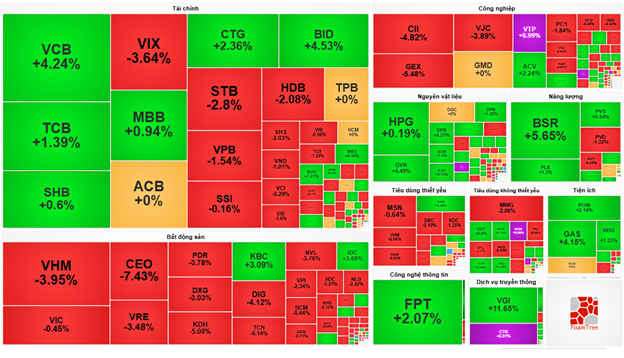

Divergent trends are evident among leading stocks. While VCB, BID, and GAS provided crucial support, helping the VN-Index maintain its green zone with a contribution of over 10 points, selling pressure from VHM, VIC, and VJC eroded approximately 7 points, hindering the index from gaining further momentum.

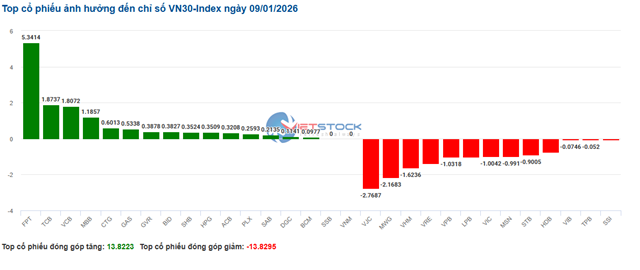

| Top Stocks Influencing the VN-Index |

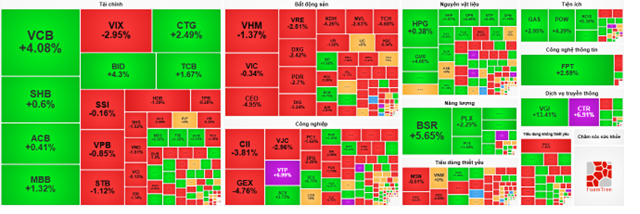

By sector, energy remains a standout performer in the morning session, with sustained buying interest in stocks like BSR (+5.65%), PLX (+1.2%), MVB (+5.26%), PVP (+5.5%), and GSP (+1.88%). Additionally, communication services, information technology, and utilities sectors recorded significant growth, driven by leading stocks such as CTR (ceiling), VGI (+11.65%), VTK (+11.64%), MFS (+11.92%); FPT (+2.07%), CMG (+3.03%); GAS (+4.15%), POW (+2.14%), and BWE (+1.9%).

Source: VietstockFinance

|

The financial sector is up by approximately 1%, though the picture is mixed. While bank stocks like VCB, BID, CTG, TCB, MBB, and SHB continue to lead, many securities stocks faced notable profit-taking pressure, including VIX, TCX, SHS, VND, DSC, and AAS.

Conversely, real estate was the most pressured sector in the morning session, with numerous stocks experiencing deep declines, such as VHM (-3.95%), VRE (-3.48%), KDH (-5.08%), NVL (-3.76%), CEO (-7.43%), DIG (-4.12%), PDR (-3.78%), TCH (-6.14%), NLG (-3.76%), and HDC (-3.21%). Excluding Vingroup stocks, this sector remains one of the weakest in recent times, with many stocks continuing to search for new lows. However, industrial real estate stocks were bright spots, defying the sector trend, with notable performers like KBC (+3.09%), IDC (+3.69%), SZC (+2.68%), SIP (+2.95%), and LHG (+0.85%).

