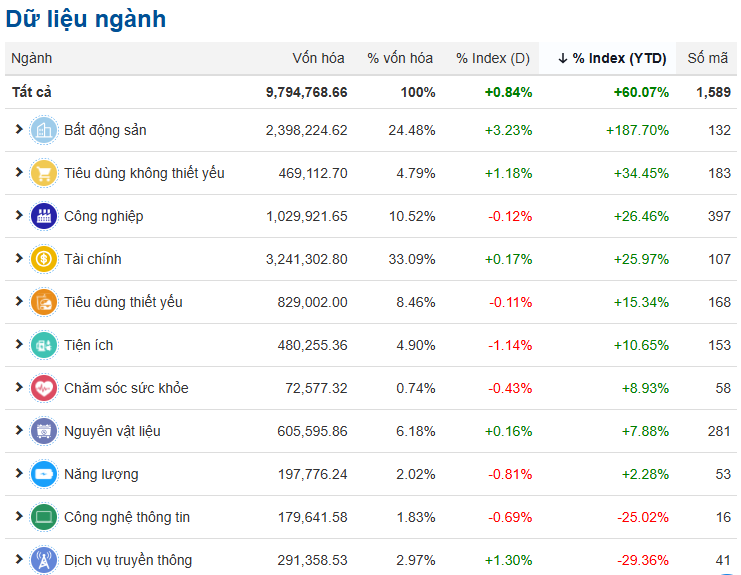

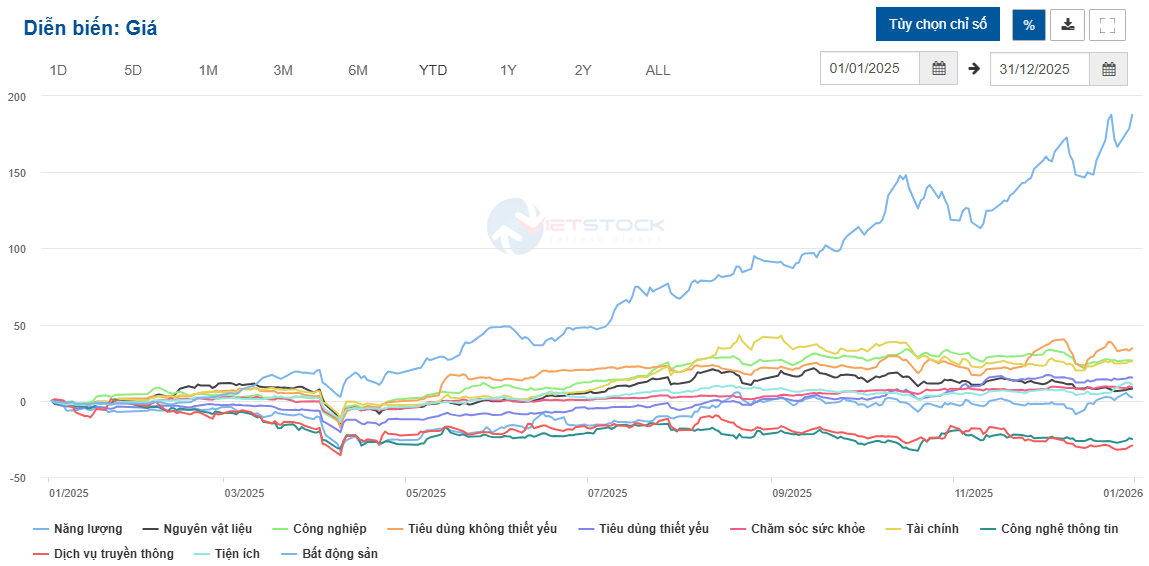

Data from VietstockFinance reveals that by the end of 2025, the real estate stock group emerged as the top performer in the market, surging by nearly 188%. This growth significantly outpaced the VN-Index‘s 41% increase and left the non-essential consumer sector, which rose by over 34%, far behind.

|

Exceptional Performance of Real Estate Stocks in 2025

Source: VietstockFinance

|

The real estate sector’s growth created a significant gap with other sectors. Source: VietstockFinance

