According to JLL, Vietnam’s real estate M&A market in 2025 witnessed significant growth, marking a positive shift after a prolonged downturn.

In the first 11 months of 2025, the cumulative transaction volume reached approximately USD 2.4 billion. However, when including undisclosed deals, the estimated figure is considerably higher.

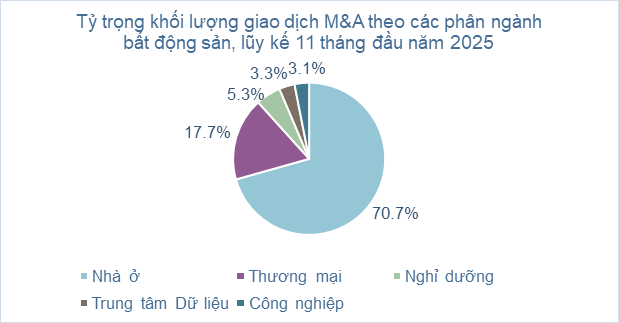

Residential real estate led the market, accounting for over 70% of total M&A transactions. Other sectors, such as commercial, hospitality, and industrial real estate, represented around 17.7%, 5.3%, and over 3%, respectively.

Source: JLL statistics and estimates

|

JLL notes that amidst tight financial conditions, businesses have turned to M&A strategies as a key solution to sustain growth. Additionally, many conglomerates, post-restructuring, have actively expanded their real estate portfolios through M&A deals.

Notable M&A transactions in the residential sector include Vinaconex (HOSE: VCG), which divested its entire 51% stake in Vinaconex ITC (UPCoM: VCR), the developer of the 176-hectare Cat Ba Amatina resort project in Hai Phong, with an initial investment of nearly VND 11 trillion.

Phu My Hung (PMHC) transferred a 49% stake in the 198-hectare Hong Hac City project in Bac Ninh to Nomura Real Estate Asia. The project’s total investment is approximately USD 1.1 billion. The transaction value was not disclosed. Post-deal, both parties will jointly develop the urban area.

Other listed companies, such as DIG (HOSE: DIG), transferred the Lam Ha Center Point residential project; Vincom Retail (HOSE: VRE) transferred Vincom Center Nguyen Chi Thanh; Becamex Group (HOSE: BCM) transferred The Charms Binh Duong project to Nam Mekong Group (HNX: VC3); and Hodeco (HOSE: HDC) divested from Ocean Construction and Investment JSC in Vung Tau, the developer of the Antares tourism complex, to a Sunshine Group affiliate.

Continued interest in industrial real estate

JLL Vietnam reports that the cumulative M&A transaction volume in the industrial real estate sector for the first 11 months of the year reached approximately USD 74 million.

Instead of leasing land for self-construction, investors increasingly prefer acquiring ready-to-use industrial parks (IPs) and expanding them in new phases. This approach saves deployment time, ensures infrastructure quality, and minimizes legal risks.

The emergence of diverse investment products, such as industrial land funds, pre-built factories, and specialized segments like cold storage and data centers, is creating more M&A opportunities.

Top M&A Deals of 2025: Foreign Capital Dominates

2026 real estate M&A market to focus on thorough project evaluation

Le Thi Huyen Trang, CEO of JLL Vietnam, forecasts that Vietnam’s real estate M&A market in 2026 will continue its growth momentum but with a more cautious and selective approach. Investors will conduct more thorough and comprehensive project evaluations.

Capital costs, though potentially reduced, are unlikely to return to previous lows. Credit is becoming more selective, favoring deals with clean legal status, clear profit potential, and sustainable development elements, prompting more careful calculations.

This selectivity will direct capital toward high-quality assets with strong resilience to market fluctuations, such as industrial real estate, logistics, data centers, Grade A offices, and residential projects meeting real demand with green and sustainable features.

“In 2026, the real estate M&A market will not explode but grow in depth, prioritizing quality over quantity, marking a more mature and sustainable market development,” said the CEO of JLL Vietnam.

