Global silver prices entered an unprecedented surge in 2025, with December futures peaking above $80 per ounce, setting a new historical high and closing the year with a staggering 160% increase—far outpacing gold’s gains. This rally was primarily fueled by prolonged geopolitical tensions, a weakening U.S. dollar, and heightened safe-haven demand. However, the long-term supply-demand dynamics of this metal are also undergoing rapid transformation.

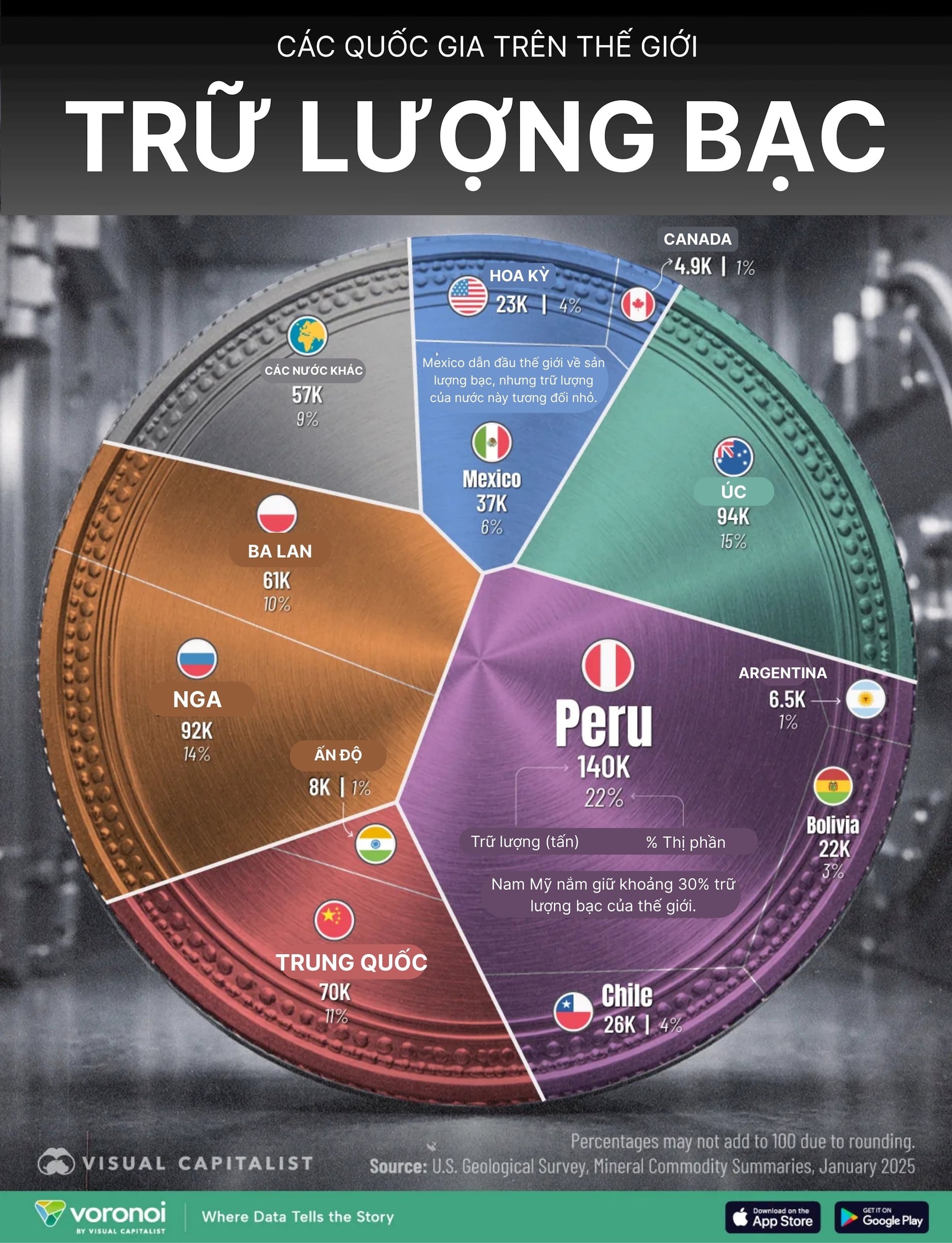

In this context, examining global silver reserves—a critical determinant of future supply capacity—becomes increasingly vital. According to the U.S. Geological Survey’s (USGS) January 2025 Mineral Commodity Summary, identified global silver reserves total approximately 641,400 tons. Yet, this resource is unevenly distributed across nations and regions.

Peru stands out as the world’s largest silver reserve holder, boasting around 140,000 tons, or 22% of global reserves. This positions Peru as a strategic linchpin in the silver supply chain, especially as demand soars while new deposits grow harder to discover and develop. South America as a whole holds roughly 30% of global silver reserves, cementing its central role in the precious metals market.

Following Peru are major reserve holders with more dispersed holdings, including Australia, Russia, and China. Each of these nations holds between 70,000 and 94,000 tons, collectively accounting for approximately 40% of global reserves. The presence of multiple large players in this group makes silver supply more multipolar compared to some other strategic metals, yet also renders the market more sensitive to geopolitical factors and mining policies.

A notable disparity exists between production capacity and reserve depth. Mexico, the world’s largest silver producer, holds only about 37,000 tons in reserves, or 6% of the global total. This indicates Mexico’s silver industry relies heavily on intensive exploitation of existing mines, with limited new projects boasting confirmed reserves. Long-term, this model could strain supply if demand continues to escalate rapidly.

Demand prospects are the linchpin driving silver’s price surge. Beyond its traditional roles in investment and industry, silver is increasingly critical in green technologies. Solar energy alone saw silver demand skyrocket from under 50 million ounces a decade ago to roughly 160 million ounces in 2023. Electric vehicles, energy storage systems, and high-performance electronics are also expanding rapidly, further fueling silver demand.

Amid uneven reserve distribution, rising extraction costs, and expanding technological demand, silver’s 2025 price rally reflects not just short-term financial factors but also structural shifts in the precious metals market.

Source: Visual Capitalist

Silver Surges 10% Overnight, Becoming the World’s Third Most Valuable Asset

Sprott Asset Management’s CIO, Maria Smirnova, expresses a bullish outlook on silver in the medium term. The technical models they monitor suggest a potential silver price surge to $100–200/oz in the coming quarters, as predicted by several analysts.