The market experienced a positive trading session, driven by the performance of large-cap stocks across various sectors. The VN-Index closed with a notable gain, rising 27.87 points (+1.56%) to reach 1,816.27 points, surpassing its highest level in 2025. Foreign investors’ net selling activity, amounting to approximately VND 520 billion, was a notable drawback.

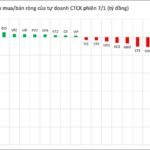

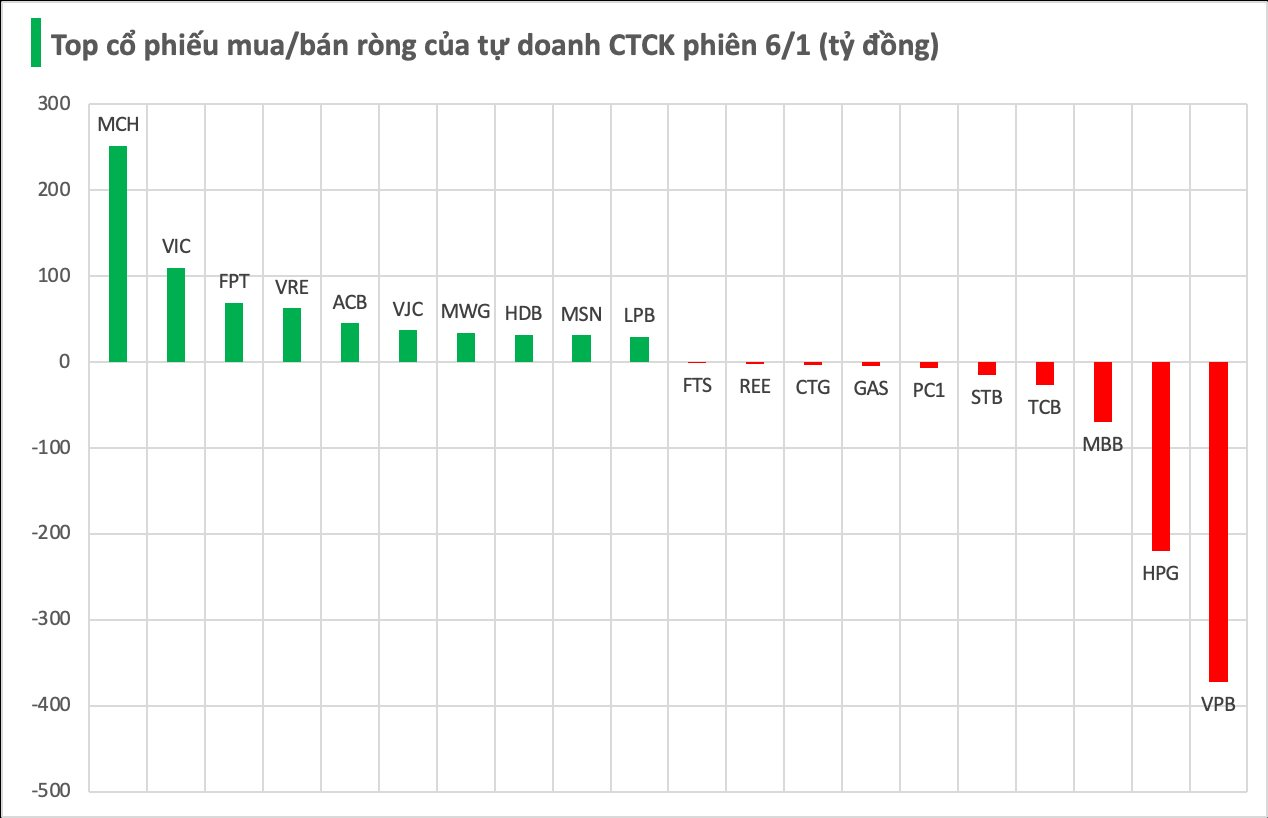

Securities firms’ proprietary trading desks recorded a net buying value of VND 179 billion on HOSE.

Specifically, MCH saw the strongest net buying at VND 252 billion, followed by VIC (VND 110 billion), FPT (VND 69 billion), VRE (VND 63 billion), ACB (VND 45 billion), VJC (VND 37 billion), MWG (VND 34 billion), HDB (VND 32 billion), MSN (VND 31 billion), and LPB (VND 29 billion) – all among the actively bought stocks by proprietary trading desks.

Conversely, VPB led the net selling list with a value of -VND 373 billion, followed by HPG (-VND 220 billion), MBB (-VND 69 billion), TCB (-VND 26 billion), and STB (-VND 15 billion). Other stocks with significant net selling included PC1 (-VND 7 billion), GAS (-VND 5 billion), CTG (-VND 4 billion), REE (-VND 2 billion), and FTS (-VND 1 billion).

A Contrasting Phenomenon Unfolds in Vietnam’s Stock Market

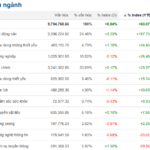

From a technical analysis perspective, Yuanta Securities asserts that the market is currently in the third wave of its upward trend, characterized by the strongest momentum and the longest duration.

“King of Stocks Roars, VN-Index Hits New Peak”

The VN-Index soared to a new peak of 1,861 points in today’s trading session (January 7th). Robust liquidity and significant capital inflows were observed, particularly in blue-chip stocks, with the banking sector standing out prominently. This early 2026 market activity signals a more optimistic outlook.

“2025 Rollercoaster Ride: Unraveling the VN-Index Peak’s Wild Swings”

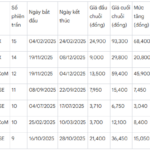

2025 marks not only the year VN-Index reaches new heights but also the year of prolonged ceiling-hitting rallies and floor-plunging declines across numerous stocks, exposing the risky underbelly of speculative waves.