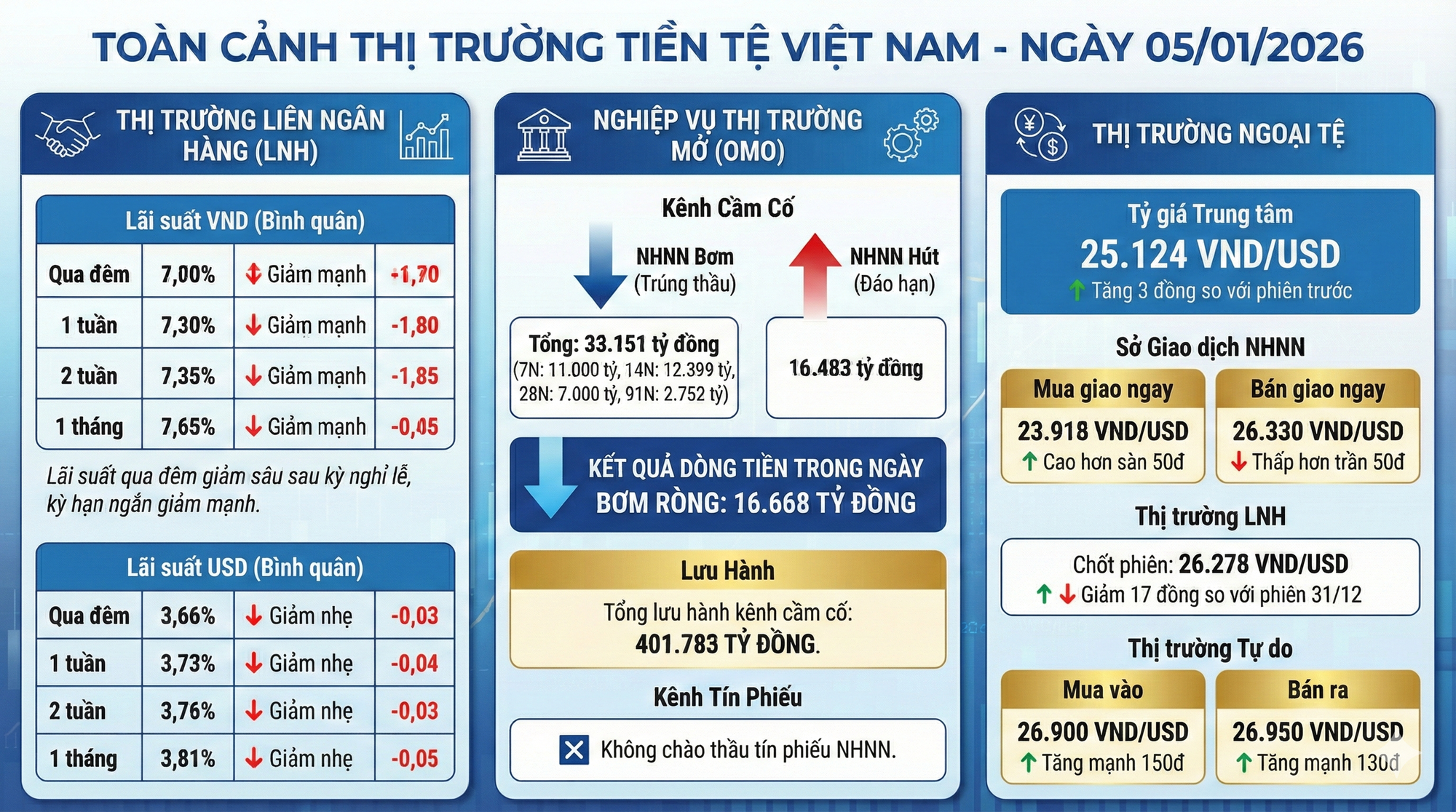

In the first trading session following the May 1st holiday, the State Bank of Vietnam maintained a substantial tender scale on the Open Market Operations (OMO) channel, focusing on short-term maturities. Specifically, the bank offered VND 11,000 billion for 7-day terms, VND 14,000 billion for 14-day terms, VND 7,000 billion for 28-day terms, and VND 4,000 billion for 91-day terms, all at a uniform interest rate of 4.5% per annum.

