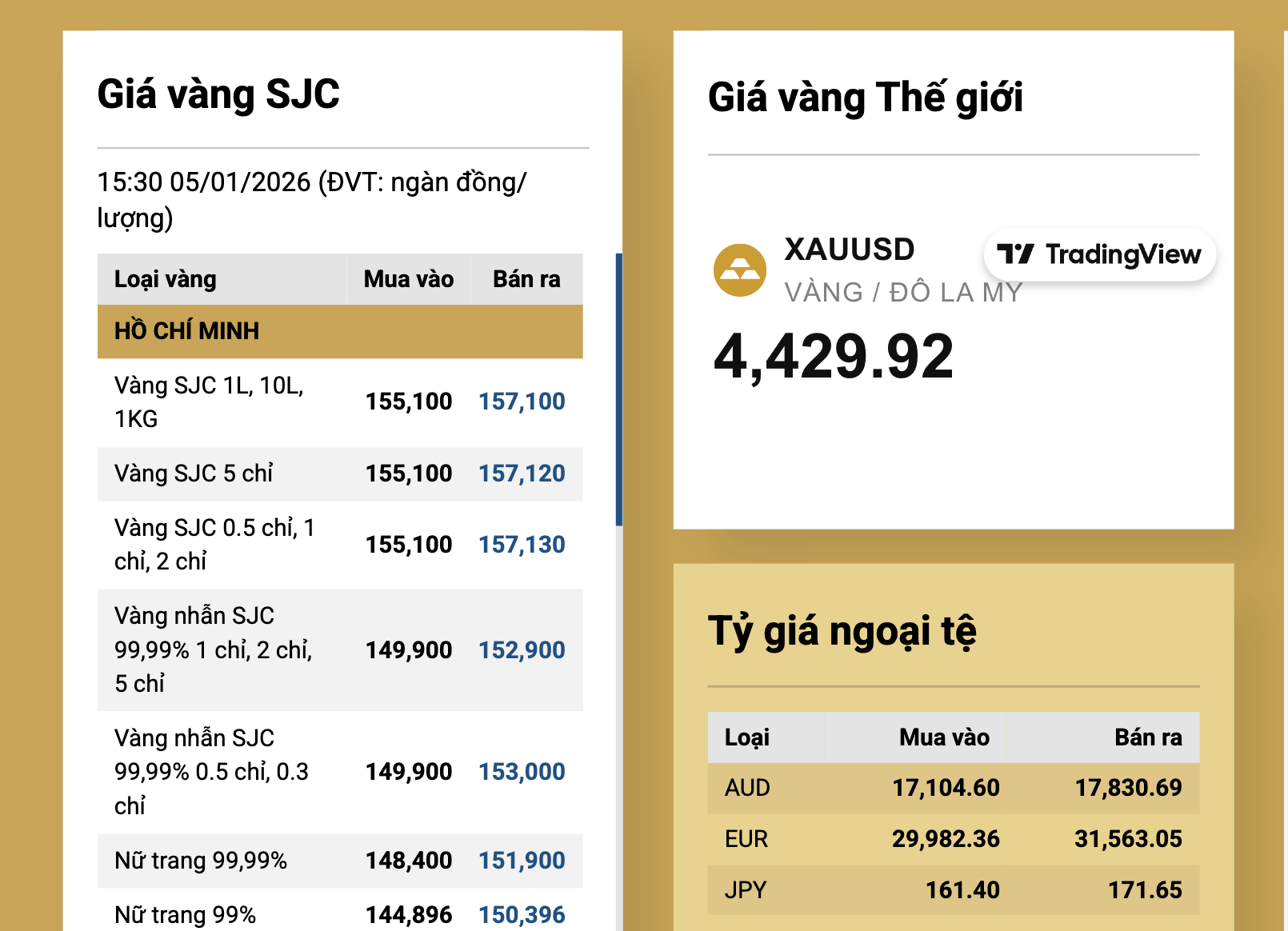

On January 6th, the price of SJC gold bars at SJC, PNJ, and DOJI companies was listed at around 155.4 million VND per tael for buying and 157.4 million VND per tael for selling, an increase of 300,000 VND compared to the previous day.

