Vietnam’s durian exports to China surge, challenging Thailand’s dominance.

China stands as the world’s largest durian importer, accounting for over 90% of global durian imports. By 2024, the country imported approximately 1.56 million tons of durian, valued at nearly $7 billion, marking significant growth in both volume and value compared to the previous year.

Thailand has long dominated the supply of fresh durian to China. In the first 11 months of 2025, Thailand exported around 903,000 tons to China, generating $3.9 billion in revenue, equivalent to a 50.39% market share. However, this figure has declined from 52.04% in the same period last year, signaling a gradual loss of dominance.

Meanwhile, Vietnam is rapidly closing the gap. During the same period, Vietnam’s durian exports to China reached $3.24 billion, with its market share rising to 49.33%, up from 47% the previous year. The narrowing gap has prompted Thai media and experts to warn of a “potential threat.”

One of Vietnam’s standout factors is its remarkable growth rate in a short period. Since beginning formal durian exports to China in 2020, Vietnam’s market share has soared from 0% to approximately 40% in just three years, according to an HSBC report.

Vietnam’s durian exports gain momentum, fueled by competitive pricing and extended harvest seasons.

Sustaining this growth is no small feat. However, Vietnam’s longer and off-season harvest periods compared to Thailand have bolstered its exports, creating a seasonal competitive advantage in the Chinese market.

Additionally, the average export price of Vietnamese durian is 10–15% lower than that of Thai durian, making it more attractive to many Chinese importers.

Despite these advantages, the path to the top is fraught with challenges. Quality control and traceability remain critical areas for Vietnamese businesses to invest in, as China imposes stringent requirements. Issues such as pesticide residue and quality certification have previously caused shipment delays or rejections, highlighting the need for continuous improvement.

Regional competition extends beyond Vietnam and Thailand. Other ASEAN nations like Malaysia, Cambodia, Indonesia, and Laos have also gained approval to export durian to China, expanding supply and intensifying competition.

Trade experts predict that if Vietnam maintains its current growth trajectory, it could become China’s largest durian exporter within the next three years, surpassing Thailand. This shift would not only signify a change in market share but also reflect broader transformations in the region’s agricultural value chain.

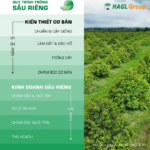

Vietnamese Durian Exports Plummeted 69.4% Due to Cadmium Barriers, But Bầu Đức Reveals Ace: 1,600 Ha in Laos and 20,000 m² Cold Storage for Frozen Durian, Aiming for 50% Higher Off-Season Prices

HAGL is strategically expanding its durian segment into a new core business pillar, focusing on a freezing strategy to command premium pricing and leveraging advanced Thai technology.