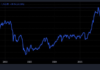

Vietnam’s stock market is experiencing a robust growth phase, with the VN-Index consistently breaking records. On January 7th, the index closed above the historic 1,860-point mark, surging over 45 points (+2.5%). Trading activity was vibrant, with the matching value on HoSE exceeding 29.7 trillion VND, the highest in two months.

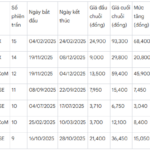

Looking back at the index’s performance since late last year, a shift in investor sentiment became evident after December 16th. This coincided with Mr. Nguyen Duy Hung, Chairman of SSI Securities, publicly stating that the market presented numerous opportunities as stock prices reached attractive levels. This marked the beginning of a nearly 200-point rally.

Specifically, on December 16th, he shared on his personal Facebook page: “When the gains are concentrated in a few large stocks, many others are trading at very low valuations!”. Coincidentally, the Vietnamese stock market entered a strong recovery phase. From the 1,680-point level in mid-December 2025, the VN-Index has climbed nearly 200 points to an all-time high. Notably, the rally has been broad-based, not limited to a few blue-chip stocks.

This isn’t the first time the market has reacted in line with Mr. Hung’s insights. On April 9th, amidst a market downturn due to tariff concerns, he remarked: “Tariffs have a negative impact, but there’s no reason for the market to react as if it’s the end of the world. It’s time to bottom-fish!”.

At that time, the market also responded positively after a rare sharp decline. Bottom-fishing demand lifted numerous stocks off the floor, setting the stage for a subsequent “V-shaped” recovery.

Overall, Mr. Hung’s views represent his personal market perspective. Given his expertise, knowledge, and extensive market experience as SSI’s Chairman, his insights are valuable for investors but should not be considered decisive.

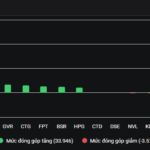

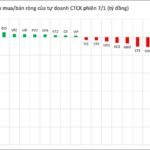

Returning to market developments, the January 7th session’s gains were widespread across sectors. Banking and securities stocks led sentiment, while cyclical sectors like oil & gas and insurance also saw positive momentum with healthy price increases.

This broad-based rally indicates that capital is seeking opportunities in stocks that have accumulated sufficiently, laying a more sustainable foundation for the VN-Index’s growth after breaking through previous peaks.

VN-Index has significant growth potential in 2026

Entering 2026, Mr. Nguyen Tien Dung – Head of Industry and Equity Research, MB Securities (MBS) believes this will be when the economy translates long-term growth targets into tangible results. Numerous infrastructure projects will move from paper to reality, while major resolutions will be implemented through specific regulations and guidelines.

Public investment will act as a “catalyst,” stimulating private sector investment and boosting core profitability for listed companies, thereby becoming the stock market’s primary driver in 2026.

Conversely, interest rates are seen as the biggest risk to the market this year. The room for monetary easing is limited as major central banks’ policies diverge. While expectations remain for at least one Fed rate cut in 2026, the greater risk comes from the Bank of Japan, which has raised rates to 0.75% – a three-decade high – and is likely to continue tightening this year.

This signals the end of the era of cheap capital flowing into Asia, including Vietnam, putting upward pressure on interest rates and corporate funding access.

Long-term, Vietnam’s stock market prospects are highly regarded by domestic and international institutions. With a target of double-digit GDP growth in 2026–2030, supported by structural reforms, strong FDI inflows, and accelerated infrastructure investment, SSI Research believes these factors will create a solid foundation for sustainable stock market growth. Analysts forecast the VN-Index could reach 1,920 points in 2026.

Similarly, in its “Vietnam 2026 Outlook” report, JPMorgan projects the VN-Index to hit 2,000 points in the base case scenario, and 2,200 points in an optimistic scenario. “Compared to market upgrades, economic reforms have a much greater impact on the stock market’s fundamentals,” JPMorgan experts noted.

Even more optimistically, Petri Deryng, head of Pyn Elite Fund, has raised his VN-Index target to 3,200 points by 2028. This new target assumes average profit growth of 18–20% in the coming years.

“King of Stocks Roars, VN-Index Hits New Peak”

The VN-Index soared to a new peak of 1,861 points in today’s trading session (January 7th). Robust liquidity and significant capital inflows were observed, particularly in blue-chip stocks, with the banking sector standing out prominently. This early 2026 market activity signals a more optimistic outlook.