The Board of Directors of Saigon Maritime Transportation Joint Stock Company (UPCoM: SGS) has approved the payment of dividends for 2023 and 2024 in cash, with a total rate of 92.5%, equivalent to VND 9,250 per share. Specifically, the dividend for 2023 is 25%, and for 2024, it is 67.5%. The ex-dividend date is January 14, 2025, and the payment is scheduled for February 3, 2026.

With over 14.4 million shares outstanding, it is estimated that SGS will need to allocate more than VND 133 billion to complete this dividend payment.

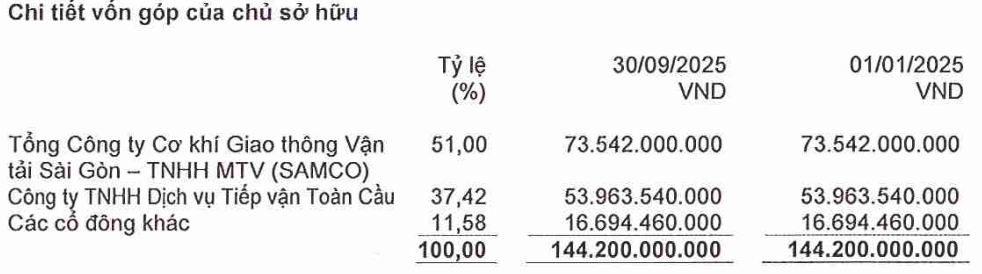

SGS is a stock with extremely low liquidity on UPCoM. As of late September 2025, Saigon Transportation Mechanical Corporation LLC (SAMCO) is the largest shareholder, holding 51% of SGS‘s capital, while Global Logistics Services (GLS) holds 37.42%, receiving over VND 68 billion and nearly VND 50 billion, respectively.

|

Shareholder Structure of SGS as of September 30, 2025

Source: SGS

|

This dividend decision is considered a rare “gift” after a long wait for SGS shareholders.

From 2017 to 2020, the company maintained a stable cash dividend payout ratio, ranging from 15% to 28%. However, no dividends were distributed thereafter due to prolonged disagreements between the two major shareholders, SAMCO and GLS.

At the 2025 Annual General Meeting of SGS held in late October, all proposals, including the plan to distribute a 92.5% dividend, were not approved. Additionally, all five other items, such as financial reports for 2021-2024, board remuneration, cancellation of old resolutions, profit distribution, and auditor selection, were also rejected.

The meeting concluded with a tense atmosphere as the deadlock over management and business development strategies persisted, leaving shareholders empty-handed once again.

SGS AGM: Prolonged Disagreements, Shareholders Leave Empty-Handed

However, the situation took an unexpected turn at the Extraordinary General Meeting held on January 5, 2026. Shareholders approved all 11 proposals. The meeting confirmed no dividends for 2021 and 2022 but approved a 25% dividend for 2023 and 67.5% for 2024. Additionally, a proposed 11% dividend for 2025 was presented.

|

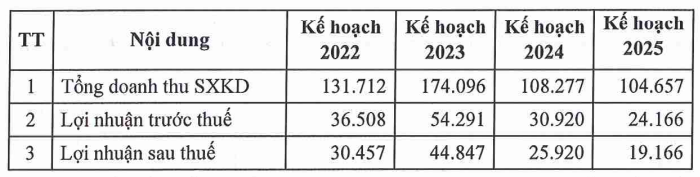

The meeting also approved the business plan for the 2022–2025 period.

Source: SGS

|

In terms of personnel, two members of the Supervisory Board, Ms. Dương Thị Kim Kiều and Ms. Nguyễn Thị Huyền Trang, were dismissed. They were replaced by Mr. Đồng Đăng Sơn and Ms. Nguyễn Vũ Anh Thư. For the Board of Directors, Ms. Lê Thị Thanh Thuận, the CEO, was elected as a board member for the 2021–2026 term. Mr. Trần Thiện was appointed as Chairman, and Ms. Huỳnh Như Ý as Vice Chairman.

Another notable decision was the cancellation of Article 6 of Resolution 01/NQ-ĐHĐCĐ-SSC dated April 28, 2021, regarding the capital plan for the project to upgrade and expand the warehouse at 27B National Highway 1A, Linh Xuân Ward, Thu Duc City. The reason is that the project is still awaiting land planning approval and has not yet required the use of after-tax profits from 2021 and 2022.

– 08:45 07/01/2026

Dairy Tycoon Announces 25% Dividend Payout: Funds Hit Accounts Just Before Lunar New Year

The company, currently trading on the UPCoM market, has announced a resolution to finalize its shareholder list for the second dividend payment of 2024 in cash. With a controlling ownership stake, the parent company and major shareholders are set to receive tens of billions of dong in cash just before the new year.

Vietinbank Issues Nearly 2.4 Billion Shares for Dividend Payment

Vietinbank has successfully issued approximately 2.4 billion dividend shares to 55,846 shareholders, with a rights execution ratio of 100:44.63658403.