Consumers Ready to “Shop for Tet”

As Tet 2026 approaches, Vietnamese consumers’ financial mindset shows a clear shift toward proactive and planned spending. However, there are still gaps in realizing long-term family expenditure needs.

According to a 2025 annual survey by Home Credit in collaboration with market research firm InsightAsia, involving over 700 consumers nationwide, 52% of respondents feel more confident about their ability to afford Tet 2026 compared to Tet 2025. This reflects significant improvement in budget planning, especially amid increasing year-end spending pressures.

However, proactive planning doesn’t equate to ample financial flexibility. Tet expenses aren’t just numbers—they’re emotional burdens translated into costs: 75% for gifts to parents and essential food; 73% for Tet shopping and house cleaning; and 40% for long-term investments like a new car or larger fridge, beyond mere “Tet celebrations.”

Shoppers flock to electronics stores for Tet preparations

60% of survey participants wish to contribute more but can’t. Mr. Nguyen Van H. (38, Hanoi) shares: “After calculations, my 13th-month salary only covers basics. Buying my dad new speakers or the oven my wife wants remains a challenge.” The hurdle isn’t poor planning but limited cash flow during a high-demand period.

A bright spot in Tet 2026’s financial landscape is the shift in solution-seeking. Three in five consumers need financial support for Tet, showing persistent cash flow pressure even among planners. 94% embrace low or 0% interest financial solutions, not as stopgaps but as standardized budget management tools.

This marks a notable financial behavior change—not passive borrowing but strategic cash flow management. Consumers learn to transform “one-time payments” into comfortable “installments,” prioritizing long-term value (34% asset investment) and meaningful gifts (26% family presents).

Financial Solutions Become Integral to Tet

As consumers grow proactive yet face year-end cash flow pressures, consumer finance companies are adapting with flexible, needs-based approaches. The focus is on ecosystems supporting rational spending—from short-term essentials to long-term family investments during Tet.

Home Credit offers 0% interest promotions for stress-free Tet shopping

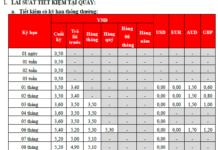

Home Credit tailors solutions to Tet’s most common needs. For short-term cash needs, online loans of 20–50 million VND include an 800,000 VND discount on the first installment, easing initial costs—a key concern during concentrated Tet spending.

For shopping, Home Credit partners with retailers like The Gioi Di Dong, Dien May Xanh, FPT Shop, and Viettel Store. Essential Tet items (TVs, fridges, washers, dryers) feature 0% interest over 4–24 months, allowing budget distribution without lump-sum payments.

Motorcycles, in high demand pre-Tet, offer reduced barriers. Buyers of Honda, Yamaha, Piaggio, or VinFast electric bikes can access 0% down payment and 36-month installments, making upgrades financially feasible.

Credit cards are personalized with “Flexible Cashback,” offering 5 cashback options. Travel and transport discounts (Traveloka, Vexere) position cards as proactive spending tools, not just payment methods.

Diverse financial support options from Home Credit for consumers

Emotionally, Home Credit’s “Building a Priceless Family Tet” campaign continues from last year, emphasizing individual contributions to a complete Tet. 66% feel stronger family bonds, and 62% greater connection to the message, merging financial solutions with Tet’s core values.

This is reflected in Home Credit’s 2026 Tet film (released 02/01/2026), depicting everyday Tet preparations and genuine family efforts. Home Credit positions itself as an empathetic partner, offering tailored solutions to ease year-end pressures.

Unlocking Vietnam’s $800 Billion Asset Potential: FIDT Chairman Declares End to Commission-Only Business Model

Anticipating the $800 billion personal wealth scale by 2030, FIDT introduces the Financial Planning Group (FPG) – Vietnam’s first Comprehensive Wealth Management model, focused on advisory fees and reducing reliance on brokerage commissions.

Lunar New Year Travel 2026: Book Early, Celebrate Spring with Peace of Mind at Dat Viet Tour

In 2025, the international travel market is expected to boom, but by 2026, Vietnamese travelers are predicted to shift their focus back to domestic destinations. According to Đất Việt Tour, a leading Vietnamese travel company, approximately 69% of their customers opted for domestic tours during both the Solar and Lunar New Year holidays, citing convenience, affordability, and time efficiency as key factors in their decision.

Smart Year-End Shopping: Cashback Rewards, Consumer Loans for Lunar New Year Preparations

As the year-end shopping frenzy intensifies amidst economic challenges, Vietnamese consumers are turning to savvy financial solutions to optimize their Tet expenses.