As we step into 2026, with the goal of supporting double-digit economic growth, banks are gearing up from the outset to continue serving as a vital lever, unlocking resources for a green and sustainable economy.

The recent Banking Sector Task Deployment Conference for 2026 has become the focal point of the financial market, with leaders of major banks, including four state-owned commercial banks, demonstrating their commitment to spearheading capital flow into the economy.

Reflecting on 2025, the State Bank’s flexible and proactive management, coupled with robust figures, successfully steered the banking sector toward achieving inflation control, systemic safety, macroeconomic stability, and economic growth of 8.02%. This was accomplished despite rising capital mobilization costs and lingering global macroeconomic risks.

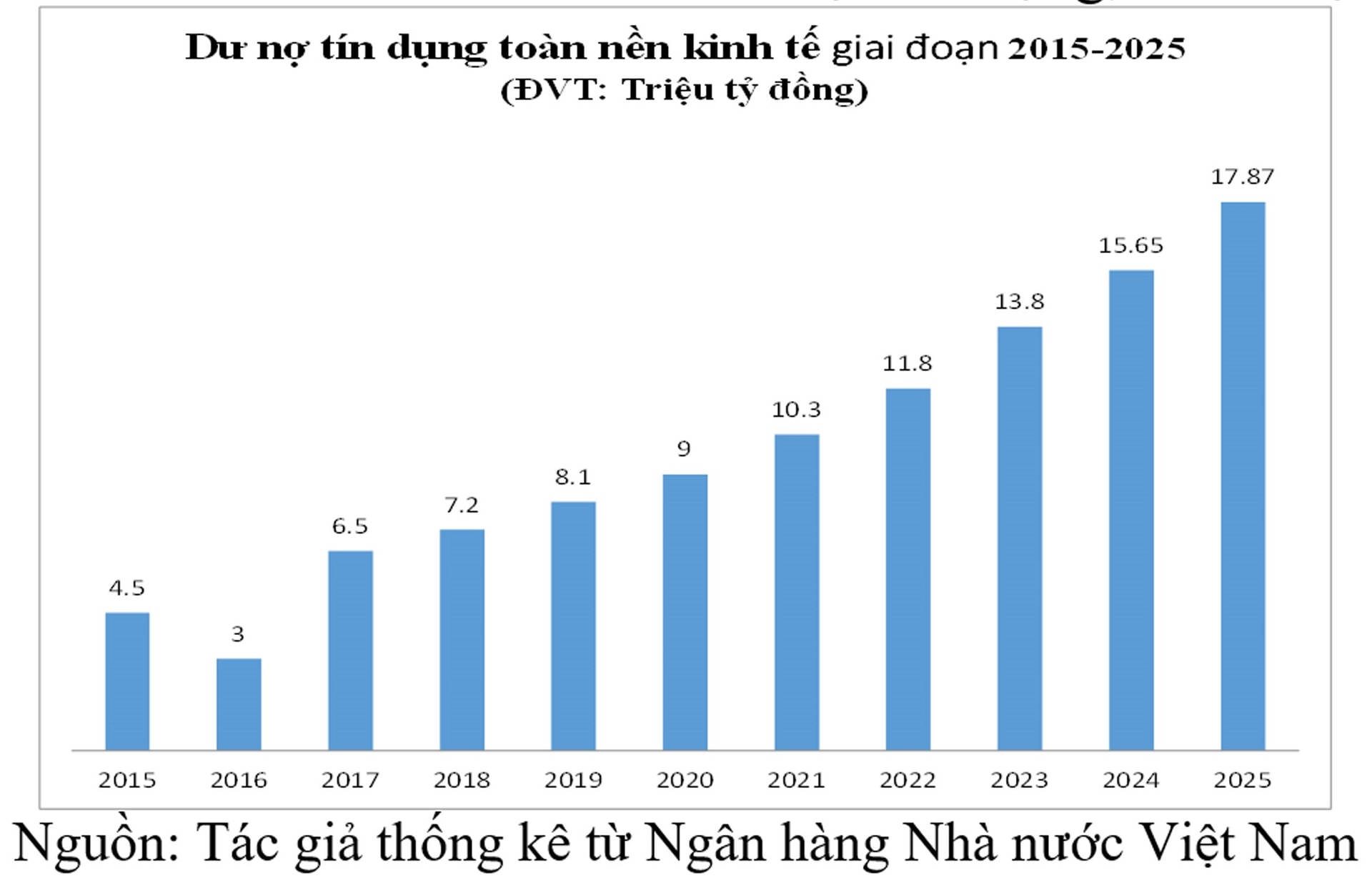

The State Bank’s report at the conference highlighted the synchronized implementation of solutions to enhance access to formal credit for individuals and businesses. These measures included supporting the collective economy, cooperatives, small and medium-sized enterprises, and vigorously expanding the bank-business connectivity program to promptly address challenges in accessing bank credit. As a result, credit growth aligned with targeted indicators, with an average annual credit growth rate of 14.17% from 2021 to 2024.

Credit growth in 2025 outpaced that of 2024. By December 25, 2025, the economy’s credit balance reached nearly 18.41 trillion VND, a 17.87% increase from the end of 2024—the highest growth rate in a decade and surpassing the State Bank’s 16% target for the year. Credit structure remained focused on production and business sectors, particularly priority areas and growth drivers aligned with government policies. This surge was driven not only by recovery capital demand but also by proactive and flexible monetary policy management.

A notable shift in 2025 was the move toward sustainable credit structuring. Capital allocation shifted from short-term loans to medium and long-term loans, which increased by 17.32% by the end of Q3. This reflects businesses’ confidence in long-term economic recovery and the effectiveness of investment-boosting policies.

Regarding interest rates, despite a slight uptick in deposit rates at year-end to attract funds, the State Bank successfully directed credit institutions to reduce costs and stabilize lending rates. Flexible management lowered the average lending rate for new transactions to 6.88% per annum by December 2025, maximizing businesses’ capital absorption capacity. Maintaining low interest rates was a key driver of the economy’s capital absorption.

