The year 2025 marked a significant breakthrough for Vietnam’s stock market, highlighted by a pivotal upgrade. Following the tariff shock in April, the market rebounded impressively, reaching a peak of 1,800 points with surging liquidity. This surge was driven not only by the anticipated official upgrade but also by the robust fundamentals of listed companies.

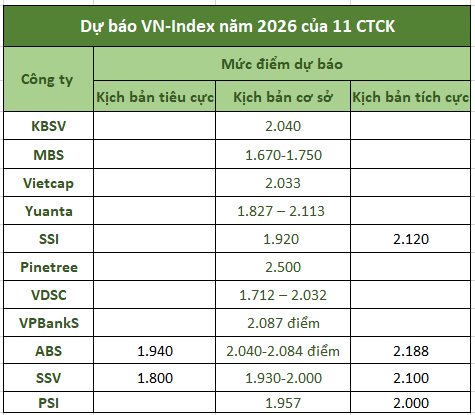

As we step into 2026, numerous securities firms anticipate the VN-Index to continue its upward trajectory, targeting ambitious levels above 2,000 points. This phase is seen as a pivotal moment for a new cycle, supported by stable macroeconomic conditions, policy reforms, public investment, market upgrades, and the maturity of listed enterprises.

A key highlight of this year is FTSE Russell’s decision to classify Vietnam as a secondary emerging market starting September, promising to attract billions of dollars and accelerate global financial integration. The synergy from major IPOs, positive profit growth, and attractive mid-term valuations further enhances the market’s appeal.

VNDirect believes 2026 will be a landmark year for Vietnam’s stock market. The official FTSE upgrade in September 2026, coupled with significant infrastructure improvements and major reforms, will bring Vietnam closer to developed regional markets. These factors will bolster investor confidence and attract major players. Additionally, strong domestic economic growth and positive profit forecasts will ensure steady market growth in 2026, with the VN-Index closing at 2,099 points, reflecting a 27.5% increase.

SSI Research shares the sentiment that Vietnam’s stock market has officially closed its bottoming phase, entering a new era of growth from 2026. This marks the market’s transition to a “post-upgrade breakout” phase, where policy reforms and global integration efforts converge to initiate a sustainable growth cycle.

The market’s allure is strengthened by an attractive P/E ratio of 14.5 times, while corporate profit growth prospects far exceed this at 14.5%. By 2026, the projected P/E ratio is expected to drop to around 12.7 times, significantly below the 10-year historical average of 14 times. SSI forecasts the VN-Index could reach 1,920 points.

Similarly, Vietcap predicts the VN-Index could hit 2,033 points in 2026, a 17% increase from 2025. The primary driver is the explosive profit growth of listed companies, with EPS growth projected at 19%. This marks the second consecutive year of double-digit profit growth, indicating a stable and sustainable recovery in business operations.

Notably, despite the index’s strong rise, market valuations remain attractive. Even at the target of 2,033 points, the P/E ratio is expected to be only 14.4 times, significantly lower than current levels. This suggests the market’s growth is grounded in real corporate value rather than temporary euphoria, providing long-term investors with greater confidence.

Echoing this optimism, An Binh Securities (ABS) forecasts the VN-Index in 2026 will surpass 2025 highs, targeting 1,940 points in a cautious scenario and potentially reaching 2,040–2,188 points in an optimistic scenario.

The primary drivers are the synergy between strong corporate earnings and ample market liquidity. With low interest rates and Vietnam’s FTSE upgrade to an emerging market, foreign capital is expected to return robustly, elevating the market’s overall valuation.

A Contrasting Phenomenon Unfolds in Vietnam’s Stock Market

From a technical analysis perspective, Yuanta Securities asserts that the market is currently in the third wave of its upward trend, characterized by the strongest momentum and the longest duration.

“King of Stocks Roars, VN-Index Hits New Peak”

The VN-Index soared to a new peak of 1,861 points in today’s trading session (January 7th). Robust liquidity and significant capital inflows were observed, particularly in blue-chip stocks, with the banking sector standing out prominently. This early 2026 market activity signals a more optimistic outlook.