Illustrative Image

U.S. President Donald Trump has signed a new bill into law, authorizing heavy tariffs on countries importing oil and uranium from Russia. Officially titled the “Russia Sanctions Act of 2025,” the legislation stipulates that nations engaging in trade with Moscow may face tariffs of at least 500%.

The Russia Sanctions Act of 2025 empowers the U.S. to impose a minimum 500% tariff on markets such as India, China, and Brazil—countries that continue to purchase Russian oil despite existing sanctions.

Senator Lindsey Graham, co-author of the bill alongside Senator Richard Blumenthal, stated that the legislation aims to penalize nations buying discounted Russian oil. This move could directly impact India’s energy imports and escalate trade tensions with Washington.

According to the bill, the U.S. President must increase tariffs on all goods and services imported from countries deliberately trading in Russian uranium and oil to a minimum of 500% of their original value. This marks one of the highest tariff rates ever imposed on Russia’s energy trade partners.

Senator Graham emphasized that the bill grants President Trump the authority to sanction countries purchasing Russian oil, a critical resource fueling Russian President Vladimir Putin’s military operations.

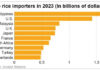

India is currently one of the largest global buyers of Russian oil. Previously, in August 2025, the country faced additional tariffs imposed by Washington. Total tariffs on certain Indian imports now reach up to 50%. Senator Graham noted that Indian Ambassador to the U.S., Vinay Mohan Kwatra, met with him last month to highlight New Delhi’s reduced oil purchases from Russia and requested a 25% reduction in additional tariffs.

Russian crude oil exports experienced a sharp decline in late 2025 and early 2026, amid falling prices and increasing disruptions in transportation. Both price and volume reductions have significantly impacted export values. In the 28 days leading up to January 4, Russia’s total oil export value dropped to approximately $960 million per week, a 10% decrease from the previous period and the lowest since the onset of the Ukraine conflict.

Russian crude oil prices have plummeted more dramatically than global benchmarks. Following new U.S. sanctions in October against major exporters Rosneft and Lukoil, the price of Urals oil in the Baltic and Black Sea regions fell below $35 per barrel, representing just 60% of early October levels.

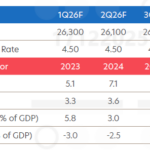

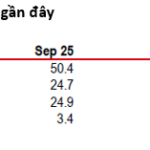

UOB Forecasts SBV to Maintain Policy Rates Unchanged Throughout 2026

UOB Bank (Singapore) has released its latest report on Vietnam’s economic outlook for 2025 and 2026.