I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF JANUARY 5-9, 2026

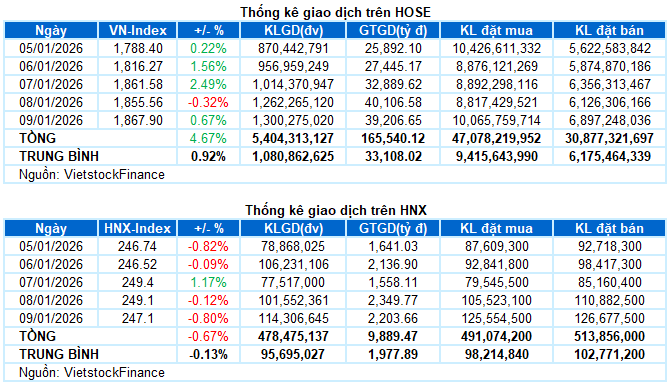

Trading Activity: Key indices showed mixed movements during the January 9th session. The VN-Index rose by 0.67%, closing at 1,867.9 points. Conversely, the HNX-Index declined by 0.8%, settling at 247.1 points. For the week, the VN-Index gained a total of 83.41 points (+4.67%), while the HNX-Index lost 1.67 points (-0.67%).

Vietnam’s stock market concluded the first trading week of 2026 on a highly positive note, marking an exciting start to the new year. The VN-Index decisively broke through the previous peak around 1,800 points, establishing a new high and solidifying its upward trend. The rally was primarily driven by large-cap stocks, but encouragingly, liquidity showed signs of broadening across various sectors. This improved liquidity indicates that investors are becoming more proactive and confident in deploying capital after a prolonged period of cautious trading. By week’s end, the VN-Index stood at 1,867.9 points, up 4.67% week-on-week.

In terms of influence, the “blue-chip” stocks VCB, BID, and CTG made the most positive contributions in the final session, adding over 16 points to the VN-Index. Conversely, STB, VIC, and HDB exerted significant downward pressure, pulling the index down by more than 3 points.

Green dominated most sectors in the final session, though divergence became more pronounced. Financials, energy, utilities, and telecom services outperformed, supported by concentrated buying in state-owned enterprises ahead of anticipated divestment plans. Notable gainers included BID, VGI, CTR, and VTP, all hitting their upper limits, along with VCB (+6.75%), CTG (+6.68%), GAS (+6%), BSR (+5.91%), and PLX (+3.61%), which were key drivers for their respective sectors.

In contrast, real estate was a notable underperformer, with widespread selling pressure. Many stocks fell over 5%, including KDH, NVL, CRV, DXG, DIG, CEO, NLG, HDC, and QCG, while PDR, TCH, DXS, SGR, and BII hit their lower limits. However, industrial real estate stocks bucked the trend, with BCM (+4.11%), KBC (+1.12%), IDC (+2.9%), SIP (+3.13%), SZC (+1.51%), and SZL (+1.05%) posting gains, partially offsetting the sector’s decline.

Similarly, the consumer discretionary sector faced pressure from declines in leading stocks such as VPL (-1.06%), MWG (-1.71%), FRT (-1.71%), HUT (-2.52%), and HHS, which hit its lower limit. However, the textile segment shone, with MSH and GIL reaching their upper limits, and VGT (+6.87%), TNG (+4.35%), and TCM (+2.26%) also posting strong gains.

