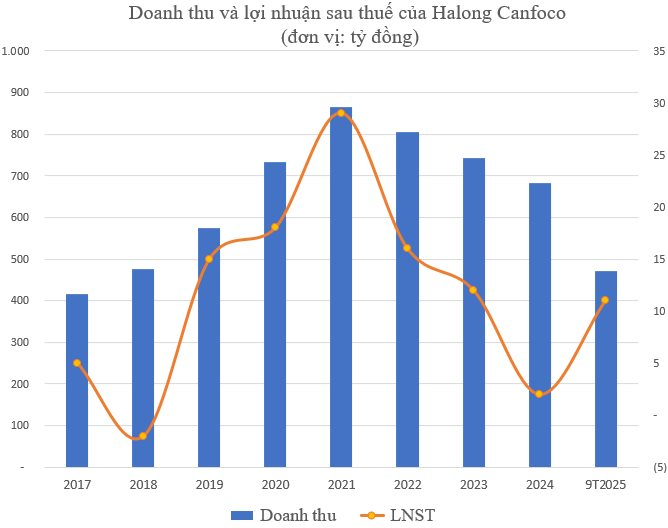

Prior to the incident involving 120 tons of African swine fever-infected pork, Ha Long Canfoco maintained a robust business performance, with annual revenue reaching nearly VND 900 billion.

From 2020 onwards, CAN’s net revenue has impressively ranged between VND 700 billion and over VND 800 billion. The peak revenue was recorded in 2021, exceeding VND 864 billion.

According to the Q3/2025 financial report, Ha Long Canned Food’s net revenue reached VND 170 billion, a 14% decrease year-on-year. Cost of goods sold declined more sharply than revenue, resulting in a VND 43 billion gross profit, up 13% year-on-year.

After deducting other expenses, the company’s after-tax profit stood at VND 7.6 billion, nearly quadrupling year-on-year.

For the first nine months of 2025, revenue totaled VND 471 billion, down nearly 11% year-on-year. Despite the sales decline, significant cost reductions led to an after-tax profit of VND 11 billion, an improvement from a VND 6 billion loss in the same period last year.

Offering 5 Million Shares at a 1:1 Ratio, Building a New VND 166 Billion Factory

In related developments, at the 2025 First Extraordinary General Meeting of Shareholders, Ha Long Canned Food approved a plan to issue shares to existing shareholders to increase charter capital. Specifically, the company will issue an additional 5 million shares at a 1:1 ratio (each shareholder holding 1 share can purchase 1 new share).

The proposed offering price is VND 15,000 per share, significantly lower than the book value (approximately VND 29,944 per share as of June 30, 2025) and the recent average market price (around VND 31,640 per share).

The expected total proceeds are VND 75 billion. Of this, VND 50 billion will be allocated to constructing a new factory and purchasing equipment, while the remaining VND 25 billion will supplement working capital. The offering is scheduled for 2026.

Addressing shareholder concerns about financial risks associated with the large-scale project, CAN’s leadership stated they had conducted thorough analysis and expressed confidence in the project’s success, urging shareholders to trust the Board of Directors to deliver optimal results.

A key agenda item at the meeting was the relocation of the food processing plant at 71 Le Lai, Ngo Quyen District, Hai Phong, described by the company’s leadership as a “critical survival task.”

This decision stems from the Ngo Quyen District’s 2040 zoning plan (approved in April 2025), which reclassifies the company’s land as public green space and recreational areas. Since 2023, the company has returned over 5,000 m² to the city.

Additionally, CAN shareholders approved leasing a 20,000 m² plot (2 hectares) in the Nam Dinh Vu Industrial Park (Zone 1), Dong Hai Ward, Hai Phong, for 34 years until 2059, with a total lease value exceeding VND 68 billion.

On this new site, Ha Long Canned Food will develop the Ha Long Canned Food Factory project with a total investment of over VND 166 billion. The capital structure includes approximately VND 83.7 billion in equity and over VND 82.2 billion in credit financing.

Unraveling the VN-Index’s 100-Point Plunge: Experts Highlight a Critical Risk to Watch

Amidst a sharp market downturn, the absence of panic-driven liquidity surges often signals a cautious stance from major investors, reflecting their reluctance to engage and a prevailing hesitancy among buyers.

QCG Stock Plunges for the Second Consecutive Session as VN-Index Takes a Sharp Dive

Amidst a declining market, Quốc Cường Gia Lai’s QCG stock defied the trend, surging to its upper limit for the second consecutive session on December 11th. This remarkable performance stands in stark contrast to the benchmark VN-Index, which continued its downward spiral, shedding over 20 points during the same trading day.

Foreign Block Reverses Flow, Pouring Hundreds of Billions into a Blue-Chip Stock Amid VN-Index’s 20-Point Drop

Foreign investors’ transactions were a notable drawback, as they recorded a net sell-off of approximately VND 532 billion.