Land price framework to influence valuation processes

Starting in 2026, a new land price framework will be uniformly applied nationwide, more closely aligning with market rates. Ms. Trang notes that this will impact both valuation processes and decision-making for M&A participants.

For project valuation, land use costs will become clearer and more predictable. This enhances financial model accuracy and reduces uncertainty, a significant risk in the past. However, higher formalized land costs will require investors to recalculate total investment and expected returns.

The focus of valuation will shift from exploiting land price differentials to assessing actual project development capabilities. A deal’s value will depend more on effective planning, construction quality, and the final product’s business strategy.

For buyers and sellers, this change will have varying impacts. Sellers with fully paid land obligations will have a clear advantage due to competitive input costs, while new projects face higher land costs. Conversely, those with incomplete land procedures may face margin pressure, potentially prompting project transfers.

Buyers will need to carefully assess capital flows and profits. With higher input costs, they will prioritize projects with complete legal status and partner with proven developers.

In the residential sector, as land costs and financial obligations rise, M&A activity will focus on assets that minimize risks and shorten deployment times. Legally complete but delayed projects due to capital shortages will be prioritized. Incomplete projects or large undeveloped land funds will be scrutinized more carefully due to increased costs and longer development times.

For industrial real estate, while higher input costs pose short-term challenges, increased transparency and predictability are core benefits. A clear land cost environment will reduce risks for international investors and large funds. This will force developers to compete on infrastructure quality and services rather than relying on cheap land. Such professionalization will enhance the market’s appeal to long-term investors prioritizing stability and sustainable growth.

“The new land price framework will set higher cost and capability requirements but also increase market transparency. While short-term adjustments may be needed, this clarity is a long-term positive, creating a more stable and attractive investment environment for professional investors, focusing M&A on real development value and sustainable market growth,” said Ms. Trang.

Legal compliance becomes non-negotiable

According to JLL Vietnam’s CEO, a key policy focus in 2026 to boost real estate M&A is accelerating the completion and harmonization of legal guidance documents for new laws.

Currently, delays in issuing detailed decrees and circulars can cause inconsistent local application, affecting core processes like determining land financial obligations or approving investors for residential and industrial projects.

International investors, particularly from South Korea, Singapore, Japan, and the U.S., prioritize two criteria when evaluating M&A opportunities in Vietnam.

Legal transparency is non-negotiable in investment decisions. These investors favor projects with complete legal profiles and immediate deployment readiness, even paying premiums for high “cleanliness” to ensure legal safety and shorten investment timelines. In joint ventures, domestic partners with proven experience, capabilities, and transparent financial reporting systems are crucial for accelerating deals.

Sustainability and environmental friendliness are also top priorities, especially for European and North American funds adhering to ESG standards. Given Vietnam’s strong Net Zero commitment, they seek climate-resilient, energy-efficient projects meeting international green standards.

4 key factors to attract investors

JLL advises Vietnamese businesses to focus on four key factors to effectively attract investors.

First, ensure complete legal compliance for assets, including land use rights and related permits, with detailed legal due diligence reports.

Second, conduct professional valuations adhering to international standards and regularly update them to reflect true market value, a critical factor in negotiations.

Third, maintain flexibility in transaction structures. Businesses should consider various cooperation forms, from joint ventures and strategic partnerships to full asset transfers.

Finally, establish transparent financial systems with internationally audited reports and clear corporate governance. Investing in standardized financial reporting and robust internal processes will ensure success in future M&A deals.

– 12:00 05/01/2026

Khải Hoàn Prime Officially Signs Sales and Purchase Agreement, Marking Complete Legal Milestone

As of December 26, 2025, Khải Hoàn Prime resort apartments are officially eligible for sales contract signing, marking a significant legal milestone that underscores the developer’s credibility and expertise.

“Built-to-Sell”: TBS Group’s Unique Approach to Real Estate Development

Rooted in manufacturing, supply chain, and services, TBS Group ventures into real estate under the TBS Land brand, guided by the consistent philosophy: “Build from the heart, create for people.” Green Skyline emerges as a continuation of this legacy, where trust is built through genuine products, authentic value, and real experiences.