On the afternoon of January 8th, the forum “Prospects of the Real Estate Market in 2026 – Momentum for a New Growth Cycle” took place in Ho Chi Minh City, attended by representatives from ministries, experts, and businesses in the real estate sector.

Addressing the forum, Deputy Minister of Construction Nguyen Van Sinh stated that Vietnam’s real estate market is poised to enter a more stable and sustainable development phase, supported by improved institutional frameworks and the gradual removal of legal bottlenecks.

According to the Deputy Minister, in recent years, the construction and real estate sectors have contributed approximately 11% to GDP, with real estate alone accounting for about 4.5%, maintaining its crucial role in economic growth and urbanization.

A notable highlight is that, amidst market challenges, the National Assembly and the Government have proactively enacted and amended a series of important laws. They have also issued resolutions to address legal hurdles, accelerate project implementation, and increase supply, particularly in social housing. Alongside this, various specific mechanisms and policies have been effective. Thanks to these comprehensive measures, real estate supply has shown positive changes.

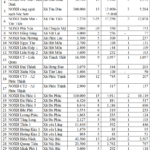

Beyond developing new projects, efforts to review and resolve stalled projects have been intensified. According to Steering Committee 751 (responsible for addressing difficulties and obstacles in stalled projects), out of nearly 3,000 problematic projects nationwide, 926 have been resolved. The remaining projects are being categorized and addressed under the authority of the National Assembly, Government, ministries, and local authorities, to unlock investment resources for the upcoming phase.

Deputy Minister of Construction Nguyen Van Sinh addressing the forum.

Assessing market prospects, Deputy Minister Nguyen Van Sinh noted, “2025 is a critical year for laying the foundation for the real estate market to enter a new growth cycle in 2026. However, challenges remain, such as a shortage of affordable housing, high property prices relative to income, and an inconsistent market information system.”

Moving forward, the Ministry of Construction will continue to refine institutional frameworks, promote social housing and affordable commercial housing, expedite project obstacle resolution, and enhance the market information system, aiming for a transparent, stable, healthy, and sustainable real estate market.

From an expert perspective, Dr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, highlighted that the merger of 34 provinces and cities has been a significant turning point for Vietnam’s real estate market, profoundly impacting market structure, investment flows, and investor behavior.

“Real estate is entering a new development cycle with both expansion opportunities and significant challenges,” Dr. Dinh observed.

According to Dr. Nguyen Van Dinh, the overall picture of the 2025 real estate market shows many positive signs. Supply has surged to its highest level since 2020, as numerous projects have resolved legal issues and re-entered the market. Liquidity has recovered significantly, approaching pre-2020 stability levels. Meanwhile, property prices, despite a sharp increase early in the year, have stabilized since mid-year, thanks to the government’s regulatory role.

The merger of 34 provinces and cities has also contributed to the formation of large-scale real estate markets such as Ho Chi Minh City, Hai Phong, Da Nang, and Lam Dong. This has disrupted short-term speculative “waves,” curbed rapid price increases, and fostered a more stable, long-term development trend.

Dr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, speaking at the forum.

Notably, public investment continues to be strongly promoted, driving demand for real estate investment. Credit flows reached a record high of over 4 million billion VND, with approximately 1.8 million billion VND allocated to real estate. The last six months of 2025 accounted for 63% of the year’s total transactions, indicating a significant improvement in market confidence.

A standout highlight is the social housing segment. In 2025, social housing supply grew robustly, achieving about 102% of the development plan, playing a vital role in balancing supply and demand and stabilizing the market.

As we move into 2026, the real estate market faces numerous opportunities, with a double-digit economic growth target, sustained capital flows supported by flexible monetary policies, and prioritized development of new urban models such as compact cities and transit-oriented development (TOD).

However, challenges persist, including a supply structure skewed toward high-priced segments, rising input costs, and heavy reliance on credit.

“The market will no longer tolerate speculative investments. The upcoming phase demands greater professionalism, transparency, and strict adherence to market discipline within a data- and technology-driven ecosystem,” Dr. Nguyen Van Dinh emphasized.

Why More Banks Are Raising Interest Rates on Social Housing Loans

Unlock exclusive savings with Agribank’s unbeatable 5.6%/year interest rate for the first 5 years of your loan. Meanwhile, top banks like Vietcombank, BIDV, and Vietinbank have halted their special 5.2-5.5% fixed-rate offers for borrowers under 35, making Agribank’s deal even more irresistible. Act now to secure your financial future!

Hanoi Announces 39 Social Housing Projects for 2026-2030 with Total Investment of Nearly VND 71.5 Trillion

Hanoi has officially released the list of 39 social housing projects slated for investment in Phase 1, spanning from now until 2030. These projects collectively cover a total area of 115 hectares, with an estimated preliminary capital of nearly 71.5 trillion VND.

Exclusive Mortgage Rate Hike for Young Buyers: Under-35s Targeted in Social Housing Loan Boost

Agribank has announced an adjustment to its lending rates for outstanding loans to young individuals under 35 purchasing social housing. This revised rate will be effective from January 1 to June 30, 2026.