Illustrative image

January 7th marked a historic session as the VN-Index surged by 45.31 points (+2.49%), reaching a new peak at 1,861.58 points. The HoSE market was dominated by green, with 256 advancing stocks and robust liquidity nearing VND 33 trillion. Foreign investors further bolstered optimism by net buying VND 522 billion.

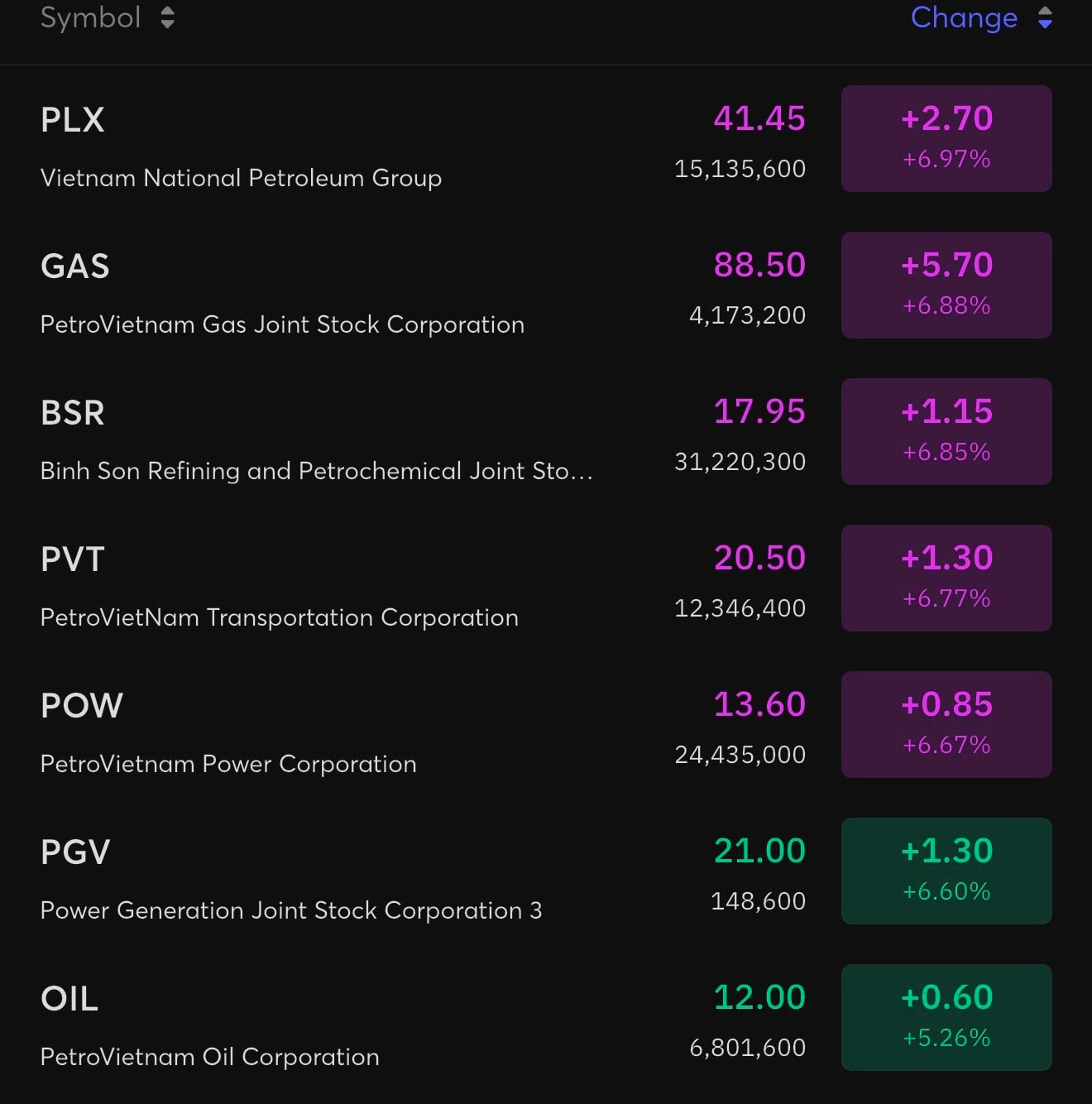

Energy stocks universally hit ceiling prices

Amid the market’s euphoria, energy stocks emerged as the primary catalysts. Beyond the leadership of key players, a wave of ceiling-hitting momentum (uplimit) swept across the sector. GAS and PLX swiftly reached their upper limits, pulling along peers like POW, PVT, BSR, and PVG, all hitting their maximum daily gains.

