|

Amid the irreversible shift towards a green economy, ESG (Environmental, Social, and Governance) is evolving from a promotional concept to a mandatory criterion. For many businesses, meeting ESG standards is not just about sustainable development and enhancing competitiveness but also a crucial condition for accessing green capital—which offers lower costs and longer terms compared to traditional financing.

Green Capital Standards Become Increasingly Stringent

Global investment trends are shifting significantly. Beyond profit, ESG is becoming an essential filter for international financial institutions and investment funds. Climate change, supply chain disruptions, and shifting consumer behaviors directly impact business operations, making sustainable development a matter of long-term risk management, not just corporate ethics.

International regulations are also tightening. The EU Green Deal demands transparency in emissions reporting, while the Carbon Border Adjustment Mechanism (CBAM) places substantial pressure on companies exporting to Europe. These requirements compel businesses to measure, report, and control their environmental impact according to increasingly specific international standards.

As a result, accessing green capital is no longer straightforward. Companies must disclose data, adhere to principles like the Green Bond Principles of ICMA, and demonstrate measurable environmental impact. ESG, therefore, cannot remain a mere “paper story” but demands serious, long-term investment.

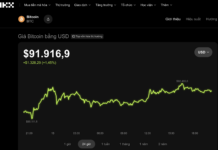

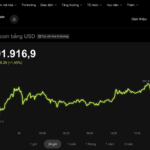

According to the World Bank, by the end of 2024, the global sustainable bond market reached approximately $6.2 trillion, highlighting the growing prominence of green capital.

|

Vietnamese Businesses Face the Green Capital Challenge

In Vietnam, the green capital market is growing positively. In 2024, the value of green bond issuances increased by approximately 175% compared to 2023, reaching nearly VND 6.9 trillion. Major companies like Vingroup and VinFast successfully raised hundreds of millions of USD for green transportation projects from ADB and HSBC, while Masan attracted capital from Bain Capital. Domestic banks and credit institutions are also participating in green capital mobilization, offering cost advantages, longer terms, and enhanced corporate reputation.

Speaking at a sustainable development forum in late 2024, Mr. Hoàng Văn Thu, Vice Chairman of the State Securities Commission, noted that investors, particularly international funds, increasingly prioritize companies with ESG-aligned governance, viewing it as a foundation for transparency and accountability. Vietnamese businesses must not only demonstrate project financial efficiency but also invest significantly in governance, environment, and social initiatives—with substantial upfront costs and longer payback periods.

Alongside its growth, the global green bond market is establishing clearer issuance standards. The Green Bond Principles issued by ICMA serve as a widely adopted framework. Under these principles, green capital typically targets projects with positive environmental impacts, such as renewable energy, clean transportation, wastewater treatment, waste management, and recycling—circular economy.

Issuing green bonds requires companies to clearly classify capital usage, strictly adhere to ICMA principles, and undergo independent evaluation (Second Party Opinion – SPO) by reputable organizations to ensure transparency and measurable environmental impact.

When Sustainability Becomes a Competitive Advantage

In this trend, recycling projects—particularly paper and packaging recycling—are emerging as priority areas for green financial institutions, thanks to their potential to realize circular economy models and deliver tangible environmental benefits.

|

Notably, in the paper packaging industry, Miza Joint Stock Company (UPCoM: MZG), a paper and packaging recycling enterprise, is increasingly recognized as a model aligned with green capital criteria.

For recycling companies, the “green” factor can be inherent in their business model. However, implementing ESG is not without challenges. The biggest hurdles lie in data standardization, investment in environmental processing technology, and maintaining long-term operational discipline.

Only companies that invest systematically from the outset can meet the stringent standards of international financial institutions. In this context, Miza’s access to green capital from UOB Bank—a major Singapore and Asian financial institution known for its rigorous sustainability standards—is a notable milestone.

The company has built a production model based on circular economy principles, investing in wastewater treatment systems and waste management, while progressively enhancing transparent governance. UOB’s financing is not just a financial endorsement but also recognition of Miza’s governance capabilities and adherence to international standards.

According to public information, by the end of 2025, Miza successfully issued the MZN12501 green bond series valued at VND 150 billion with a 7-year term. This not only strengthens Miza’s stable medium- to long-term capital but also enhances its reputation, demonstrating a strong commitment to a circular economy model and sustainable green transformation vision.

As ESG increasingly becomes the “passport” for capital, companies with suitable foundations and substantive approaches are expected to leverage opportunities for sustainable growth, rather than merely following trends.

Services

– 18:00 08/01/2026

Inclusive Institutions and Multifaceted Values: The Foundation of a Prosperous Nation

This article explores the symbiotic relationship between inclusive institutions and the diversity of value metrics, aiming for prosperity and dignity beyond mere material wealth and inequality.

Kobler Unveils Eco-Friendly Material Solutions at Architecture for Health Seminar

The Vietnam Association of Architects proudly presents the Autumn Encounter 2025 Seminar, themed “Architecture for Health,” taking place from December 26th to 28th, 2025, in Phu Tho Province. This prestigious event brings together a diverse array of delegates, including representatives from central and local agencies, renowned experts, scientists, and architects from both Vietnam and around the globe.

International Green Capital: Why HDBank Stands Among the Select Few?

Accessing green capital from institutions like IFC, ADB, or FMO comes with stringent requirements in governance, transparency, and ESG compliance. Only a select few domestic banks meet these criteria. By 2025, HDBank will be distinctly recognized through its successful international transactions—deals that demand high operational standards and further integrate HDBank into the inner circle of the global green capital market.

Dược Nam Hà: Sustainable Growth Journey, Enhancing Value

Value10’s Pharmaceutical and Medical Device sector exemplifies the steady growth and long-term vision of Dược Nam Hà within an increasingly competitive and demanding industry.

North Ninh Welcomes New 35-Story Tower Project with $750 Million Investment Following Vingroup, Sun Group, and T&T Developments

The People’s Committee of Bac Ninh Province has recently approved the detailed planning for a new urban area spanning nearly 50 hectares in the northwestern region. Notably, the master plan features a high-rise complex, including a 35-story tower, designated as the architectural centerpiece of the entire development.