Mr. Suan Teck Kin – Managing Director of Global Market and Economic Research, UOB Bank Singapore

|

UOB Revises Vietnam’s 2026 GDP Growth Forecast to 7.5%

Vietnam’s GDP surged by 8.46% year-on-year in Q4 2025, surpassing the 8.25% growth in Q3 2025. This robust performance was driven by resilient exports and manufacturing, despite the impact of U.S. tariffs. The result exceeded Bloomberg’s forecast of 7.7% and UOB’s projection of 7.2%, marking the strongest quarterly growth since 2009 (excluding COVID-19 fluctuations). For the full year 2025, GDP expanded by 8%, higher than UOB’s 7.7% forecast but slightly below the government’s target of 8.3-8.5%, which would have required a Q4 growth of 9.7-10.5%.

The Q4 2025 growth was primarily fueled by exports, which rose 19% year-on-year, and a 17% increase for the entire year, despite tariff challenges. Manufacturing also saw a significant uptick, growing 11.3% in Q4 2025, up from 10% in the same period in 2024, resulting in a 10.5% annual growth.

Vietnam’s economy demonstrated remarkable resilience in 2025, despite pressures from U.S. tariffs. With an 8% growth in 2025, Vietnam enters 2026 on solid footing. UOB has revised its 2026 growth forecast upward to 7.5% (from 7%), reflecting the economy’s current momentum and robustness. However, risks such as a high statistical base, potential export slowdown after a period of strong growth, and U.S. tariff policy uncertainties could temper this trajectory.

A Strong Start to 2026

Vietnam’s open economy, with exports of goods and services accounting for 83% of GDP—the second-highest in ASEAN after Singapore (182%)—makes it particularly vulnerable to trade conflicts like U.S. tariffs. In 2024, the U.S. was Vietnam’s largest export market, receiving 30% of its total exports (USD 406 billion), followed by China (15%) and South Korea (6%). Key exports to the U.S. in 2024 included electrical products (HS85, USD 41.7 billion), mobile phones and related devices (HS84, USD 28.8 billion), furniture (HS94, USD 13.2 billion), footwear (HS64, USD 8.8 billion), knitted apparel (HS61, USD 8.2 billion), and non-knitted apparel (HS62, USD 6.6 billion), comprising nearly 80% of Vietnam’s total exports to the U.S.

While Vietnam’s trade remains robust despite U.S. tariffs, a potential scenario is a decline in export orders as the earlier surge in demand wanes and higher prices dampen U.S. consumer purchasing power, particularly in 2026.

State Bank of Vietnam Maintains Stable Interest Rates

Given the strong 2025 growth and optimistic 2026 outlook, the State Bank of Vietnam (SBV) has limited room for policy easing. Inflation remains a concern, averaging 3.2% in 2025 (headline) and 3.3% (core, excluding food and energy), compared to 3.6% and 2.85% in 2024, respectively. Healthcare and education costs are key drivers of sustained inflation, though the trend has stabilized somewhat.

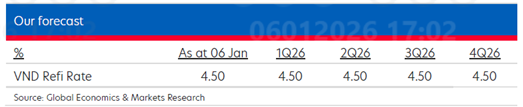

The foreign exchange market is another critical factor for the SBV. The VND was the third-weakest Asian currency in 2025, depreciating 3.1% against the USD, behind only the Indian rupee (4.8%) and Indonesian rupiah (3.5%), but more than the Philippine peso. Conversely, regional currencies benefited from a weakening USD, with gains ranging from 10% for the Malaysian ringgit to 0.3% for the Japanese yen. Based on these factors, UOB expects the SBV to maintain the refinancing rate at 4.5% throughout 2026.

– 15:58 09/01/2026

Overnight Interest Rates Surge to 8.7%, SBV’s System Support Surpasses VND 400 Trillion

The final trading session of 2025 saw significant developments in the currency market, with the overnight interbank VND interest rate—the dominant tenor accounting for the majority of transaction value—surging to 8.7% per annum. Amid this context, the State Bank intensified its net liquidity injection through the open market channel.

U.S. Threatens 500% Tariffs on Multiple Nations, with Russia as the Primary Target

The most stringent U.S. sanctions to date will target buyers of Russian oil, marking a significant escalation in economic pressure.

Why More Banks Are Raising Interest Rates on Social Housing Loans

Unlock exclusive savings with Agribank’s unbeatable 5.6%/year interest rate for the first 5 years of your loan. Meanwhile, top banks like Vietcombank, BIDV, and Vietinbank have halted their special 5.2-5.5% fixed-rate offers for borrowers under 35, making Agribank’s deal even more irresistible. Act now to secure your financial future!