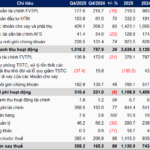

Currently, four ETFs are tracking the VN30 index: DCVFMVN30 ETF (with a NAV of 6.6 trillion VND), KIM Growth VN30 ETF (2.5 trillion VND), MAFM VN30 ETF (902 billion VND), and SSIAM VN30 ETF (230 billion VND). These funds experienced a highly successful 2025, as the benchmark VN30 index surged by over 50%.

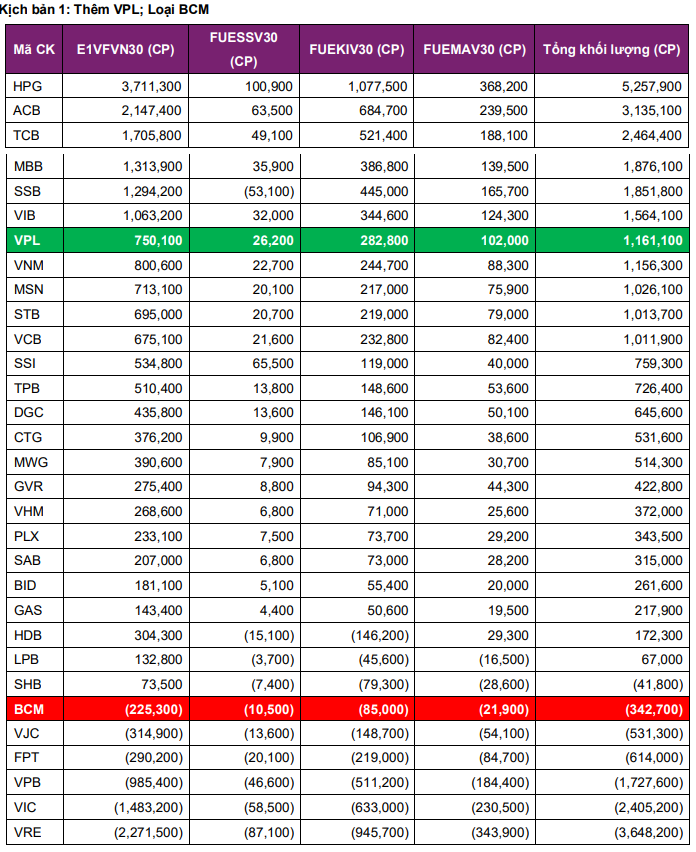

According to Yuanta Securities Vietnam’s forecast, BCM is expected to be removed from the VN30 basket due to insufficient liquidity. The stock’s average order-matching trading value reached only 26.83 billion VND per session, falling short of the minimum threshold of 30 billion VND per session as required.

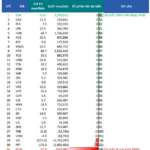

The removal of BCM will trigger substantial selling pressure from ETFs. It is anticipated that the total net selling volume of BCM will exceed 340,000 shares, with DCVFMVN30 ETF, the largest fund, selling over 225,000 shares.

Conversely, VPL emerges as the most promising replacement candidate, ranking 11th in free-float market capitalization, qualifying it for direct entry into the Top 20 priority group of the index basket. If selected, VPL will be purchased with a total volume of 1.16 million shares by the ETFs.

In this scenario, DCVFMVN30 ETF will acquire 750,000 VPL shares, KIM Growth VN30 ETF will purchase over 280,000 shares, and MAFM VN30 ETF will buy more than 100,000 shares.