The price of SJC-branded 99.99% gold rings and jewelry also rose to 150.4 million VND per tael for buying and 153.4 million VND per tael for selling, up by 1.2 million VND from the previous day.

The prices of plain gold rings from other brands surged significantly, far surpassing SJC. Bao Tin Minh Chau and Bao Tin Manh Hai listed buying prices at 153.3 million VND per tael and selling prices at 157.3 million VND per tael, the highest in the market.

Not only gold, but silver prices have also been continuously hitting new highs. This morning, silver bars from brands like SBJ and Phu Quy were bought at 2.91 million VND per tael and sold at 2.98 million VND per tael, an increase of 61,000 VND compared to yesterday.

In 2025, silver prices have risen by 150%, while gold prices have increased by approximately 65%.

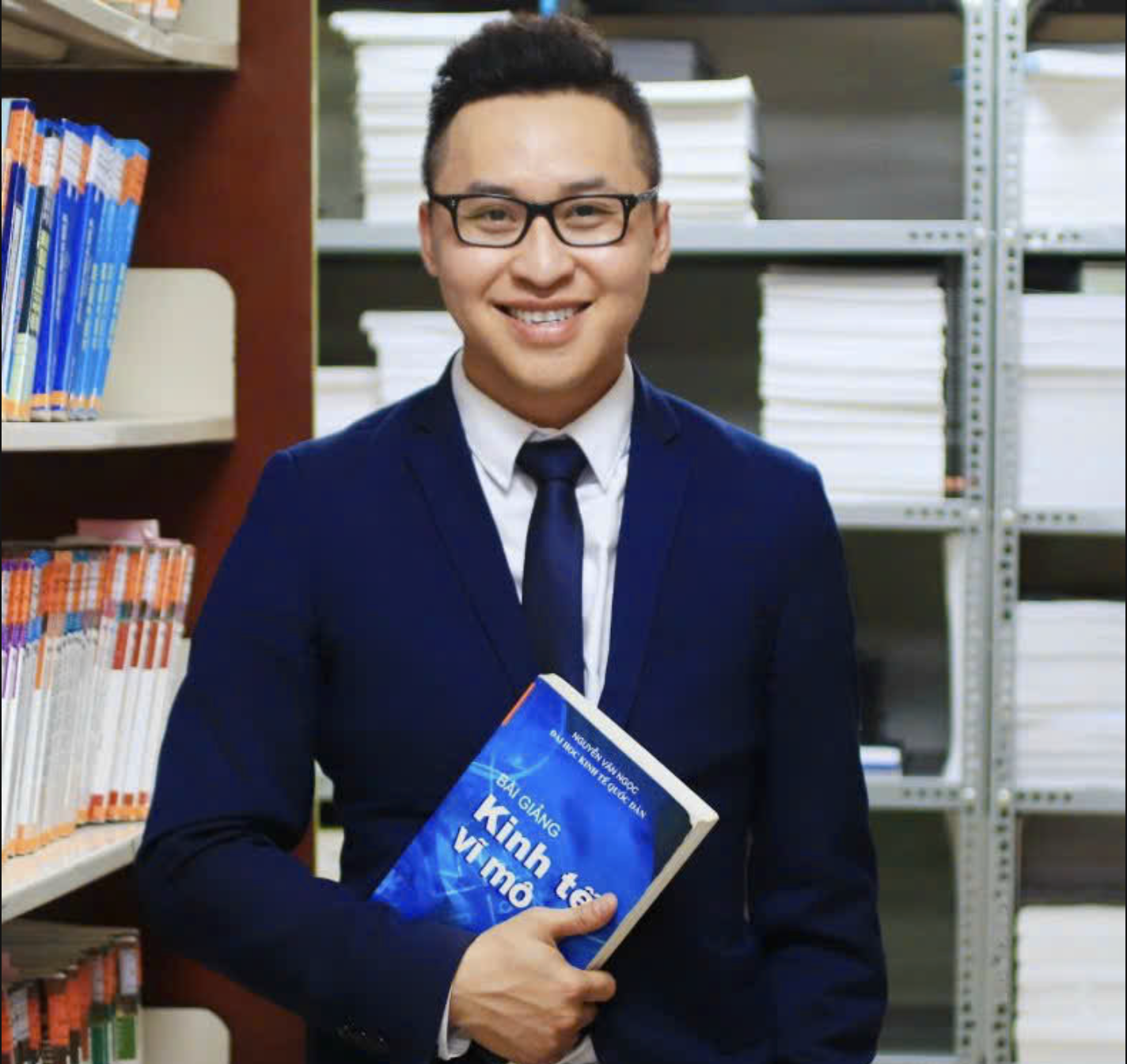

Regarding the fluctuations in precious metal prices, reporters from *Bao Nguoi Lao Dong* spoke with Dr. Nguyen Duy Quang, Head of the Digital Economics Department at the University of Economics and Finance, Ho Chi Minh City (UEF).

Reporter: What is happening with precious metals, as both platinum and copper prices have reached record highs?

Dr. Nguyen Duy Quang

– Dr. Nguyen Duy Quang: Firstly, the global supply-demand balance is shifting significantly, with industrial demand for silver, platinum, and copper surging simultaneously.

Meanwhile, the supply from mining and refining of these metals has only increased marginally. China’s restrictions on exports, which account for 60-70% of global silver production, have exacerbated the shortage, driving silver prices up and affecting other metals through the “demand shift” effect.

Additionally, the declining U.S. dollar interest rates in 2025-2026 have reduced the opportunity cost of holding gold, silver, platinum, and copper.

Central banks continue to actively stockpile precious metals. Inflows from ETF funds and trust funds into precious metals have also provided significant momentum, reinforcing the overall price increase.

Domestic gold prices have been rising steadily in recent times

Geopolitical instability and trade tensions have also increased the safe-haven appeal of precious metals. Amid trade wars, debt crises, or supply chain disruptions, investors turn to gold, silver, platinum, and copper as a means of value preservation and risk mitigation. This ripple effect has pushed most base and precious metal prices to record highs.