Meanwhile, other energy stocks such as OIL (+5%) and PVD (+1.35%) also basked in the green glow.

Analysts attribute this explosive rally and the influx of capital into energy stocks to market reactions stemming from Venezuela’s developments. While the actual impact on global supply-demand dynamics remains modest, the event served as a perfect trigger for speculative funds, transforming macroeconomic concerns into buying momentum.

Divestment “game” fuels frenzy amid concentrated ownership

However, the deeper impetus driving substantial capital to aggressively “buy the rally” lies in the synergy between divestment expectations and the scarcity of free-float shares.

Investors are pinning hopes on the State Economic Resolution (expected in 2026) to legally compel enterprises to accelerate state ownership reduction, aligning with listing requirements and efficiency enhancements. PV GAS’s recent announcement of failing public company criteria is turning divestment pressure into a revaluation opportunity.

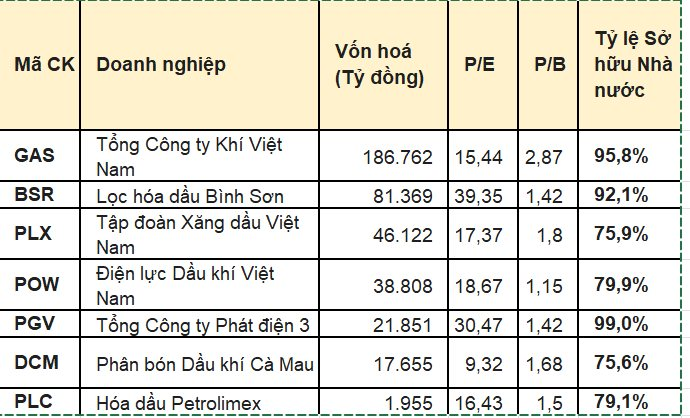

Ultra-concentrated ownership structure in energy sector

This context highlights the allure of the ultra-concentrated ownership structure within the energy sector. Data reveals state ownership in these giants remains overwhelmingly dominant: PGV (99%), GAS (96%), BSR (92%), and even highly liquid stocks like POW (80%) and PLX (76%).

Fundamental support from $25.7 billion reinvestment

The current rally is underpinned by the sector’s long-term growth narrative. A $25.7 billion reinvestment campaign for 2025-2030, focusing on mega-projects like Lot B – O Mon, is generating massive backlogs across the value chain.

The 2026 profit outlook is equally promising. PVS holds a record engineering backlog of $5.3 billion; PVD benefits from jack-up rig rentals averaging $120,000/day. Downstream, GAS targets 2025 pre-tax profits of VND 14.5 trillion, while BSR posted robust Q4/2025 earnings.

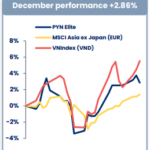

Stock Market Week 05-09/01/2026: Kicking Off the Year with a Bang

The VN-Index kicked off 2026 with a remarkable start, surging 4.67% in the first trading week. This upward momentum was primarily driven by large-cap stocks, while liquidity expanded significantly, indicating a more optimistic investor sentiment after a prolonged period of caution. Additionally, the broader market saw improved capital flow across various sectors, further bolstering the positive outlook.

Market Pulse 09/01: Clear Divergence as VN-Index Returns to Starting Line

Profit-taking pressure continued to mount, pushing the VN-Index back to its starting point by the end of the morning session. The index hovered just above the reference mark, closing the mid-session at 1,856.23 points. Meanwhile, the HNX-Index dipped slightly by 0.24%, settling at 248.5 points. Market breadth increasingly favored sellers, with 390 decliners outpacing 311 gainers.

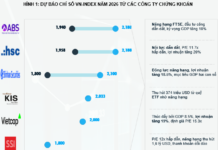

What’s Driving the VN-Index Surge Past 2,000 Points as Brokerages Unanimously Predict the Rally?

As we step into 2026, numerous securities firms are optimistic about the VN-Index, anticipating a significant surge with ambitious targets surpassing the 2,000-point milestone.