Source: Yuanta Securities Vietnam

|

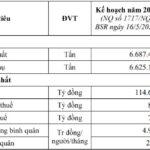

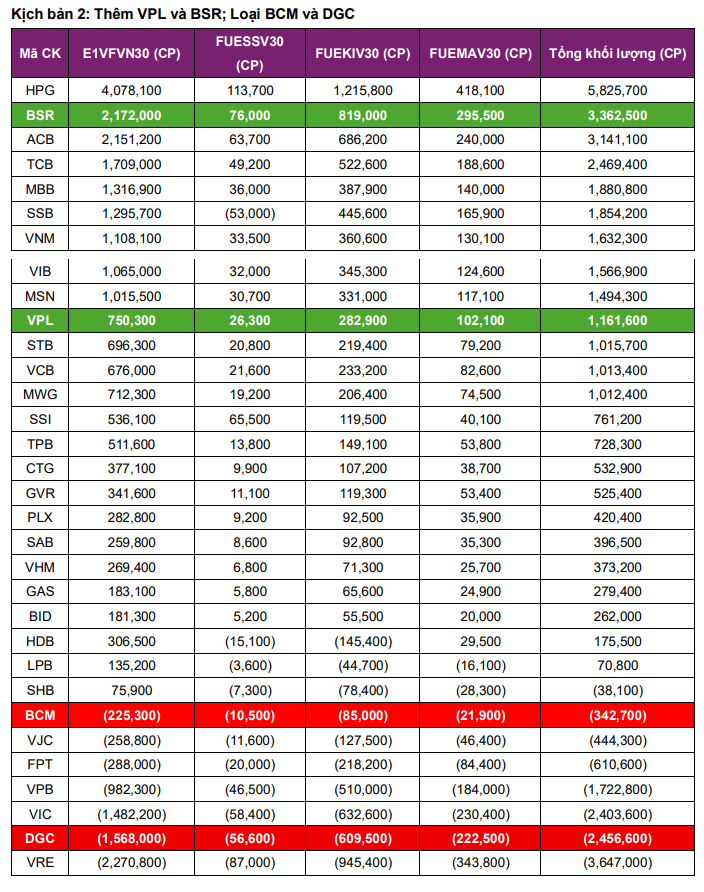

Alternative Scenario with BSR

Yuanta also presents a second scenario where BSR (ranked 22nd in market capitalization) could be added to the portfolio. In this case, both VPL and BSR would join the VN30, while BCM and DGC, the lowest-capitalized stocks in the current portfolio, would be removed.

If this scenario materializes, BSR will be purchased with a total volume of 3.36 million shares, significantly higher than VPL. Simultaneously, DGC will face net selling pressure of 2.46 million shares.

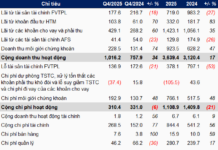

Other large stocks in the portfolio will also undergo adjustments. HPG is expected to be heavily purchased, with volumes ranging from 5.26 million to 5.83 million shares depending on the scenario. ACB and TCB will also see substantial buying interest.

On the other hand, VRE, VIC, and VPB will experience the most significant selling pressure, with respective selling volumes of 3.65 million, 2.4 million, and 1.72 million shares.

Source: Yuanta Securities Vietnam

|

As per the schedule, the rebalanced portfolio will be officially announced on January 21, 2026, and completed by February 2, 2026. With the total assets of ETFs tracking the VN30 index reaching 10.3 trillion VND, this rebalancing is expected to generate significant market movements.

– 14:33 08/01/2026

BSR Revises 2025 Profit Plan, Targeting 3.6x Original Goal

In late 2025, Binh Son Refining and Petrochemical JSC (HOSE: BSR) unexpectedly announced a resolution to adjust its previous year’s business plan, introducing significant changes.

The Dung Quất Story: Unveiling a Legacy of Resilience and Innovation

Few realize that the specialized fuel powering A80, fueling the proud performances of fighter jets, submarines, and more, is crafted at Dung Quát—the nation’s first oil refinery, built and operated entirely by Vietnamese hands, mastering cutting-edge technology.

BSR Signs Coordination Agreement with Quang Ngai Border Guard

On December 25, 2025, in Quang Ngai, Binh Son Refining and Petrochemical Joint Stock Company (BSR) held a conference to review the implementation of Coordination Regulation No. 6848/QCPH-BSR-BĐBP. This regulation focuses on managing and protecting national borders, as well as ensuring the security and safety of offshore facilities at the Dung Quat Oil Refinery.