According to Yuanta’s 2026 Strategic Report, global economic growth is projected to continue slowing down. The International Monetary Fund (IMF) estimates that global GDP growth will reach approximately 3.1% in 2026, compared to 3.3% in 2024 and 3.2% in 2025. Developed economies are expected to grow at a slower pace (1.6%), while emerging economies are projected to maintain growth around 4%.

Global inflation is generally easing after reaching multi-year highs, thanks to cooling energy and commodity prices. However, expansionary fiscal spending plans and efforts to boost economic growth in many countries could lead to a resurgence in global inflation.

Major central banks are shifting from monetary easing to tightening policies: The Federal Reserve is expected to cut rates by only 0.25–0.5 percentage points in 2026, following a 0.75-point reduction in 2025. Meanwhile, the European Central Bank is likely to maintain its key interest rate at 2.15%, with no further cuts until 2027. Central banks’ continued accommodative policies will support cheap capital flows into Vietnam, sustaining FDI inflows to some extent.

However, rising protectionism, trade wars, or escalating geopolitical tensions could harm international trade, potentially dampening global growth. This may indirectly impact Vietnam’s export demand. Overall, the 2026 global environment is not expected to exert significant pressure on Vietnam, especially as the country actively builds a robust growth foundation driven by internal strength.

Yuanta forecasts that the 2026 global macroeconomic landscape will remain challenging and unpredictable, characterized by slowing growth, persistent geopolitical tensions, and rising trade protectionism. These factors could disrupt global supply chains and reduce demand for Vietnamese goods. Nonetheless, global inflation is expected to continue easing due to lower energy and commodity prices, while many countries’ fiscal expansion and limited room for monetary easing will play a role.

In this context, the Vietnamese government has set an ambitious target of 10% GDP growth for 2026, with inflation controlled at around 4.5%. Achieving this goal requires coordinated fiscal and monetary policies, along with decisive implementation of public investment programs, institutional reforms, and economic transformation. International organizations are more cautious: the World Bank predicts 6.5% GDP growth for Vietnam in 2026, while the IMF forecasts only 5.6%.

|

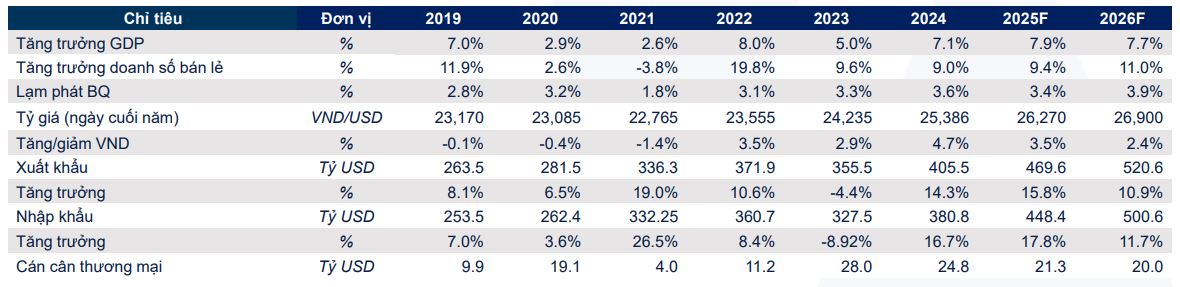

Yuanta Securities’ Macroeconomic Forecast for Vietnam

|

Yuanta believes that ongoing institutional reforms, new growth-supportive legislation, and a stable macroeconomic foundation will help Vietnam sustain high growth in 2026. Three key drivers will lead this growth: (1) substantial public investment in transportation infrastructure, logistics, and energy; (2) a recovering private sector contributing increasingly to growth, particularly in manufacturing, technology, and processing industries; and (3) improved domestic consumption driven by rising incomes, controlled inflation, and supportive fiscal policies.

While export growth may slow due to global demand, FDI inflows are expected to remain stable, focusing on high-tech, renewable energy, and data center sectors.

Vietnam’s GDP growth in 2026 is projected to reach 7.7%, with average inflation rising slightly to 3.9%, still below the government’s target.

