Maybank IBG’s Top 10 Stock Picks for 2026

As we step into 2026, Vietnam’s stock market is poised for a new cycle, according to international analysts. The country’s economic growth remains robust, outpacing regional averages, while fiscal and monetary policies continue to provide support. Additionally, many sectors still offer room for valuation improvements.

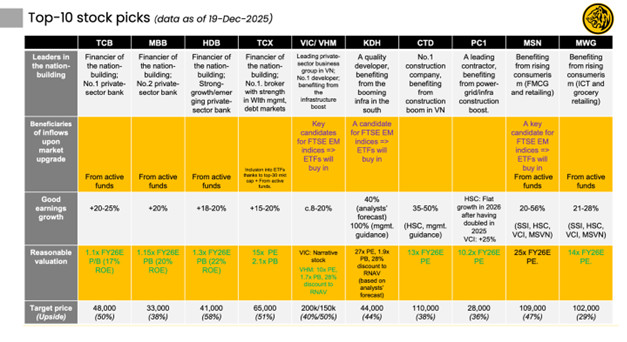

In its latest “Vietnam Monthly Update,” Maybank Securities unveiled its Top 10 stock picks, selected based on profit growth, capital efficiency, reasonable valuations, and potential to benefit from major macroeconomic themes.

The Top 10 list includes: HDBank (HDB), Techcombank (TCB), Military Bank (MBB), TCBS (TCX), Vingroup / Vinhomes (VIC/VHM), Khang Dien (KDH), Coteccons (CTD), PC1 Group (PC1), Masan Group (MSN), and MWG (MWG).

The banking sector dominates with three representatives: HDBank, Techcombank, and Military Bank. Maybank Securities highlights their pivotal role in channeling capital into the economy and benefiting directly from the new growth cycle.

HDBank stands out as a high-growth private bank with exceptional efficiency, boasting a projected ROE of 22%, surpassing industry averages. Profits are expected to grow by 18-20%, while its 2026 projected P/B ratio of 1.3 remains attractive.

Techcombank, a leading private bank, is projected to sustain profit growth of 20-25%, with a projected ROE of 17%. Its 2026 projected P/B ratio stands at 1.1.

Military Bank follows closely, leveraging its scale, network, and cost control. Maybank Securities forecasts 20% profit growth, a 20% ROE, and a 2026 projected P/B ratio of 1.15.

Banks: The Backbone of the New Growth Cycle

Maybank Securities anticipates a favorable macroeconomic environment for banks in 2026, with robust credit growth and easing pressure on net interest margins (NIM). While NIMs may not return to previous highs, banks with strong capital bases, stable funding, and robust risk management can maintain high profitability.

The report emphasizes that investors are increasingly focusing on banks with high ROE, sustainable profit growth, and healthy balance sheets, rather than short-term cyclical factors.

A key observation is the gap between profit growth and current valuations for banks, particularly those with high double-digit ROE and clear growth strategies.

The inclusion of bank stocks in the Top 10 list reflects expectations of medium-term revaluation, as the market shifts from speculation to deeper growth quality assessment.

For investors, the presence of HDB, TCB, and MBB in Maybank Securities’ list underscores a clear trend: the 2026 cycle is about banks with strong fundamentals, high efficiency, and the ability to lead capital allocation in a more selective market.

– 11:45 07/01/2026

A Contrasting Phenomenon Unfolds in Vietnam’s Stock Market

From a technical analysis perspective, Yuanta Securities asserts that the market is currently in the third wave of its upward trend, characterized by the strongest momentum and the longest duration.