Vietnam’s stock market concluded its first trading week of the new year with notable volatility. Despite the VN-Index closing in the green, the overall market saw a predominance of declining stocks. As of the session’s close on January 9th, the VN-Index surged by over 12 points, reaching a new peak of 1,867.9 points. Trading value on the Ho Chi Minh Stock Exchange (HoSE) hit a high of VND 36 trillion.

Foreign trading activity also proved favorable, with net buying of VND 790 billion across the market. Specifically:

On HoSE, foreign investors net bought approximately VND 805 billion

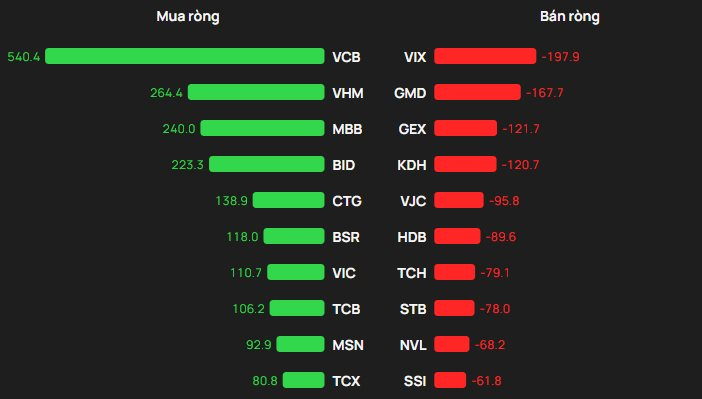

On the buying side, the banking sector took center stage, with VCB leading in net purchases at around VND 540 billion, followed by VHM (+VND 264 billion), MBB (+VND 240 billion), BID (+VND 223 billion), and CTG (+VND 139 billion).

Conversely, VIX saw the heaviest net selling at roughly VND 198 billion, trailed by GMD (-VND 168 billion). GEX (-VND 122 billion), KDH (-VND 121 billion), and VJC (-VND 96 billion) also faced significant selling pressure.

Top foreign net buy/sell stocks on HoSE. Unit: billion VND

On HNX, foreign investors net bought approximately VND 15 billion

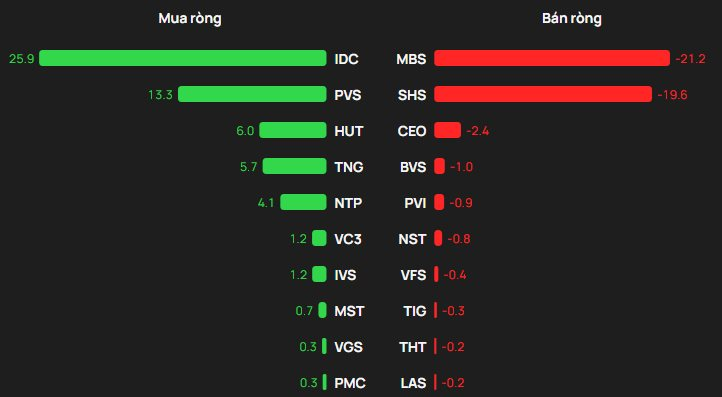

On the buying side, IDC led with net purchases of around VND 26 billion, followed by PVS (nearly VND 13 billion). HUT (+VND 6 billion), TNG (+VND 6 billion), and NTP (+VND 4 billion) also saw net buying interest.

On the selling side, MBS faced the heaviest net selling at approximately VND 21 billion, followed by SHS (-VND 20 billion). CEO (-VND 2 billion), BVS (-VND 1 billion), and PVI (-VND 1 billion) were also among the top net sold stocks.

Top foreign net buy/sell stocks on HNX. Unit: billion VND

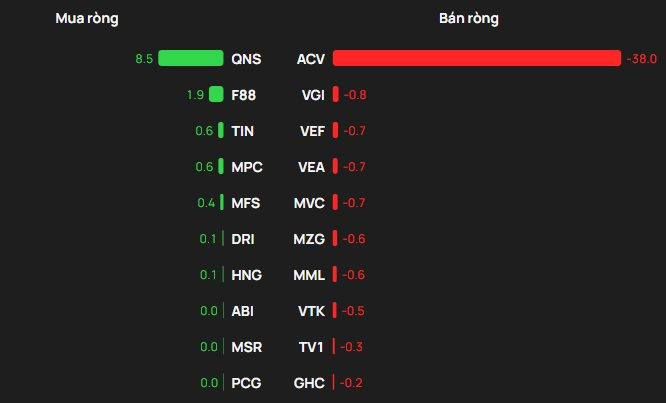

On UPCoM, foreign investors net sold approximately VND 31 billion

On the buying side, QNS saw the strongest net buying at around VND 9 billion, followed by F88 (approximately VND 2 billion). Smaller net purchases were recorded in TIN (+VND 1 billion), MPC (+VND 1 billion), and MFS (+VND 0.4 billion).

Conversely, ACV dominated net selling with roughly VND 38 billion, while VGI (-VND 1 billion), VEF (-VND 1 billion), VEA (-VND 1 billion), and MVC (-VND 1 billion) also witnessed notable selling pressure on UPCoM.

Top foreign net buy/sell stocks on UPCoM. Unit: billion VND

Market Pulse 09/01: Capital Flees Real Estate Sector, VN-Index Holds Steady

At the close of trading, the VN-Index climbed 12.34 points (+0.67%) to reach 1,867.9 points, while the HNX-Index dipped 2 points (-0.8%), settling at 247.1 points. Market breadth favored decliners, with 423 stocks falling and 290 advancing. Similarly, the VN30 basket saw red dominate, as 17 stocks declined, 12 rose, and 1 remained unchanged.