Land Plot Liquidity Improves but Remains Selective

The land plot segment recorded 9,448 primary plots, a slight 2% increase compared to 2024. Consumption reached 1,718 plots, a significant 69% surge year-on-year, reflecting a notable improvement in demand, although the absorption rate stands at approximately 18%. Tay Ninh emerged as the leading locality in both supply and liquidity, with supply and consumption shares of 38% and 53%, respectively. Primary prices rose by an average of 6%, while the secondary market saw increases of 12-15%.

However, transactions remain concentrated in projects with completed legal procedures, well-developed infrastructure, and reputable developers. New supply remains scarce, indicating the market has not yet entered a robust recovery phase.

Mid-Range Apartments Take the Market Lead

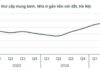

The apartment segment experienced the most significant growth in 2025. Total primary supply reached 40,523 units, a 73% increase from the previous year; consumption hit 33,015 units, 2.6 times higher than the same period last year. Ho Chi Minh City accounted for 87% of the total supply, with over half of the new supply concentrated in the former Binh Duong area.

Mid-range apartments took the market lead. Primary prices increased by 4-16%, with some projects near Metro Line 1 and the Eastern area of Ho Chi Minh City seeing rises of 20-28%. Secondary prices rose by an average of 10-18%. However, the growth remains localized, focusing on large-scale projects with complete legal frameworks.

Townhouses and Resort Real Estate Show Signs of Recovery but Lack Clarity

Primary supply of townhouses and villas reached 22,403 units, three times higher than in 2024; consumption exceeded 11,380 units, 6.5 times higher year-on-year. Ho Chi Minh City and Tay Ninh accounted for 86% of the supply. Primary prices increased by 3-5%, while secondary prices rose by 12-19%. However, transactions are limited to a few large-scale projects, indicating a localized trend rather than a market-wide rebound.

Resort segments generally face challenges. Resort villas saw a 25% supply increase and 1.3 times higher consumption, but liquidity remains limited. Overall, the market faces obstacles in liquidity and price growth, as investor confidence and recovery momentum in this segment remain low.

Recovery Trend Expected to Strengthen in 2026

In 2026, DKRA Consulting forecasts a continued strengthening of the recovery trend. New land plot supply is projected at 3,500-4,000 plots, concentrated in familiar satellite cities like Long An and Binh Duong, benefiting directly from infrastructure development. Primary prices may rise slightly as transactions remain selective, focusing on localities and products with completed infrastructure and legal frameworks.

For the apartment segment, new supply is estimated at 30,000-35,000 units, with Ho Chi Minh City maintaining its dominant role. Liquidity is expected to improve significantly from the second half of the year, driven by legal resolutions and more flexible credit. Primary and secondary prices will continue to grow steadily, with price increases spreading to suburban apartment projects priced at 30-50 million VND/m².

Townhouses and villas are projected to add 13,500-15,500 new units in 2026, though primary prices will remain high due to input costs and infrastructure development. Demand for this segment remains strong but selective, focusing on large projects by reputable developers.

Finally, resort real estate is expected to see condotel supply of 2,500-3,000 units, resort villas at 1,200-1,500 units, and resort townhouses/shophouses at 1,000-1,200 units. While demand is expected to improve, significant short-term breakthroughs are unlikely. Primary prices will remain high due to elevated input costs. Discounts, interest support, and debt moratoriums will continue to be widely applied in 2026.

– 16:42 09/01/2026

Unveiling Sunshine Group’s European-Standard Townhouse Project: A Closer Look at Every Detail, Down to the Pavement Stones in West Hanoi

The value of a townhouse project isn’t solely determined at handover; it’s proven through its quality after at least 10–20 years of operation. Noble Palace Tay Thang Long WorldHotels Residences—a luxury low-rise project by Sunshine Group, located near the Tay Thang Long axis—begins this legacy with sustainable, premium materials designed to stand the test of time.

MIK Group: Pioneering a New Development Blueprint from North to South

Over the past decade, MIK Group has consistently expanded its scale and solidified its reputation as a leading and trusted real estate developer in the market.