According to VNDirect’s 2026 investment strategy report, the brokerage firm forecasts a 10.8% growth in PNJ’s net revenue for 2026.

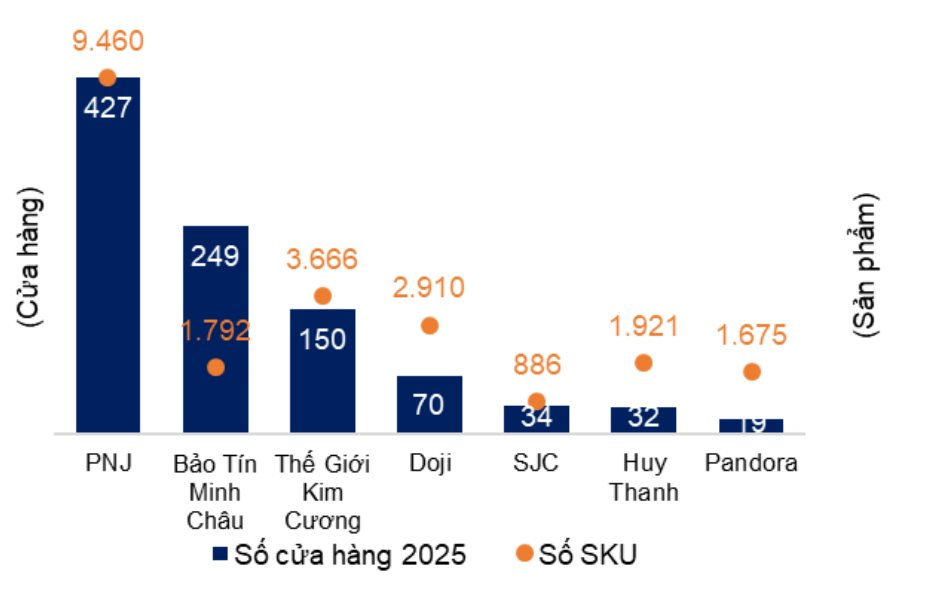

VNDirect highlights that PNJ’s dominant market position benefits from a robust recovery in demand. Expansionary measures—such as infrastructure spending, credit growth, VAT reductions, and unemployment support—have contributed to job and income restoration, driving retail sales up by 9% year-on-year since early 2025.

PNJ’s same-store sales, which dropped to VND 3.4 billion (USD 131,000) per month in Q2/2023, are projected to rebound to VND 3.7–5.2 billion (USD 142,000–200,000) from Q2/2025 onward.

Coupled with a product diversification strategy, this positions PNJ to capitalize on growth as the market normalizes.

Additionally, the participation of commercial banks and retailers in gold bar imports and production may alleviate raw material shortages.

VNDirect identifies eight banks potentially eligible to import and trade gold bars under Decree 232. Due to limited production experience and equipment, some banks are considering

outsourcing manufacturing

to ensure product quality standardization.

As one of Vietnam’s largest jewelry manufacturers, PNJ’s extensive experience and infrastructure position it to boost B2B sales in line with this trend.

Meanwhile, eased raw material supply supports gold jewelry sales and gross profit margins (GPM). A gold shortage previously compressed PNJ’s jewelry GPM in Q3/2024 before gradual recovery through inventory optimization and buyback policies.

VNDirect notes that Decree 232, which eliminates the state monopoly on gold, will restore gold bar transactions through jewelry retail chains, reduce raw material costs, and bolster jewelry margins—particularly ahead of the upcoming wedding season.

PNJ Pioneers Market-Rate Buyback Program for Low-Purity Gold Jewelry

Vietcap anticipates that the new revenue recognition policy will positively impact PNJ’s retail sales growth, while its effect on the retail segment’s gross margin is expected to be negligible.