Saigon Maritime Corporation (Saigonship, Stock Code: SGS, listed on UPCoM) has recently announced the Board of Directors’ Resolution regarding dividend payments for 2023 and 2024.

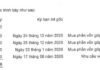

According to the resolution, Saigonship will distribute a combined dividend for 2023 and 2024 to shareholders in cash at a rate of 92.5%, meaning shareholders holding one share will receive 9,250 VND. This includes a 25% dividend for 2023 and 67.5% for 2024.

The final registration date for dividend eligibility is January 15, 2026, with the payment scheduled for February 3, 2026.

With over 14.4 million SGS shares currently in circulation, Saigonship is expected to allocate approximately 133.4 billion VND for this dividend payout.

Illustrative image

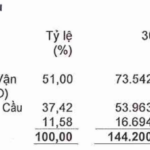

As of September 30, 2025, Saigon Transportation Mechanical Corporation (SAMCO) holds nearly 7.4 million SGS shares (51% ownership), anticipating a dividend income of over 68 billion VND from Saigonship.

Additionally, Global Logistics Services (GLS), holding approximately 5.4 million SGS shares (37.42%), is expected to receive nearly 50 billion VND in dividends.

Saigonship was established through the equitization of the state-owned Saigon Maritime Transportation Company, as per Decision No. 6205/QĐ-UB dated December 9, 2004, by the Chairman of Ho Chi Minh City People’s Committee. Its primary business areas include trade and services, with its headquarters located at 9 Nguyen Cong Tru Street, Saigon Ward, Ho Chi Minh City.

In terms of business performance, in the first nine months of 2025, the company reported consolidated net revenue of nearly 100.3 billion VND, a 24.2% decrease compared to the same period in 2024. After-tax profit reached over 14.2 billion VND, down 33%.

By the end of Q3 2025, Saigonship’s total assets increased by 3.5% from the beginning of the year to over 362.8 billion VND. Held-to-maturity investments accounted for nearly 214.4 billion VND, representing 59.1% of total assets.

On the liabilities side, total debt stood at over 34 billion VND, a 5.3% decrease from the start of the year. This includes short-term debt of nearly 25.7 billion VND and long-term debt of over 8.3 billion VND.

Iconic Stocks Set to Switch Exchanges

KienlongBank, Vietbank, Gia Lai Hydropower, and Truong Son Investment and Construction are set to elevate their market presence as their shares transition from the Upcom exchange to the Ho Chi Minh City Stock Exchange.

GELEX’s Credit Rating Outlook Upgraded by VIS Rating

GELEX Group Corporation (HOSE: GEX) has had its long-term issuer credit rating reaffirmed at A by VIS Rating, with an outlook upgrade from “Stable” to “Positive.”