The stock market opened with a significant gap up on January 8th, aiming for the 1,900-point mark, driven by the positive influence of large-cap stocks. However, selling pressure intensified in the afternoon session, causing the VNINDEX to close down -6.02 points (-0.32%) at 1,855.56 points. Foreign investors provided a silver lining with net buying of approximately 568 billion VND.

Securities firms’ proprietary trading desks net sold 483 billion VND on HoSE.

Specifically, proprietary trading desks of securities firms net sold the most in TCB with a value of -302 billion VND, followed by VTP (-113 billion), STB (-107 billion), ACB (-96 billion), and MBB (-26 billion VND). Other stocks also recorded notable net selling, including NT2 (-25 billion), SSI (-23 billion), CTG (-21 billion), PVD (-14 billion), and GVR (-14 billion VND).

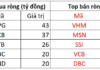

Conversely, MWG stocks saw the strongest net buying with a value of 55 billion VND, followed by HPG (48 billion), E1VFVN30 (34 billion), MCH (32 billion), VCB (23 billion), MSN (19 billion), CTR (15 billion), FPT (15 billion), DGC (10 billion), and TCX (10 billion VND).

Market Pulse 09/01: Capital Flees Real Estate Sector, VN-Index Holds Steady

At the close of trading, the VN-Index climbed 12.34 points (+0.67%) to reach 1,867.9 points, while the HNX-Index dipped 2 points (-0.8%), settling at 247.1 points. Market breadth favored decliners, with 423 stocks falling and 290 advancing. Similarly, the VN30 basket saw red dominate, as 17 stocks declined, 12 rose, and 1 remained unchanged.

Stock Market Week 05-09/01/2026: Kicking Off the Year with a Bang

The VN-Index kicked off 2026 with a remarkable start, surging 4.67% in the first trading week. This upward momentum was primarily driven by large-cap stocks, while liquidity expanded significantly, indicating a more optimistic investor sentiment after a prolonged period of caution. Additionally, the broader market saw improved capital flow across various sectors, further bolstering the positive outlook.

Market Pulse 09/01: Clear Divergence as VN-Index Returns to Starting Line

Profit-taking pressure continued to mount, pushing the VN-Index back to its starting point by the end of the morning session. The index hovered just above the reference mark, closing the mid-session at 1,856.23 points. Meanwhile, the HNX-Index dipped slightly by 0.24%, settling at 248.5 points. Market breadth increasingly favored sellers, with 390 decliners outpacing 311 gainers.