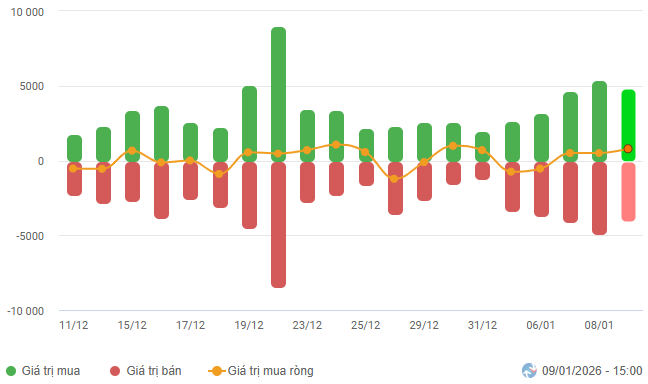

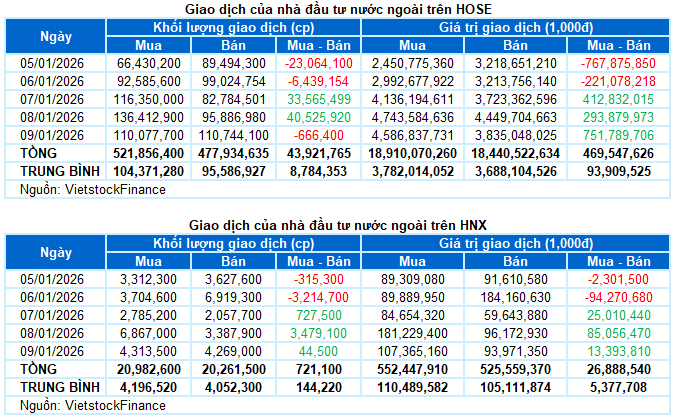

Foreign investors were net buyers with a total value of over 496 billion VND across both exchanges during the week. Specifically, they were net buyers of nearly 470 billion VND on the HOSE and 27 billion VND on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

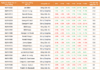

Net Trading Value by Stock Code. Unit: Billion VND

Top Performing Stock of the Week: GAS

GAS +34.12%: GAS concluded an impressive week with five consecutive strong sessions. The stock decisively broke through its June 2022 peak, setting a new all-time high. It consistently traded near the Upper Band of the Bollinger Bands with volume well above the 20-day average, reflecting highly optimistic investor sentiment.

The short-term outlook remains positive, supported by a strongly rising MACD indicator. However, investors should note the potential for technical pullbacks in upcoming sessions, as the Stochastic Oscillator is deeply in overbought territory.

Worst Performing Stock of the Week: HID

HID -24.68%: HID continued its downward trend, marking its fifth consecutive week of losses. The stock price successively fell below its 50-day SMA and 100-day SMA, indicating prevailing bearish sentiment.

Short-term risks remain high, with the MACD indicator continuing to weaken and falling below the zero line. Meanwhile, the Stochastic Oscillator is deeply in oversold territory. A return of buying signals could improve the situation.

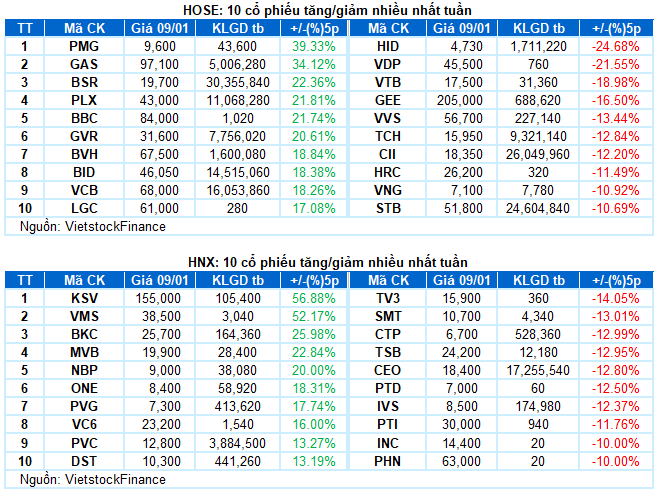

II. WEEKLY MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:15 09/01/2026

Market Pulse 09/01: Clear Divergence as VN-Index Returns to Starting Line

Profit-taking pressure continued to mount, pushing the VN-Index back to its starting point by the end of the morning session. The index hovered just above the reference mark, closing the mid-session at 1,856.23 points. Meanwhile, the HNX-Index dipped slightly by 0.24%, settling at 248.5 points. Market breadth increasingly favored sellers, with 390 decliners outpacing 311 gainers.

What’s Driving the VN-Index Surge Past 2,000 Points as Brokerages Unanimously Predict the Rally?

As we step into 2026, numerous securities firms are optimistic about the VN-Index, anticipating a significant surge with ambitious targets surpassing the 2,000-point milestone.