The Dai Phuoc Eco-Tourism Urban Area Project by DIG

|

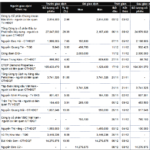

Specifically, DIG transferred zones 1, 2, and 3, totaling 307,428m², to TNT Phu Hoa JSC for over 2.465 trillion VND.

According to research, TNT Phu Hoa is a real estate company established in March 2023 with a charter capital of 660 billion VND. TNT Real Estate Development JSC is the parent company, holding 99.8%, while Mr. Le Ngoc Khanh Viet and Ms. Ha Thi Nhung each own 0.1%.

Initially, Ms. Viet served as Director and legal representative of TNT Phu Hoa, but by late 2023, Ms. Vu Thi Tuyet took over. Just three months after the new Director’s appointment, the company’s charter capital increased to 925 billion VND.

Ms. Nhung and Ms. Viet are Chairwoman and CEO of TNT Real Estate Development, respectively. Founded in 2018 in Ho Chi Minh City with an initial charter capital of 20 billion VND, the company is owned by three individuals: Mr. Pham Cong Dien (45%), Ms. Le Ngoc To Nga (30%), and Ms. Nguyen Tran Thao Vy (25%). Its charter capital has since risen to 880 billion VND.

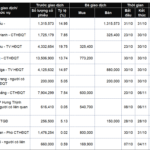

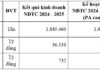

The Dai Phuoc Eco-Tourism Urban Area Project by DIG, located in Dai Phuoc Commune, Dong Nai Province, spans 464.5 hectares with a total investment of 7.506 trillion VND. By September 2025, DIG’s incurred costs for this project exceeded 2.1 trillion VND.

At the Analyst Meeting on 26/09/2025, Mr. Nguyen Quang Tin, Board Member and CEO of DIG, announced a target of 1 trillion VND in revenue for 2025 from the Dai Phuoc project transfer.

According to Mr. Tin, the project retains approximately 30 hectares (zones 10, 14, and part of the 30-hectare zone). The company has reached a transfer agreement with a partner, expected to finalize in October, generating around 2.4 trillion VND in revenue and 748 billion VND in gross profit (30% margin), barring financial costs. This transaction, slated for Q4 recognition, will help DIG meet its 2025 profit target, currently short by 500 billion VND.

Given these details, the partner mentioned by DIG’s CEO is likely TNT Phu Hoa, given the 30+ hectare transfer valued at over 2.4 trillion VND.

Did EVG join DIG’s Dai Phuoc project after exiting Splendora?

In addition to the above zones, DIG transferred zone 7.1 (143,906m²) to Everland An Giang JSC for over 489 billion VND.

Everland An Giang, established in January 2022, is an affiliate of EverLand Group JSC (HOSE: EVG), headquartered at 47-49 Truong Dinh Street, District 3, Ho Chi Minh City.

With a charter capital of 1.2 trillion VND, EVG holds 45.833%, Mr. Dau Quoc Dung 30%, and Mr. Le Dinh Vinh, EVG’s Chairman, 24.167%. Mr. Le Dinh Tuan, EVG’s Board Member and Deputy CEO (and Mr. Vinh’s brother), serves as Everland An Giang’s CEO and legal representative.

Before joining DIG’s Dai Phuoc project, EVG withdrew from the Splendora project in October 2025, reclaiming a deposit for a land plot in the Bac An Khanh New Urban Area.

Why did Everland abruptly reclaim its deposit for the Bac An Khanh project?

According to EVG’s Q3/2025 consolidated financial report, the company has 712 billion VND in receivables from An Khanh JVC, Splendora’s developer, including 637.5 billion VND in principal and financing costs agreed upon by An Khanh JVC.

– 16:45 05/01/2026

Market Plunges, Insider Trading Surges on Both Buy and Sell Sides

Despite the market’s sharp decline during the trading week of December 8-12, 2025, data reveals that insiders and their affiliates remained highly active, maintaining a balanced approach between buying and selling activities, both in transactions and registrations.

Insider Trading Surge: Top Executives’ Notable Stock Transactions in Early November

In the first week of November, the market witnessed significant insider transactions, predominantly in the form of registrations. Notably, DIG announced plans to reduce its stake in DC4, while the Vice Chairman of KDH gifted 17.7 million shares to his mother. Simultaneously, the CEO of Nagakawa capitalized on the market downturn by actively accumulating shares at their lowest prices.

DIG Records Q3 Net Profit of Over 210 Billion VND from Lam Ha Center Point Transfer

Fueled by a remarkable third-quarter performance, Construction Development Investment Corporation (HOSE: DIG) witnessed a staggering 14-fold increase in consolidated net profit for the first nine months of the year compared to the same period last year.

Shocking Twist at the Billion-Dollar Bac An Khanh Project: Real Estate Firm Pulls Out as Loan Interest “Devours” Profits

After nearly two years of involvement in the Sky Lumiere Center complex (located in Mailand Hanoi City), Everland has decided to withdraw the entire deposit and terminate the transfer contract. This decision stems from the prolonged transfer process, coupled with the significant loan interest costs the company has had to bear.