|

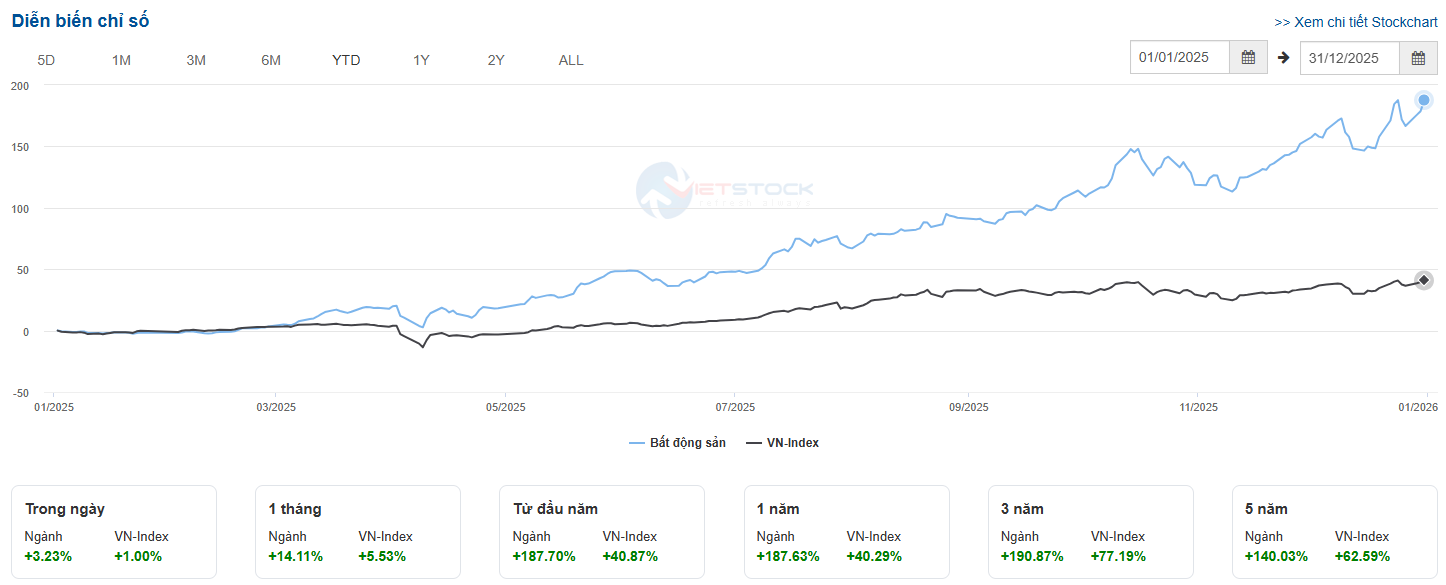

The real estate sector’s performance surpassed the VN-Index from late February 2025 and continued to widen the gap in subsequent months.

Source: VietstockFinance

|

This outcome reflects the real estate market’s recovery after a prolonged challenging period from 2022 to 2024. A key driver was the effectiveness of several legal policies, notably the trio of the Land Law, Housing Law, and Real Estate Business Law. Additionally, the government issued various decrees and circulars to resolve issues for stalled projects.

According to the Ministry of Construction, as of December 4, 2025, the number of commercial housing units eligible for future sales reached over 61,700, and social housing units eligible for transactions exceeded 11,600—up 5% and 50% respectively compared to 2024.

The Ministry of Construction also reported that by the end of Q3 2025, outstanding credit in the real estate sector reached approximately 1.9 trillion VND, a 30% increase from the beginning of the year, matching the growth rate of 2024. This was further fueled by preferential credit packages, particularly policies supporting social housing buyers.

The business results of listed real estate companies also showed recovery. In the first nine months of 2025, net revenue and net profit of 132 listed real estate companies reached nearly 313 trillion VND and 40 trillion VND, up 15% and 1.4% year-on-year, respectively.

Residential Real Estate Soars, Industrial Park Stocks Lag

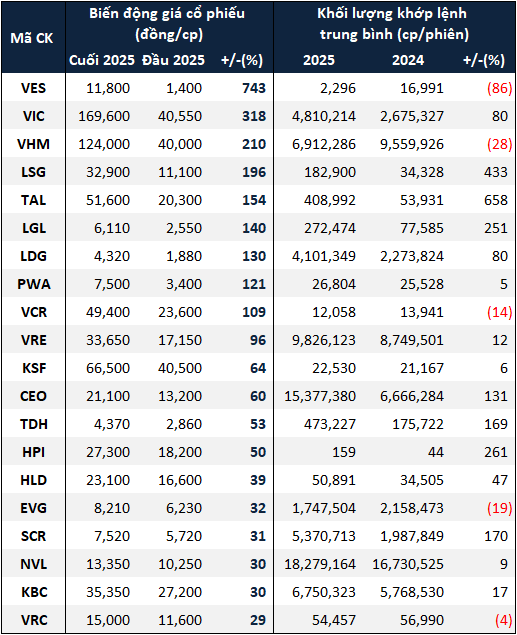

In 2025, despite the sector’s impressive index growth, the overall picture revealed a clear polarization among stocks. Out of 132 real estate stocks, only 60 increased in value, while 63 decreased and 10 remained unchanged.

