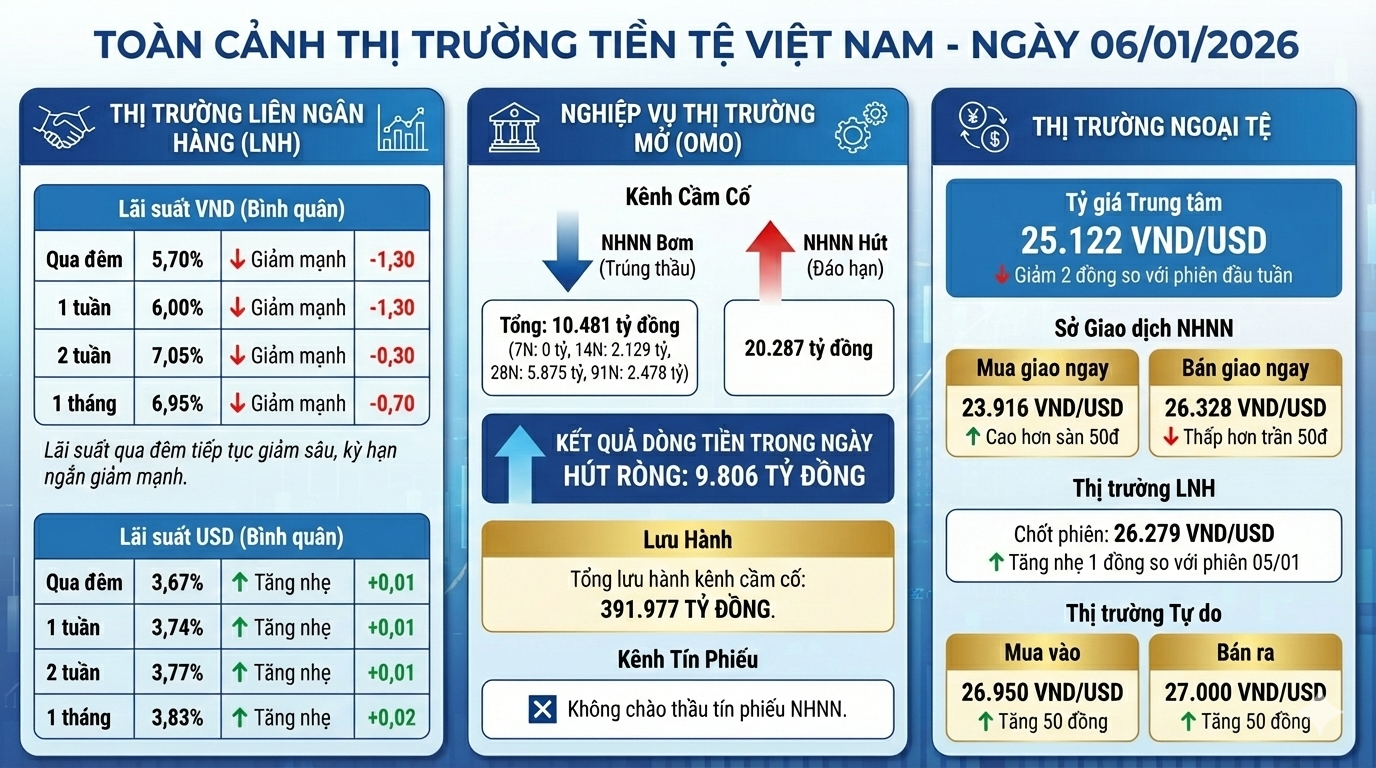

By the close of trading on January 6th, the average interbank lending rates for the Vietnamese Dong (VND) saw a significant decline across all short-term maturities, from one month and below, compared to the start of the week. Notably, the overnight rate—which accounts for approximately 80–90% of transaction value—dropped by 1.30 percentage points to 5.70% per annum.

Similarly, the one-week rate decreased by 1.30 percentage points to 6.00% per annum, the two-week rate fell by 0.30 percentage points to 7.05% per annum, and the one-month rate dropped by 0.70 percentage points to 6.95% per annum.

For the US Dollar (USD), interbank lending rates edged slightly higher. The overnight rate increased by 0.01 percentage points to 3.67% per annum. Both the one-week and two-week rates rose by 0.01 percentage points, reaching 3.74% per annum and 3.77% per annum, respectively, while the one-month rate climbed by 0.02 percentage points to 3.83% per annum.

In the Open Market Operations (OMO) channel, during the January 6th session, the State Bank of Vietnam significantly reduced the auction scale compared to the previous session. Specifically, the State Bank auctioned 1,000 billion VND for a 7-day term, 3,000 billion VND for each of the 14-day and 91-day terms, and 6,000 billion VND for a 28-day term, all at a uniform interest rate of 4.5% per annum.

The total successful auction volume reached 10,481 billion VND, with no successful bids for the 7-day term, 2,129 billion VND for the 14-day term, 5,875 billion VND for the 28-day term, and 2,478 billion VND for the 91-day term. On the same day, 20,287 billion VND matured. The State Bank did not auction treasury bills.

Thus, during this trading session, the State Bank net absorbed approximately 9,806 billion VND from the market. The total outstanding volume in the collateral channel decreased to 391,977 billion VND.

In the foreign exchange market, during the January 6th session, the State Bank of Vietnam continued to slightly lower the central exchange rate. The central rate was set at 25,122 VND/USD, a decrease of 2 VND compared to the start of the week.

At the Trading Desk, the spot buying rate was listed at 23,916 VND/USD, 50 VND higher than the floor rate, while the spot selling rate was listed at 26,328 VND/USD, 50 VND lower than the ceiling rate.

In the interbank market, the USD/VND exchange rate closed at 26,279 VND/USD, a slight increase of 1 VND compared to the January 5th session. In the free market, the USD rate increased by 50 VND in both buying and selling directions, trading around 26,950 VND/USD and 27,000 VND/USD.

Overnight Interest Rates Surge to 8.7%, SBV’s System Support Surpasses VND 400 Trillion

The final trading session of 2025 saw significant developments in the currency market, with the overnight interbank VND interest rate—the dominant tenor accounting for the majority of transaction value—surging to 8.7% per annum. Amid this context, the State Bank intensified its net liquidity injection through the open market channel.

August 1st Currency Market Update: Overnight Interest Rates Dip to 4%, State Bank Nets Over 35 Trillion VND in Withdrawal

The January 7th trading session witnessed a continued sharp decline in Vietnamese Dong (VND) interbank interest rates, with the overnight rate plunging below 5% per annum. Against this backdrop, the State Bank of Vietnam (SBV) intensified its net liquidity withdrawal through open market operations, while the USD exchange rate fell across both the interbank and free markets.

Currency Market Update: SBV Nets Over VND 16,000 Billion in Injection, Interbank Rates Decline Across the Board, USD Free Market Exchange Rate Surges

The first trading session post-holiday witnessed a cooling trend in interbank VND interest rates, as the State Bank continued its net liquidity injection. Meanwhile, in the foreign exchange market, the free USD rate surged significantly, nearing the 27,000 VND mark.