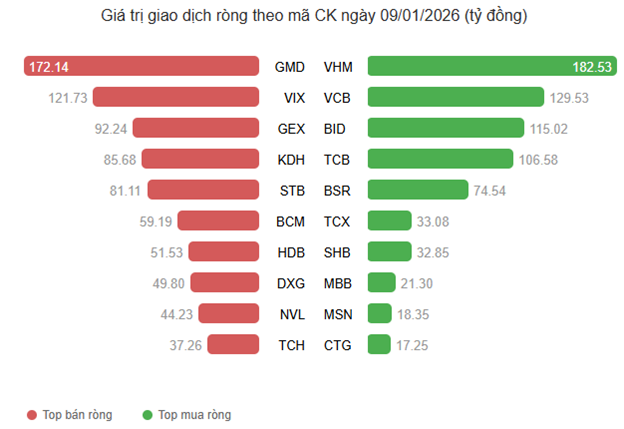

Foreign investors returned to net selling, with a value of 400 billion VND across all three exchanges in the morning session. On the buying side, foreign capital focused primarily on leading stocks like VHM, VCB, BID, TCB, and BSR, while GMD and VIX faced the strongest net selling pressure, with values of 172 billion VND and 122 billion VND, respectively.

Source: VietstockFinance

|

10:30 AM: Real Estate Sector Under Broad Selling Pressure, VN-Index in a Tug-of-War

Buying and selling forces are relatively balanced, preventing major indices from breaking out. As of 10:30 AM, the VN-Index rose 6.43 points, trading around 1,861 points. The HNX-Index retreated close to the reference level at 249 points.

Stocks in the VN30 basket are showing a balanced mix of green and red. Specifically, FPT, TCB, VCB, and MBB contributed 5.34 points, 1.87 points, 1.8 points, and 1.18 points, respectively, to the overall index. Conversely, VJC, MWG, VHM, and VRE faced strong selling pressure, eroding over 7.9 points from the VN30-Index.

Source: VietstockFinance

|

The real estate and industrial sectors are under significant selling pressure, with major players like VHM down 1.58%, DXG down 2.42%, CEO down 4.95%, VRE down 2.92%, CII down 3.81%, GEX down 5%, VJC down 3.35%, and DPG down 2.28%.

Conversely, the energy sector is among the strongest performers, supporting the overall market with contributions from major oil and gas players like BSR up 5.38%, PLX up 2.41%, and PVS up 0.81%.

Following closely, utility stocks also showed impressive gains. Notable performers include GAS up 3.17%, POW up 4.29%, KOS up 0.38%, REE up 0.32%, and BWE up 2.02%.

Additionally, despite some divergence, sellers held a slight advantage in the financial sector, helping it maintain a modest gain. On the buying side, VCB rose 3.92%, BID rose 4.3%, CTG rose 2.49%, and TCB rose 1.67%. However, some stocks remained in the red, including VIX down 2.95%, TCX down 1.19%, STB down 1.12%, and HDB down 1.56%.

Compared to the opening session, buyers and sellers engaged in a fierce tug-of-war, with over 950 stocks unchanged. Sellers held a slight edge, with 310 declining stocks (28 hitting the floor) versus 277 advancing stocks (26 hitting the ceiling).

Source: VietstockFinance

|

9:30 AM: Positive Start with Financial Stocks Leading

At the opening session on January 9th, as of 9:30 AM, the VN-Index surged over 15 points, trading around 1,870 points. The HNX-Index also recorded a slight gain, holding at 250 points.

The financial sector is among the top performers, with leading stocks like VCB up 3.77%, BID up 3.48%, CTG up 3.6%, and TCB up 2.36%.

Raw materials showed stable growth from the opening session, with significant contributions from stocks like HPG up 0.76%, KSV up 1.18%, GVR up 2.66%, and DPM up 0.87%.

Alongside these sectors, many Large Cap stocks are also performing positively. GAS, BSR, and VPB are contributing to the index’s support.

– 11:00 AM, January 9, 2026

Vietnamese Stocks Surge Nearly 200 Points Since Nguyen Duy Hung’s “Bottom Call”

Since SSI Securities Chairman last suggested that the market was presenting numerous opportunities with attractively priced stocks, the VN-Index has surged impressively.

“King of Stocks Roars, VN-Index Hits New Peak”

The VN-Index soared to a new peak of 1,861 points in today’s trading session (January 7th). Robust liquidity and significant capital inflows were observed, particularly in blue-chip stocks, with the banking sector standing out prominently. This early 2026 market activity signals a more optimistic outlook.