The sector’s strong growth was primarily driven by a group of leading stocks. Companies within the “Vingroup family,” such as VIC, VHM, and VRE, all featured in the Top 10 best-performing real estate stocks of the year. VIC was also the stock with the most significant impact on the VN-Index in 2025, helping the index overcome several critical resistance levels.

With a market capitalization accounting for 65% of the entire real estate sector, the trio of VIC, VRE, and VHM was the main factor behind the sector’s remarkable achievement in the past year.

|

Top 10 Best-Performing Real Estate Stocks of 2025

Source: VietstockFinance

|

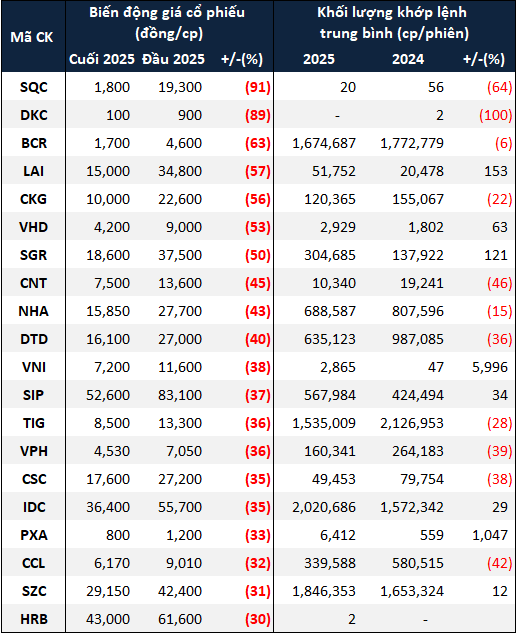

Many other stocks were less fortunate. BCR, CKG, NHA, VPH, TIG, and SGR saw significant declines in 2025, primarily due to senior management changes or major shareholder divestments, which made investors cautious.

|

Top 20 Worst-Performing Real Estate Stocks of 2025

Source: VietstockFinance

|

Additionally, there was a clear divide between segments. While residential real estate saw positive growth, industrial park real estate faced significant pressure.

Statistics show that 14 out of 20 industrial park real estate stocks declined in 2025. Major companies like BCM and SNZ fell by 15% and 10%, respectively, mainly due to global economic fluctuations, particularly U.S. tariff policies on Vietnamese exports and transit activities. KBC was a rare gainer in this group, rising by 24%.

Will Real Estate Stocks Remain Attractive in 2026?

According to Mirae Asset Vietnam Securities (MAS), in 2026-2027, the apartment supply in Ho Chi Minh City is expected to increase by 14% and 15% year-on-year, significantly higher than Hanoi’s projected growth of 4% and 9%.

MAS believes that companies with prepared inventory from late 2025 are likely to benefit as market liquidity improves and prices continue to rise. This is seen as a key factor driving the prospects of real estate companies in the coming year.

Similarly, Vietcombank Securities (VCBS) predicts that housing supply in 2026 will increase significantly due to two main drivers. First, the legal framework reshaped in 2025 will unlock capital and accelerate project implementation. Second, improved access to credit and bond issuance will provide financial leeway for companies to develop land funds and launch new projects.

An Binh Securities (ABS) assesses that public investment will likely remain a key growth pillar for the economy. Beyond directly boosting infrastructure projects in transportation and energy, this capital also acts as a catalyst, attracting additional resources from the private sector and foreign investment.

In this context, sectors like residential real estate, industrial parks, transportation, and warehousing are expected to continue benefiting indirectly as infrastructure improves, enhancing connectivity and goods circulation.

Despite the positive outlook, ABS cautions that the real estate market in 2026 still faces challenges. Property prices surged in 2025, and rising interest rates could further strain market absorption. Additionally, the corporate bond market is expected to remain tight under new regulations, hindering real estate companies’ capital raising efforts.

However, with interest rates remaining relatively low and a lack of attractive alternative investment channels, domestic capital is expected to continue flowing into the stock market, supporting real estate stocks.

FPT Securities (FPTS) believes that the prospects for real estate companies will be clearly polarized, with investment strategies needing to focus on companies with strong financial foundations and high safety margins.

FPTS suggests that investors prioritize companies with existing supply (including projects with completed financial obligations or finished construction) due to their advantages in absorption rates and profit margins as prices rise and market liquidity remains positive. Additionally, companies with healthy capital structures and low leverage will minimize risks as market capital demands remain high.

– 10:13 08/01/2026

Sacombank Shares Plummet to Floor Level

The market soared, surging over 45 points, with the “bank” sector unanimously rallying. However, not all bank shareholders shared in today’s triumph.