In 2026, the banking sector faces heightened expectations to lead capital toward rapid and sustainable growth. The State Bank’s monetary policy will remain focused on macroeconomic stability and systemic safety.

Commenting on 2026’s credit growth drivers, MSc. Nguyễn Văn Hoàng, Deputy Director of Agribank’s An Giang Branch, noted that the amended Law on Credit Institutions, effective October 15, 2025, is expected to accelerate bad debt recovery and asset quality improvement. Additionally, the recovery of the production sector, stable international trade, demand from small and medium-sized enterprises, and public investment will be pillars of credit growth.

The gradual stabilization of the real estate market will help clear outstanding debts and enable banks to replenish provisions. Success in 2026 will favor banks with strong risk management, healthy asset structures, and optimized non-interest income.

However, technology risk management and data standardization will be critical to sustaining growth in the digital era.

To achieve double-digit economic growth in 2026, Assoc. Prof. Dr. Phạm Thị Hoàng Anh, Acting Deputy Director of the Banking Academy’s Executive Board, suggests the banking sector focus on strategic pillars:

First, leverage the new legal framework: The amended Law on Credit Institutions, effective October 15, 2025, will accelerate bad debt recovery and balance sheet cleanup, enabling banks to enhance asset quality and expand lending capacity.

Second, target economic drivers: Increase capital flow to production, international trade, and small and medium-sized enterprises. Unlock public investment and support real estate market recovery to clear outstanding debts.

Third, strengthen capital and governance: Success in 2026 will require robust risk management, healthy asset structures, and data standardization.

Credit in 2026 will prioritize “real effectiveness” over volume. Banks must balance economic stimulus with adherence to international capital safety standards to avoid systemic risks.

Top Bank Stocks to Watch in 2026: Maybank Securities Highlights HDB, TCB, and MBB

Maybank Securities, a member of the esteemed Maybank Investment Banking Group (Maybank IBG), has unveiled its top 10 stock picks for 2026 in the Vietnamese market. This prestigious list features a trio of banking sector stocks: HDB, TCB, and MBB.

2026 Interest Rate Forecast: Predictions for Deposit and Lending Rates

ACBS’s analytical team forecasts that the CASA (current account and savings account) ratio will remain stable due to higher cash usage and rising interest rates, which are dampening the shift to online payments and the recovery of investment channels.