According to a recent report by the General Statistics Office (Ministry of Finance), Vietnam’s automotive market saw the addition of approximately 76,186 new vehicles in December 2025. This figure includes domestically produced, assembled, and fully imported vehicles, marking a 12.8% increase compared to November 2025 (67,550 vehicles).

Of this total, the domestic production and assembly volume in December 2025 reached an estimated 60,700 units, a significant 23.4% rise from the previous month and a remarkable 57.5% surge compared to December 2024. This monthly output stands as the highest ever recorded in Vietnam’s automotive industry, reflecting domestic manufacturers’ efforts to boost capacity amid year-end shopping demand.

Domestic car production in 2025 reached an all-time high. Photo: VinFast

For the entire year of 2025, domestic automakers are estimated to have produced and assembled around 484,500 vehicles, a 39.1% increase compared to 2024. This annual figure is also the highest ever recorded.

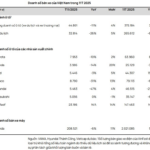

In the imported vehicle segment, approximately 15,486 foreign cars were brought into Vietnam in December 2025, with a total value of about $406 million. Compared to November 2025 (18,350 vehicles, worth $455 million), imported vehicle volume decreased by 15.6%, and value dropped by 10.7%. However, compared to December 2024, imported vehicles still saw a 21.1% increase in volume and a 35.2% rise in value.

For the full year of 2025, Vietnam is estimated to have imported 206,628 completely built-up vehicles, with a total value of approximately $4.737 billion, representing a 19.1% increase in volume and a 31.1% increase in value compared to 2024.

Thus, the total new car supply in 2025 reached over 691,000 units. However, market sales up to November only reached over 520,000 units (combined data from VAMA, VinFast, and Hyundai Thanh Cong).

If December maintains the same sales level as November at around 68,000 units, the total market consumption for 2025 is estimated at approximately 590,000 vehicles. This figure still falls short of the supply by about 100,000 units, which represents the surplus inventory awaiting sale.

Not only are 2025-model vehicles (VIN2025) in surplus, but the market also has leftover 2024-model vehicles and even older ones. For instance, some dealerships for Honda, Subaru, Suzuki, Mazda, and MG are still selling 2024-model vehicles, albeit in limited quantities.

Many dealerships are still offering the 2024 Honda Civic hybrid model. Photo: Dealership.

This indicates that Vietnam’s automotive market is in a state of oversupply, with accumulated inventory from multiple years. Older models remain unsold while new ones continue to be added, forcing manufacturers to maintain promotions to clear stock.

As a result, many vehicle models are being sold at significantly lower prices than their listed values, sometimes even dropping to the level of lower segments. This directly benefits consumers, offering a wide range of choices and numerous discounts from the ongoing price war.

In fact, as the new year began, mainstream brands like Toyota, Honda, Mitsubishi, Mazda, and Ford quickly joined the promotional race to attract consumers. This trend is expected to continue at least until the Lunar New Year, a period when purchasing power typically declines across all segments.

Overall, the abundant supply and reduced prices due to promotional programs create favorable conditions to boost car sales from the beginning of the year.

“2026 Kickoff: VinFast, Toyota, Hyundai Unleash Heavy-Hitting Incentives—What’s in Store for This Year’s Auto Market?”

The year 2026 kicks off with a bang as automakers unleash a barrage of jaw-dropping deals, signaling an intense battle for market dominance.

VinFast’s Competitive Pressure Intensifies Challenges for Vietnam’s Largest Auto Company

Despite seasonal year-end shopping incentives, underlying demand remains weak, with November 2025 sales plunging 26% year-over-year. This highlights continued pressure on traditional internal combustion engine (ICE) vehicles amid policy headwinds and the accelerating shift toward electric vehicles.