The results showed a total successful bid volume of VND 33,151 billion, with VND 11,000 billion for 7-day terms, VND 12,399 billion for 14-day terms, VND 7,000 billion for 28-day terms, and VND 2,752 billion for 91-day terms. On the same day, VND 16,483 billion matured. The State Bank did not tender treasury bills.

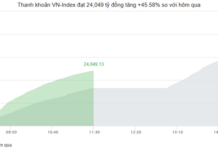

Thus, during this session, the State Bank of Vietnam net injected approximately VND 16,668 billion into the market. The total outstanding volume on the collateral channel stood at VND 401,783 billion.

On January 5th, the average interbank VND lending rates significantly declined across all maturities of one month or less compared to the pre-holiday session. Notably, the overnight rate—the primary term accounting for 80–90% of transaction value—closed with a sharp drop of 1.70 percentage points, falling to 7.00% per annum.

Similarly, the one-week rate decreased by 1.80 percentage points to 7.30% per annum; the two-week rate fell by 1.85 percentage points to 7.35% per annum; while the one-month rate dropped by 0.45 percentage points to 7.65% per annum.

For USD, interbank lending rates continued to cool. The overnight rate decreased by 0.03 percentage points to 3.66% per annum. The one-week rate dropped by 0.04 percentage points to 3.73% per annum; the two-week rate fell by 0.03 percentage points to 3.76% per annum; and the one-month rate declined by 0.05 percentage points to 3.81% per annum.

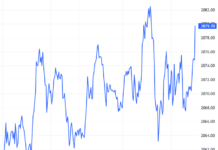

In the foreign exchange market on January 5th, the State Bank of Vietnam slightly adjusted the central exchange rate upward. The central rate was set at VND 25,124 per USD, an increase of 3 dong compared to the pre-holiday session.

At the Trading Desk, the spot buying rate was listed at VND 23,918 per USD, 50 dong higher than the floor rate, while the spot selling rate was set at VND 26,330 per USD, 50 dong lower than the ceiling rate.

On the interbank market, the USD/VND rate closed at VND 26,278 per USD, down 17 dong from the December 31st session. In the free market, the USD rate surged by 150 dong on the buying side and 130 dong on the selling side, trading around VND 26,900 per USD and VND 26,950 per USD, respectively.

Key Highlights in the Regulation of Banking System Liquidity for 2025

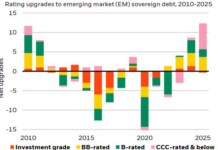

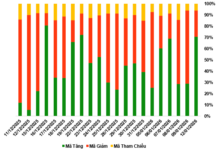

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s outright purchase channel to stabilize exchange rates while balancing systemic liquidity. By 2025, however, the operational strategy underwent a notable shift.

What Factors Will Drive USD/VND Exchange Rate Pressure in 2026?

Despite the significant decline in the DXY index in 2025, the USD/VND exchange rate remains under pressure, indicating that domestic factors are playing a dominant role. As we move into 2026, the question arises: will this trend persist, or will new dynamics emerge to ease the exchange rate tensions?

Mr. Nguyen Duc Lenh: 2025 Monetary Policy Reflects SBV’s Distinctive Management Approach

Achieving the dual objectives of monetary policy in 2025 marks a significant milestone. This accomplishment underscores the adept stewardship of the State Bank of Vietnam (SBV), showcasing its agility, efficiency, and resilience in navigating the complexities of macroeconomic stabilization while simultaneously fostering economic growth.

HDBank Plans to Transform HD SAISON into a Joint Stock Company

On January 7th, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) announced a written shareholder vote regarding the legal restructuring of HD SAISON Finance Company.