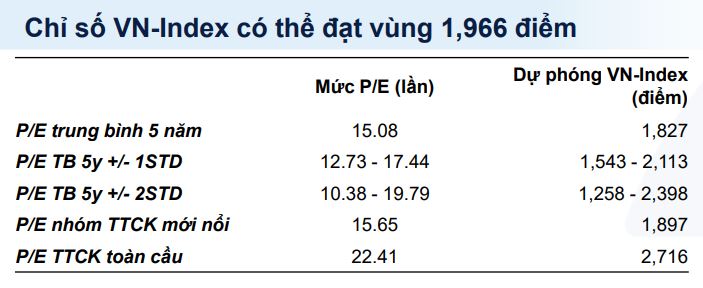

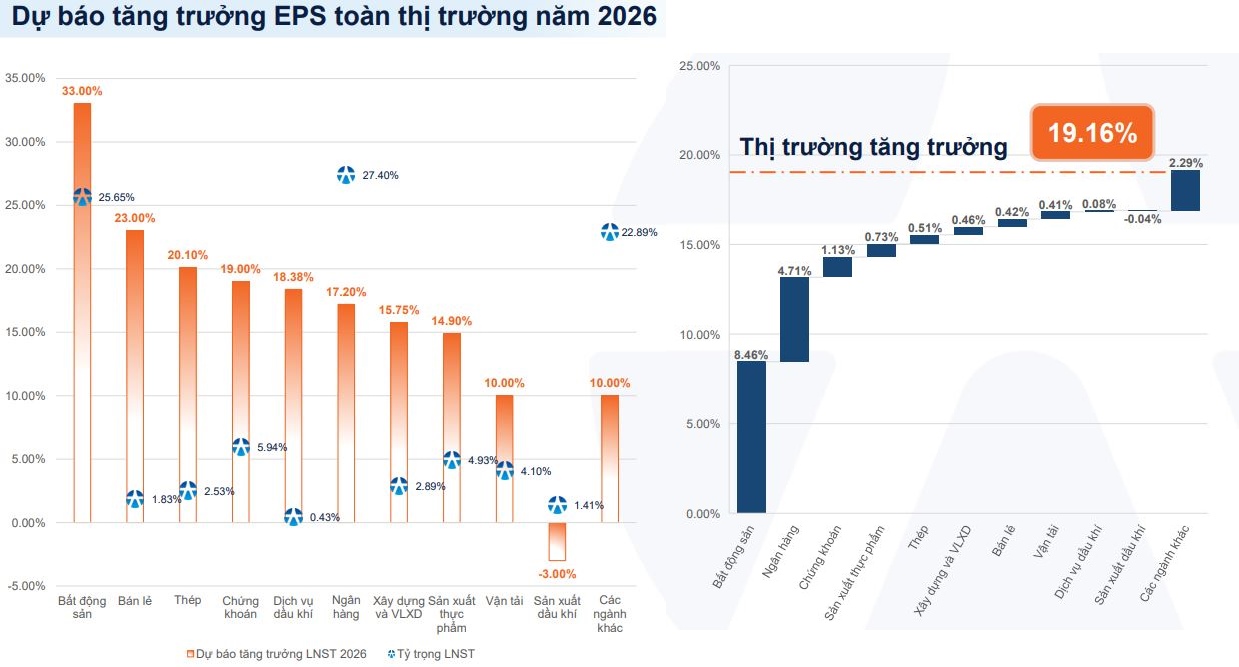

Regarding the stock market, Yuanta observes a contrasting trend: the P/E ratios of many key sectors have been discounted below historical averages, while 2026 EPS growth prospects remain high. This divergence creates a significant value gap. Consequently, 2026 is expected to be a year of market revaluation, narrowing this gap as policy catalysts and infrastructure investments take effect.

The long-term trend of the VN-Index remains upward. Using a quantitative trend model, Yuanta forecasts the VN-Index to reach 1,966 points, corresponding to a projected 2026 P/E of 14.0x.

Source: Yuanta Vietnam

|

The securities firm presents two scenarios for the 2026 market.

In Scenario 1 (67% probability), the VN-Index remains in a long-term Wave 3 uptrend, targeting 2,280 points. Growth will be broadly distributed across stock groups, with the strongest momentum in large-cap VN30 stocks, driven by growth convergence and low valuations. The narrative of market upgrades, coupled with a strong macroeconomic foundation, will fuel the market in 2026. Yuanta considers this scenario highly likely.

In the alternative scenario (33% probability), the VN-Index could fall below 1,475 points. Rising domestic interest rates and the Fed’s decision not to cut rates in 2026 would lead to continued foreign capital outflows, weakening domestic investor confidence. If this scenario materializes, investors should prepare for a potential repeat of 2022.

– 16:46 08/01/2026

Tracking the Whale Money Flow on December 30: Proprietary Traders Heavily Accumulate Bank Stocks, Foreign Investors Return with Nearly 1 Trillion VND in Net Buying

Proprietary trading firms extended their buying streak to a fifth consecutive session, while foreign investors reversed their trend, injecting a substantial 943 billion VND into the market. This significant inflow provided crucial support, bolstering market performance on December 30th.