The rise in silver prices has stimulated domestic investor demand, but the number of suppliers is limited. What should investors note?

– Investors should pay attention to liquidity and transaction costs. With limited domestic supply of silver bars or ingots, the buy-sell spread will widen, and storage and insurance costs will rise. Investors should compare these spreads across brands and choose reputable trading platforms to optimize costs.

Currently, there are few companies producing and trading silver bars, and ensuring the purity of 999.9 silver with clear origins is essential. Investors should prioritize reputable brands to avoid counterfeit or impure products.

A balanced portfolio allocation is crucial. While silver benefits from industrial demand, it remains highly volatile due to macroeconomic factors and market sentiment. Investors should define clear holding periods, leverage ratios (if using margin), and opportunity costs compared to other assets, avoiding overconcentration in silver.

What factors could cause gold and silver prices to adjust?

– If the U.S. Federal Reserve (FED) or other central banks unexpectedly tighten monetary policy more than anticipated (raising interest rates, reducing quantitative easing), the opportunity cost of holding precious metals will increase. This could lead to capital outflows and price adjustments.

If supply chains improve significantly—such as new silver mines coming online or China easing export restrictions—increased supply will ease shortages, lowering silver and platinum prices. Similarly, slower growth in renewable energy or electric vehicle sectors will reduce industrial demand.

When concerns about safe-haven assets diminish, gold and silver prices may face short-term downward pressure.

Silver Prices Surge: Who Holds the World’s Largest Silver Reserves?

Silver prices continue to soar to unprecedented heights, with one South American nation holding a staggering 140,000 tons of this precious metal.

Global Gold Prices Plunge Over $200/Ounce in Surprise Late-Night Drop on December 29th

Precious metals, not just gold, experienced a significant decline in prices during Monday’s trading session.