Dabaco Group Joint Stock Company (Dabaco, Stock Code: DBC, HoSE) has recently announced key resolutions from its Board of Directors (BOD) meeting, as outlined in Resolution No. 11/2025/NQ-HĐQT dated December 31, 2025.

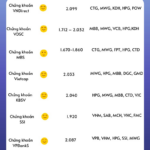

The company has approved its 2026 business plan, targeting a total revenue of VND 29,311 billion (including internal consumption). Pre-tax profit is projected at VND 1,261 billion, with a net profit of VND 1,117 billion after tax deductions.

Dabaco’s BOD has tasked the CEO with directing subsidiary companies and affiliated units to optimize production, foster innovation, and ensure autonomy to achieve the 2026 business objectives.

Illustrative image

Based on the approved business plan and capital requirements, the BOD has authorized Dabaco to secure loans from banks, credit institutions, and financial leasing companies to support its 2026 operations and investment projects.

The total short-term, medium-term, and long-term credit limits will be determined by the BOD based on actual needs and market conditions, ensuring sufficient funding for production, business activities, and project investments.

Additionally, the BOD has approved the use of the company’s existing assets and those of its subsidiaries as collateral for the aforementioned loans.

Dabaco has also agreed to provide guarantees for its subsidiaries’ loans from banks, credit institutions, and financial leasing companies to meet their 2026 operational and investment needs.

Lastly, the company has revised its capital allocation plan from the 2024 public offering and ESOP issuance. A total of VND 66 billion originally earmarked for working capital will now be redirected to fixed asset investment for the “Dabaco Soybean Oil Extraction and Refining Plant Project.”

The revised capital utilization is expected to be completed by June 30, 2026.

Hodeco Revises Capital Allocation Strategy for Convertible Bond Issuance

Hodeco has recently revised its capital allocation plan for the proceeds from the issuance of nearly 5 million convertible bonds under the code HDC425001, totaling approximately VND 500 billion in raised funds.

Revitalizing Ho Chi Minh City’s Public Investment: Replacing Underperforming Officials to Accelerate Capital Disbursement

The Chairman of Ho Chi Minh City has issued a directive to promptly replace underperforming civil servants, officials, and public employees who demonstrate incompetence, lethargy, or engage in corrupt practices that cause harassment and inconvenience to the public. The directive emphasizes a zero-tolerance policy towards negative behaviors in public investment management, ensuring swift and decisive action against any misconduct.