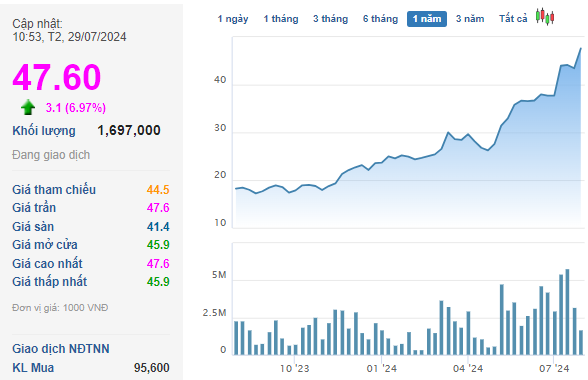

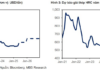

At the “2026 Investment Strategy Seminar” held on the afternoon of January 9, 2026, Mr. Quan Trong Thanh, Director of the Analysis Division at Maybank Securities, stated that the government is demonstrating a strong commitment to boosting economic growth, with a GDP target higher than previous years. However, the policy direction has shifted toward a more balanced approach to avoid overheating, booming, and subsequent collapse. Interest rates are expected to rise but not to levels that would harm the economy; an average rate of around 6–6.5% is considered suitable to maintain credit growth at 15–16% and ensure liquidity for the stock market.

Mr. Quan Trong Thanh – Director of Securities Analysis at Maybank

|

A key highlight for 2026 is the market upgrade narrative. Based on international experience, after an adjustment period following the announcement of an upgrade, markets typically enter a strong “rally” phase as stocks are officially included in the index. With a positive macroeconomic foundation, Vietnam is expected to replicate this scenario in 2026, attracting significant capital from global investment funds.

In terms of valuation, a P/E ratio of around 15 times is considered reasonable for the market. In an optimistic scenario, the index could target the 2,000–2,100 range, or even higher if the upgrade-driven capital inflow is robust.

Key Stock Groups to Watch in 2026

Policies promoting public investment alongside private sector development are seen as long-term drivers for infrastructure companies. Capital will focus on transportation, energy, and urban infrastructure, driving significant demand for construction materials and installation services.

Notable companies include large-scale real estate and infrastructure developers such as Vingroup (VIC), Vinhomes (VHM), and Khang Dien (KDH); construction materials and building firms like HPG and CTD; and energy infrastructure companies such as PC1 and PVS. These companies are well-positioned to benefit directly from the new investment wave and national-scale projects.

Banks remain the most favorably viewed group among analysts. Leading private banks are expected to play a key role in financing national development programs, while some state-owned banks are becoming more attractive due to their low valuations and strong asset quality.

Simultaneously, securities firms like SSI, TCBS, and VCI stand to gain from improved market liquidity and potential trading surges once the upgrade is finalized. If privatization and state divestment efforts resume, this group will benefit further.

After a period of weakness due to COVID-19 and sluggish demand, consumer stocks are expected to recover as incomes and economic activity improve. This once-overlooked sector could rebound strongly as economic growth broadens, offering opportunities for leading consumer stocks to regain prominence.

Beyond sector-specific trends, Mr. Thanh emphasized the importance of capital flows, particularly upgrade-driven inflows, and factors like profit growth and valuation as critical lenses for selecting stocks within the broader trend.

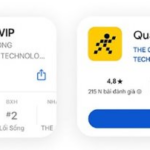

The Vingroup Stock Story

Stocks within the Vingroup ecosystem are among the most closely watched as we enter the 2026 cycle. According to Mr. Thanh, the recent strong performance of these stocks is supported by technical factors (low free float, concentrated capital, and backing from major shareholders), but it’s not merely speculative. More importantly, Vingroup possesses foundational narratives substantial enough to sustain market interest.

One key expectation is Vingroup’s potential deep involvement in major infrastructure projects. With proven execution capabilities in large-scale projects and rapid deployment, Vingroup is a top contender for nationally significant initiatives.

In real estate, Vinhomes remains a “crown jewel” within the Vingroup ecosystem. The company boasts a nationwide project portfolio, directly benefiting from infrastructure development and urbanization. Major projects like Can Gio are expected to boost sales and profits. According to estimates, Vinhomes’ profits could grow by 20–25% annually in the coming period, while its current valuation still underreflects its asset value.

Additionally, Vingroup’s expansion into energy, steel, and infrastructure not only completes its ecosystem but also provides a more stable long-term cash flow.

Market concerns persist regarding VinFast due to its heavy investment phase and significant capital burn. However, Mr. Thanh noted that 6–7 years of losses are typical for the global electric vehicle industry. VinFast’s domestic sales are showing improvement, and its expansion into international markets, particularly India, is worth monitoring this year. If sales improve, the path to breakeven will become clearer.

Overall, Mr. Thanh believes that with its large-scale narrative, Vingroup remains an attractive stock group in the context of market upgrades and infrastructure investment trends. However, the sharp short-term rise also increases the risk of correction. From a cautious perspective, investors may prioritize Vinhomes due to its clearer cash flow and profit foundation, though timing purchases during market adjustments is advisable.

– 11:09 10/01/2026

Lessons Learned: Strategies to Exceed Public Investment Disbursement Targets

Establishing a Land Clearance Steering Committee, proactively collaborating with neighboring localities to source construction materials, and implementing a ‘green lane’ mechanism for streamlined procedures in key projects are among the proactive solutions adopted by local authorities. These measures aim to ensure the full disbursement of allocated capital by 2025.

Vietlott Awards Over 5.342 Trillion VND in Prizes in 2025, Including a Record-Breaking Jackpot Winner

In 2025, Vietlott (Vietnam Computerized Lottery One Member Limited Liability Company) achieved a remarkable revenue of over 9.686 trillion VND, marking a 22% increase compared to 2024 and surpassing the Ministry of Finance’s target by 11%. The company contributed more than 2.495 trillion VND to local budgets, a 20% rise year-over-year. Vietlott recorded over 32 million winning entries and distributed prizes totaling over 5.342 trillion VND to players nationwide, reflecting a 25% growth in payouts.